COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

1. SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

(p) Segment reporting<br />

A segment is a distinguishable component of the consolidated entity that is engaged either in providing products or services<br />

(business segment), or in providing products or services within a particular economic environment (geographical segment), which is<br />

subject to risks and rewards that are different from those of other segments.<br />

(q) Goods and Services Tax<br />

Revenue, expenses and assets are recognised net of the amount of goods and services tax (GST), except where the amount of GST<br />

incurred is not recoverable from the taxation authority. In these circumstances, the GST is recognised as part of the cost of<br />

acquisition of the asset or as part of the expense.<br />

Receivables and payables are stated with the amount of GST included. The net amount of GST recoverable from, or payable to,<br />

the ATO is included as a current asset or liability in the statement of financial position.<br />

Cash flows are included in the statement of cash flows on a gross basis. The GST components of cash flows arising from investing<br />

and financing activities which are recoverable from, or payable to, the ATO are classified as operating cash flows.<br />

2. SEGMENT INFORMATION<br />

During the year <strong>Mirabela</strong> <strong>Nickel</strong> Limited operated in one business segment — mineral exploration, and in one geographical area —<br />

Brazil.<br />

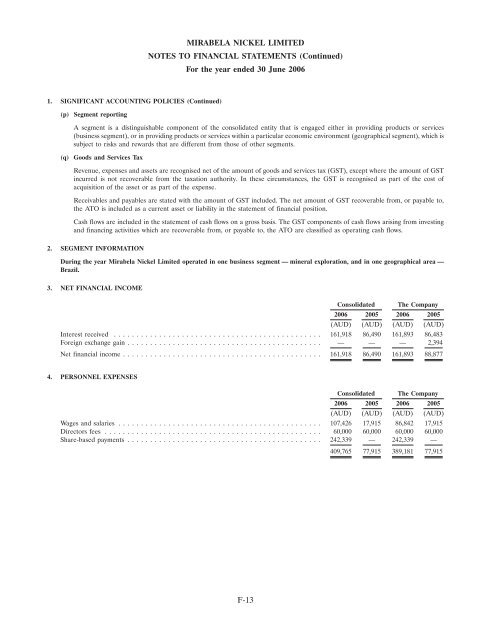

3. NET FINANCIAL INCOME<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

(AUD) (AUD) (AUD) (AUD)<br />

Interest received .............................................. 161,918 86,490 161,893 86,483<br />

Foreign exchange gain ........................................... — — — 2,394<br />

Net financial income ............................................ 161,918 86,490 161,893 88,877<br />

4. PERSONNEL EXPENSES<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

(AUD) (AUD) (AUD) (AUD)<br />

Wages and salaries ............................................. 107,426 17,915 86,842 17,915<br />

Directors fees ................................................ 60,000 60,000 60,000 60,000<br />

Share-based payments ........................................... 242,339 — 242,339 —<br />

409,765 77,915 389,181 77,915<br />

F-13