COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

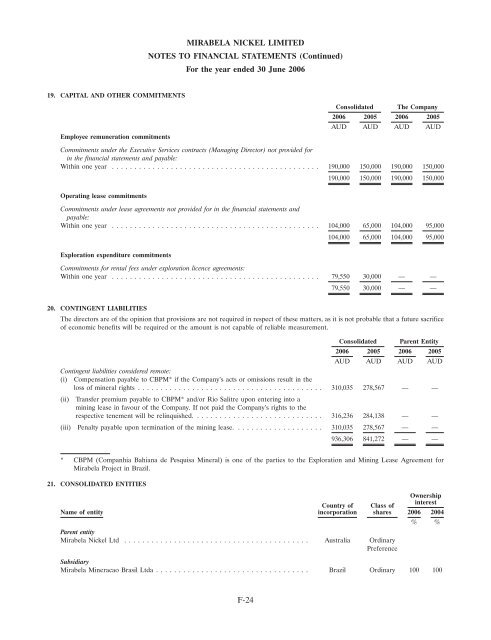

19. CAPITAL AND OTHER COMMITMENTS<br />

Employee remuneration commitments<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

AUD AUD AUD AUD<br />

Commitments under the Executive Services contracts (Managing Director) not provided for<br />

in the financial statements and payable:<br />

Within one year .............................................. 190,000 150,000 190,000 150,000<br />

190,000 150,000 190,000 150,000<br />

Operating lease commitments<br />

Commitments under lease agreements not provided for in the financial statements and<br />

payable:<br />

Within one year .............................................. 104,000 65,000 104,000 95,000<br />

104,000 65,000 104,000 95,000<br />

Exploration expenditure commitments<br />

Commitments for rental fees under exploration licence agreements:<br />

Within one year .............................................. 79,550 30,000 — —<br />

79,550 30,000 — —<br />

20. CONTINGENT LIABILITIES<br />

The directors are of the opinion that provisions are not required in respect of these matters, as it is not probable that a future sacrifice<br />

of economic benefits will be required or the amount is not capable of reliable measurement.<br />

Consolidated Parent Entity<br />

2006 2005 2006 2005<br />

AUD AUD AUD AUD<br />

Contingent liabilities considered remote:<br />

(i) Compensation payable to CBPM* if the Company’s acts or omissions result in the<br />

loss of mineral rights ......................................... 310,035 278,567 — —<br />

(ii) Transfer premium payable to CBPM* and/or Rio Salitre upon entering into a<br />

mining lease in favour of the Company. If not paid the Company’s rights to the<br />

respective tenement will be relinquished. ............................ 316,236 284,138 — —<br />

(iii) Penalty payable upon termination of the mining lease. ................... 310,035 278,567 — —<br />

936,306 841,272 — —<br />

* CBPM (Companhia Bahiana de Pesquisa Mineral) is one of the parties to the Exploration and Mining Lease Agreement for<br />

<strong>Mirabela</strong> Project in Brazil.<br />

21. CONSOLIDATED ENTITIES<br />

Country of Class of<br />

Ownership<br />

interest<br />

Name of entity incorporation shares 2006 2004<br />

% %<br />

Parent entity<br />

<strong>Mirabela</strong> <strong>Nickel</strong> Ltd ......................................... Australia Ordinary<br />

Preference<br />

Subsidiary<br />

<strong>Mirabela</strong> Mineracao Brasil Ltda .................................. Brazil Ordinary 100 100<br />

F-24