COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Disclosure of Shareholding Information<br />

Under the Australian Corporations Act 2001 (Cth), a person who acquires ‘‘voting power’’ of a corporation<br />

of five percent or more is a ‘‘substantial holder’’ and as such must serve notice on the corporation and the ASX,<br />

by the end of the second business day following an acquisition disclosing certain details regarding such<br />

acquisition. In general terms, voting power is calculated as the sum total of all votes attaching to shares in which<br />

the person and their associates have a relevant interest, divided by the total number of votes that may be cast at<br />

a general meeting of the shareholders of the corporation. In general terms, a person will have a relevant interest<br />

in shares if that person has the ability to exercise, or control the exercise of, the power to vote or dispose of the<br />

shares. A substantial holder must also give notice, within the same time period, of ceasing to be a substantial<br />

holder, or any change of one percent or more in their voting power.<br />

Foreign Acquisition and Takeovers Act, 1975 (Cth)<br />

The Australian Foreign Acquisitions and Takeover Act, 1975 (Cth) (‘‘FATA’’) restricts certain action by<br />

foreign persons in connection with Australian assets.<br />

FATA requires that approval be obtained from the Australian Treasurer (acting through the Foreign<br />

Investment Review Board (‘‘FIRB’’)) for the acquisition:<br />

(a) by a single foreigner (together with its associates) of 15% or more of the shares or votes of an<br />

Australian corporation with total assets of more than A$100 million or where the acquisition values the<br />

corporation at more than A$100 million; or<br />

(b) by a group of separate foreigners (together with their respective associates) of 40% or more of the<br />

shares or votes of such an Australian corporation.<br />

A higher monetary threshold (presently A$871 million) applies to acquisitions by certain categories of<br />

US investors.<br />

FATA also gives the Treasurer the authority to prohibit a proposed acquisition by foreign persons of shares<br />

or votes in an Australian corporation, or of assets of an Australian business in excess of $100 million, if the<br />

proposal would result in a change in control, the resultant control would be foreign and the foreign control<br />

would be contrary to Australia’s national interest. The Treasurer can also make divestment orders where such a<br />

proposal has already been implemented without prior approval.<br />

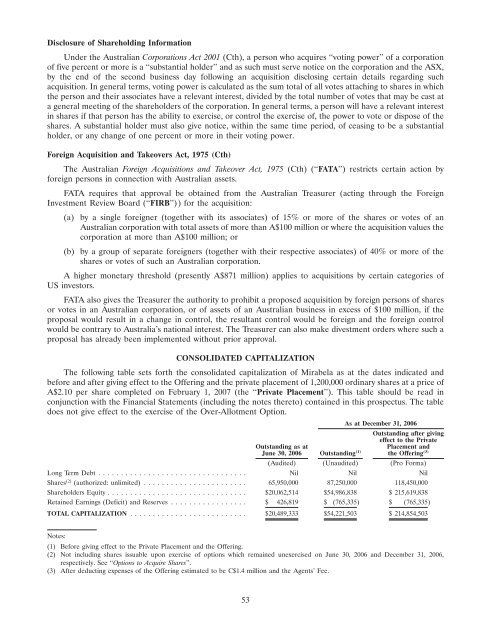

CONSOLIDATED CAPITALIZATION<br />

The following table sets forth the consolidated capitalization of <strong>Mirabela</strong> as at the dates indicated and<br />

before and after giving effect to the Offering and the private placement of 1,200,000 ordinary shares at a price of<br />

A$2.10 per share completed on February 1, 2007 (the ‘‘Private Placement’’). This table should be read in<br />

conjunction with the Financial Statements (including the notes thereto) contained in this prospectus. The table<br />

does not give effect to the exercise of the Over-Allotment Option.<br />

As at December 31, 2006<br />

Outstanding after giving<br />

effect to the Private<br />

Outstanding as at<br />

Placement and<br />

June 30, 2006 Outstanding (1) the Offering (3)<br />

(Audited) (Unaudited) (Pro Forma)<br />

Long Term Debt ................................. Nil Nil Nil<br />

Shares (2) (authorized: unlimited) ....................... 65,950,000 87,250,000 118,450,000<br />

Shareholders Equity ............................... $20,062,514 $54,986,838 $ 215,619,838<br />

Retained Earnings (Deficit) and Reserves ................. $ 426,819 $ (765,335) $ (765,335)<br />

TOTAL CAPITALIZATION .......................... $20,489,333 $54,221,503 $ 214,854,503<br />

Notes:<br />

(1) Before giving effect to the Private Placement and the Offering.<br />

(2) Not including shares issuable upon exercise of options which remained unexercised on June 30, 2006 and December 31, 2006,<br />

respectively. See ‘‘Options to Acquire Shares’’.<br />

(3) After deducting expenses of the Offering estimated to be C$1.4 million and the Agents’ Fee.<br />

53