COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

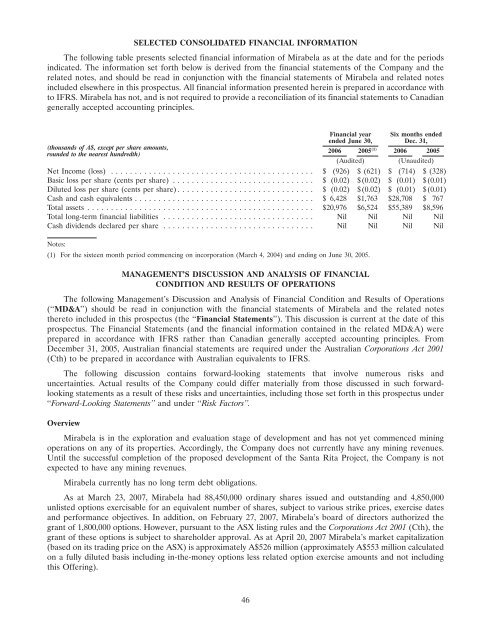

SELECTED CONSOLIDATED FINANCIAL INFORMATION<br />

The following table presents selected financial information of <strong>Mirabela</strong> as at the date and for the periods<br />

indicated. The information set forth below is derived from the financial statements of the Company and the<br />

related notes, and should be read in conjunction with the financial statements of <strong>Mirabela</strong> and related notes<br />

included elsewhere in this prospectus. All financial information presented herein is prepared in accordance with<br />

to IFRS. <strong>Mirabela</strong> has not, and is not required to provide a reconciliation of its financial statements to Canadian<br />

generally accepted accounting principles.<br />

(thousands of A$, except per share amounts,<br />

rounded to the nearest hundredth)<br />

Financial year Six months ended<br />

ended June 30, Dec. 31,<br />

2006 2005 (1) 2006 2005<br />

(Audited)<br />

(Unaudited)<br />

Net Income (loss) ........................................... $ (926) $ (621) $ (714) $ (328)<br />

Basic loss per share (cents per share) .............................. $ (0.02) $(0.02) $ (0.01) $(0.01)<br />

Diluted loss per share (cents per share) ............................. $ (0.02) $(0.02) $ (0.01) $(0.01)<br />

Cash and cash equivalents ...................................... $6,428 $1,763 $28,708 $ 767<br />

Total assets ................................................ $20,976 $6,524 $55,389 $8,596<br />

Total long-term financial liabilities ................................ Nil Nil Nil Nil<br />

Cash dividends declared per share ................................ Nil Nil Nil Nil<br />

Notes:<br />

(1) For the sixteen month period commencing on incorporation (March 4, 2004) and ending on June 30, 2005.<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS <strong>OF</strong> FINANCIAL<br />

CONDITION AND RESULTS <strong>OF</strong> OPERATIONS<br />

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

(‘‘MD&A’’) should be read in conjunction with the financial statements of <strong>Mirabela</strong> and the related notes<br />

thereto included in this prospectus (the ‘‘Financial Statements’’). This discussion is current at the date of this<br />

prospectus. The Financial Statements (and the financial information contained in the related MD&A) were<br />

prepared in accordance with IFRS rather than Canadian generally accepted accounting principles. From<br />

December 31, 2005, Australian financial statements are required under the Australian Corporations Act 2001<br />

(Cth) to be prepared in accordance with Australian equivalents to IFRS.<br />

The following discussion contains forward-looking statements that involve numerous risks and<br />

uncertainties. Actual results of the Company could differ materially from those discussed in such forwardlooking<br />

statements as a result of these risks and uncertainties, including those set forth in this prospectus under<br />

‘‘Forward-Looking Statements’’ and under ‘‘Risk Factors’’.<br />

Overview<br />

<strong>Mirabela</strong> is in the exploration and evaluation stage of development and has not yet commenced mining<br />

operations on any of its properties. Accordingly, the Company does not currently have any mining revenues.<br />

Until the successful completion of the proposed development of the Santa Rita Project, the Company is not<br />

expected to have any mining revenues.<br />

<strong>Mirabela</strong> currently has no long term debt obligations.<br />

As at March 23, 2007, <strong>Mirabela</strong> had 88,450,000 ordinary shares issued and outstanding and 4,850,000<br />

unlisted options exercisable for an equivalent number of shares, subject to various strike prices, exercise dates<br />

and performance objectives. In addition, on February 27, 2007, <strong>Mirabela</strong>’s board of directors authorized the<br />

grant of 1,800,000 options. However, pursuant to the ASX listing rules and the Corporations Act 2001 (Cth), the<br />

grant of these options is subject to shareholder approval. As at April 20, 2007 <strong>Mirabela</strong>’s market capitalization<br />

(based on its trading price on the ASX) is approximately A$526 million (approximately A$553 million calculated<br />

on a fully diluted basis including in-the-money options less related option exercise amounts and not including<br />

this Offering).<br />

46