COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

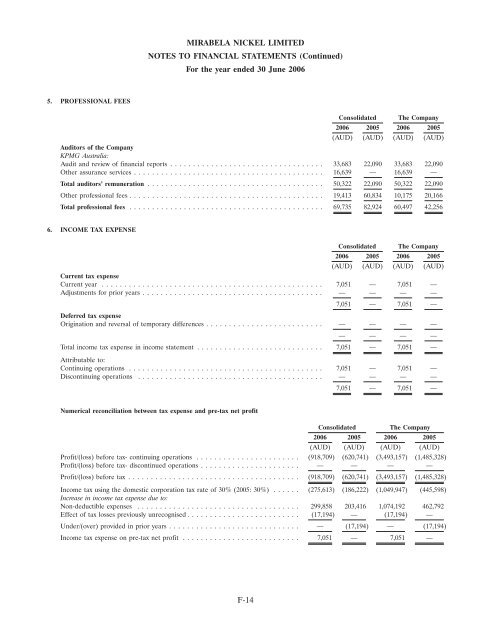

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

5. PR<strong>OF</strong>ESSIONAL FEES<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

(AUD) (AUD) (AUD) (AUD)<br />

Auditors of the Company<br />

KPMG Australia:<br />

Audit and review of financial reports .................................. 33,683 22,090 33,683 22,090<br />

Other assurance services .......................................... 16,639 — 16,639 —<br />

Total auditors’ remuneration ....................................... 50,322 22,090 50,322 22,090<br />

Other professional fees ........................................... 19,413 60,834 10,175 20,166<br />

Total professional fees ........................................... 69,735 82,924 60,497 42,256<br />

6. INCOME TAX EXPENSE<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

(AUD) (AUD) (AUD) (AUD)<br />

Current tax expense<br />

Current year ................................................. 7,051 — 7,051 —<br />

Adjustments for prior years ........................................ — — — —<br />

7,051 — 7,051 —<br />

Deferred tax expense<br />

Origination and reversal of temporary differences .......................... — — — —<br />

— — — —<br />

Total income tax expense in income statement ............................ 7,051 — 7,051 —<br />

Attributable to:<br />

Continuing operations ........................................... 7,051 — 7,051 —<br />

Discontinuing operations ......................................... — — — —<br />

7,051 — 7,051 —<br />

Numerical reconciliation between tax expense and pre-tax net profit<br />

Consolidated<br />

The Company<br />

2006 2005 2006 2005<br />

(AUD) (AUD) (AUD) (AUD)<br />

Profit/(loss) before tax- continuing operations ....................... (918,709) (620,741) (3,493,157) (1,485,328)<br />

Profit/(loss) before tax- discontinued operations ...................... — — — —<br />

Profit/(loss) before tax ...................................... (918,709) (620,741) (3,493,157) (1,485,328)<br />

Income tax using the domestic corporation tax rate of 30% (2005: 30%) ...... (275,613) (186,222) (1,049,947) (445,598)<br />

Increase in income tax expense due to:<br />

Non-deductible expenses .................................... 299,858 203,416 1,074,192 462,792<br />

Effect of tax losses previously unrecognised ......................... (17,194) — (17,194) —<br />

Under/(over) provided in prior years ............................. — (17,194) — (17,194)<br />

Income tax expense on pre-tax net profit .......................... 7,051 — 7,051 —<br />

F-14