COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

25. EXPLANATION <strong>OF</strong> TRANSITION TO AUSTRALIAN EQUIVALENTS TO IFRS (Continued)<br />

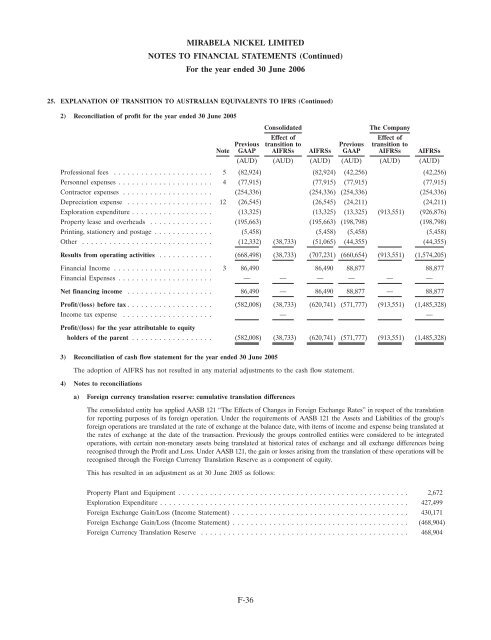

2) Reconciliation of profit for the year ended 30 June 2005<br />

Consolidated<br />

The Company<br />

Effect of<br />

Effect of<br />

Previous transition to Previous transition to<br />

Note GAAP AIFRSs AIFRSs GAAP AIFRSs AIFRSs<br />

(AUD) (AUD) (AUD) (AUD) (AUD) (AUD)<br />

Professional fees ...................... 5 (82,924) (82,924) (42,256) (42,256)<br />

Personnel expenses ..................... 4 (77,915) (77,915) (77,915) (77,915)<br />

Contractor expenses .................... (254,336) (254,336) (254,336) (254,336)<br />

Depreciation expense ................... 12 (26,545) (26,545) (24,211) (24,211)<br />

Exploration expenditure .................. (13,325) (13,325) (13,325) (913,551) (926,876)<br />

Property lease and overheads .............. (195,663) (195,663) (198,798) (198,798)<br />

Printing, stationery and postage ............. (5,458) (5,458) (5,458) (5,458)<br />

Other ............................. (12,332) (38,733) (51,065) (44,355) (44,355)<br />

Results from operating activities ............ (668,498) (38,733) (707,231) (660,654) (913,551) (1,574,205)<br />

Financial Income ...................... 3 86,490 86,490 88,877 88,877<br />

Financial Expenses ..................... — — — — — —<br />

Net financing income ................... 86,490 — 86,490 88,877 — 88,877<br />

Profit/(loss) before tax ................... (582,008) (38,733) (620,741) (571,777) (913,551) (1,485,328)<br />

Income tax expense .................... — —<br />

Profit/(loss) for the year attributable to equity<br />

holders of the parent .................. (582,008) (38,733) (620,741) (571,777) (913,551) (1,485,328)<br />

3) Reconciliation of cash flow statement for the year ended 30 June 2005<br />

The adoption of AIFRS has not resulted in any material adjustments to the cash flow statement.<br />

4) Notes to reconciliations<br />

a) Foreign currency translation reserve: cumulative translation differences<br />

The consolidated entity has applied AASB 121 ‘‘The Effects of Changes in Foreign Exchange Rates’’ in respect of the translation<br />

for reporting purposes of its foreign operation. Under the requirements of AASB 121 the Assets and Liabilities of the group’s<br />

foreign operations are translated at the rate of exchange at the balance date, with items of income and expense being translated at<br />

the rates of exchange at the date of the transaction. Previously the groups controlled entities were considered to be integrated<br />

operations, with certain non-monetary assets being translated at historical rates of exchange and all exchange differences being<br />

recognised through the Profit and Loss. Under AASB 121, the gain or losses arising from the translation of these operations will be<br />

recognised through the Foreign Currency Translation Reserve as a component of equity.<br />

This has resulted in an adjustment as at 30 June 2005 as follows:<br />

Property Plant and Equipment ................................................... 2,672<br />

Exploration Expenditure ....................................................... 427,499<br />

Foreign Exchange Gain/Loss (Income Statement) ....................................... 430,171<br />

Foreign Exchange Gain/Loss (Income Statement) ....................................... (468,904)<br />

Foreign Currency Translation Reserve .............................................. 468,904<br />

F-36