COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Risks and Uncertainties<br />

The financial performance of the Company is expected to be affected by ongoing exploration activities<br />

being conducted on its properties, and the proposed development of the Santa Rita Project. Until such time as<br />

commercial production is achieved, the Company will continue to incur administration costs and exploration and<br />

development expenditures that are either deferred or expensed, depending upon the nature of those<br />

expenditures, resulting in continuing operating losses.<br />

Should the development of the Santa Rita Project occur, the financial performance of the Company will be<br />

closely linked to the price of nickel concentrate produced by the Company. Commodity price fluctuations will<br />

significantly affect the results of operations once mining commences and the economics of mineral deposits. The<br />

monitoring of price movements and trend for nickel is essential to monitor the viability of the Company’s assets.<br />

The Company reports its financial results in Australian dollars. The Company’s costs, however, are in<br />

Australian dollars, United States dollars, and Brazilian Reals. If the Santa Rita Project, as expected by<br />

management, commence production in early 2009, or any of the Company’s other properties commence<br />

production, future metal sales revenue will be in United States dollars. Fluctuations in these exchange rates may<br />

therefore significantly affect the results of the operations of the Company.<br />

The Company has not hedged against changes in metal prices or exchange rates to date though the<br />

Company may enter into hedge contracts at some future date.<br />

The exploration and development of the Company’s properties will require substantial additional financing<br />

and the capital required for the development of the Santa Rita Project is estimated to be approximately<br />

US$223 million. Failure to obtain sufficient financing in the future may result in the delay or indefinite<br />

postponement of the development of the Santa Rita Project, and the exploration, development or production on<br />

any or all of the Company’s other properties. There can be no assurance that bank financing or other types of<br />

financing will be available when needed or that, if available, the terms of such financing will be acceptable to<br />

the Company.<br />

See ‘‘Risk Factors’’ for a further discussion of these and other risk factors associated with the Company and<br />

any investment in the Shares.<br />

Summary of Half Year Results<br />

Over the past three half-year periods, the Company’s expenses have been increasing as a result of the<br />

matters described in ‘‘Six Months Ended December 31, 2006 Compared to Six Months Ended December 31, 2005’’<br />

and ‘‘Twelve Months Ended June 30, 2006 Compared to Sixteen Months Ended June 30, 2005’’ set out above.<br />

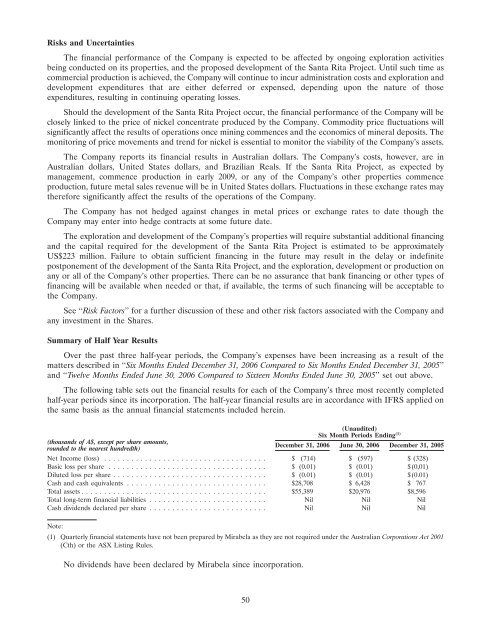

The following table sets out the financial results for each of the Company’s three most recently completed<br />

half-year periods since its incorporation. The half-year financial results are in accordance with IFRS applied on<br />

the same basis as the annual financial statements included herein.<br />

(thousands of A$, except per share amounts,<br />

rounded to the nearest hundredth)<br />

(Unaudited)<br />

Six Month Periods Ending (1)<br />

December 31, 2006 June 30, 2006 December 31, 2005<br />

Net Income (loss) .................................... $ (714) $ (597) $ (328)<br />

Basic loss per share ................................... $ (0.01) $ (0.01) $(0,01)<br />

Diluted loss per share .................................. $ (0.01) $ (0.01) $(0.01)<br />

Cash and cash equivalents ............................... $28,708 $ 6,428 $ 767<br />

Total assets ......................................... $55,389 $20,976 $8,596<br />

Total long-term financial liabilities .......................... Nil Nil Nil<br />

Cash dividends declared per share .......................... Nil Nil Nil<br />

Note:<br />

(1) Quarterly financial statements have not been prepared by <strong>Mirabela</strong> as they are not required under the Australian Corporations Act 2001<br />

(Cth) or the ASX Listing Rules.<br />

No dividends have been declared by <strong>Mirabela</strong> since incorporation.<br />

50