COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

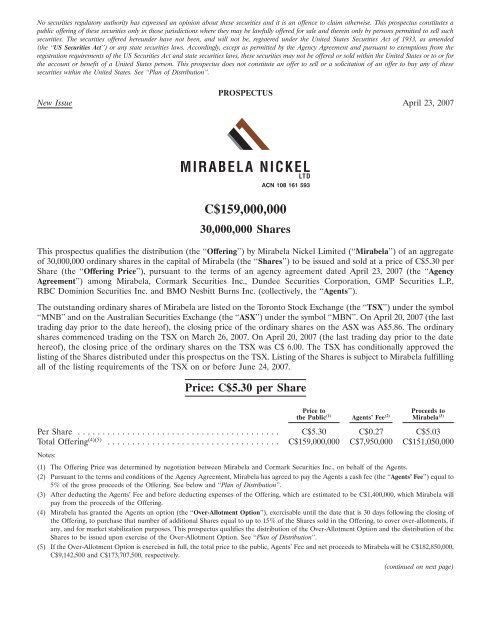

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus constitutes a<br />

public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such<br />

securities. The securities offered hereunder have not been, and will not be, registered under the United States Securities Act of 1933, as amended<br />

(the ‘‘US Securities Act’’) or any state securities laws. Accordingly, except as permitted by the Agency Agreement and pursuant to exemptions from the<br />

registration requirements of the US Securities Act and state securities laws, these securities may not be offered or sold within the United States or to or for<br />

the account or benefit of a United States person. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of these<br />

securities within the United States. See ‘‘Plan of Distribution’’.<br />

<strong>PROSPECTUS</strong><br />

New Issue April 23, 2007<br />

30MAR200715160103<br />

ACN 108 161 593<br />

C$159,000,000<br />

30,000,000 Shares<br />

This prospectus qualifies the distribution (the ‘‘Offering’’) by <strong>Mirabela</strong> <strong>Nickel</strong> Limited (‘‘<strong>Mirabela</strong>’’) of an aggregate<br />

of 30,000,000 ordinary shares in the capital of <strong>Mirabela</strong> (the ‘‘Shares’’) to be issued and sold at a price of C$5.30 per<br />

Share (the ‘‘Offering Price’’), pursuant to the terms of an agency agreement dated April 23, 2007 (the ‘‘Agency<br />

Agreement’’) among <strong>Mirabela</strong>, Cormark Securities Inc., Dundee Securities Corporation, GMP Securities L.P.,<br />

RBC Dominion Securities Inc. and BMO Nesbitt Burns Inc. (collectively, the ‘‘Agents’’).<br />

The outstanding ordinary shares of <strong>Mirabela</strong> are listed on the Toronto Stock Exchange (the ‘‘TSX’’) under the symbol<br />

‘‘MNB’’ and on the Australian Securities Exchange (the ‘‘ASX’’) under the symbol ‘‘MBN’’. On April 20, 2007 (the last<br />

trading day prior to the date hereof), the closing price of the ordinary shares on the ASX was A$5.86. The ordinary<br />

shares commenced trading on the TSX on March 26, 2007. On April 20, 2007 (the last trading day prior to the date<br />

hereof), the closing price of the ordinary shares on the TSX was C$ 6.00. The TSX has conditionally approved the<br />

listing of the Shares distributed under this prospectus on the TSX. Listing of the Shares is subject to <strong>Mirabela</strong> fulfilling<br />

all of the listing requirements of the TSX on or before June 24, 2007.<br />

Price: C$5.30 per Share<br />

Price to<br />

Proceeds to<br />

the Public (1) Agents’ Fee (2) <strong>Mirabela</strong> (3)<br />

Per Share ......................................... C$5.30 C$0.27 C$5.03<br />

Total Offering (4)(5) ................................... C$159,000,000 C$7,950,000 C$151,050,000<br />

Notes:<br />

(1) The Offering Price was determined by negotiation between <strong>Mirabela</strong> and Cormark Securities Inc., on behalf of the Agents.<br />

(2) Pursuant to the terms and conditions of the Agency Agreement, <strong>Mirabela</strong> has agreed to pay the Agents a cash fee (the ‘‘Agents’ Fee’’) equal to<br />

5% of the gross proceeds of the Offering. See below and ‘‘Plan of Distribution’’.<br />

(3) After deducting the Agents’ Fee and before deducting expenses of the Offering, which are estimated to be C$1,400,000, which <strong>Mirabela</strong> will<br />

pay from the proceeds of the Offering.<br />

(4) <strong>Mirabela</strong> has granted the Agents an option (the ‘‘Over-Allotment Option’’), exercisable until the date that is 30 days following the closing of<br />

the Offering, to purchase that number of additional Shares equal to up to 15% of the Shares sold in the Offering, to cover over-allotments, if<br />

any, and for market stabilization purposes. This prospectus qualifies the distribution of the Over-Allotment Option and the distribution of the<br />

Shares to be issued upon exercise of the Over-Allotment Option. See ‘‘Plan of Distribution’’.<br />

(5) If the Over-Allotment Option is exercised in full, the total price to the public, Agents’ Fee and net proceeds to <strong>Mirabela</strong> will be C$182,850,000,<br />

C$9,142,500 and C$173,707,500, respectively.<br />

(continued on next page)