COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS<br />

For the six months ended 31 December 2006<br />

1. REPORTING ENTITY<br />

<strong>Mirabela</strong> <strong>Nickel</strong> Limited (the ‘‘Company’’) is a company domiciled in Australia. The consolidated interim financial report of the<br />

Company as at and for the six months ended 31 December 2006 comprises the Company and its subsidiary (together referred to as the<br />

‘‘consolidated entity’’).<br />

The consolidated annual financial report of the consolidated entity as at and for the year ended 30 June 2006 is available upon request<br />

from the Company’s registered office at 8 Colin Street, 6005 West Perth, or at www.mirabelanickel.com.au.<br />

2. STATEMENT <strong>OF</strong> COMPLIANCE<br />

The consolidated interim financial report is a general purpose financial report which has been prepared in accordance with AASB 134:<br />

Interim Financial Reporting, IAS 34: Interim Financial Reporting and the Corporations Act 2001.<br />

The consolidated interim financial report does not include all of the information required for a full annual financial report, and should<br />

be read in conjunction with the consolidated annual financial report of the consolidated entity as at and for the year ended<br />

30 June 2006.<br />

This consolidated interim financial report was approved by the Board of Directors on 1 March 2007.<br />

3. SIGNIFICANT ACCOUNTING POLICIES<br />

Except as described below, the accounting policies applied by the consolidated entity in this consolidated interim financial report are the<br />

same as those applied by the consolidated entity in its consolidated financial report as at and for the year ended 30 June 2006.<br />

In the prior financial year, the consolidated entity adopted AASB 132: Financial Instruments: Disclosure and Presentation and AASB<br />

139: Financial Instruments: Recognition and Measurement in accordance with the transitional rules of AASB 1. There has been no<br />

change in the opening balance of retained earnings and reserves at 1 July 2005, upon adoption of AASB 132 and AASB 139.<br />

4. SEGMENT REPORTING<br />

The consolidated entity operates in one business and geographical segment, namely mineral exploration in Brazil.<br />

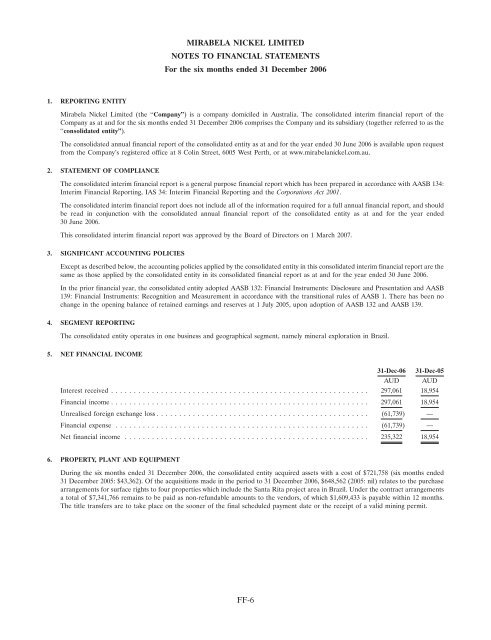

5. NET FINANCIAL INCOME<br />

31-Dec-06 31-Dec-05<br />

AUD AUD<br />

Interest received ......................................................... 297,061 18,954<br />

Financial income ......................................................... 297,061 18,954<br />

Unrealised foreign exchange loss ............................................... (61,739) —<br />

Financial expense ........................................................ (61,739) —<br />

Net financial income ...................................................... 235,322 18,954<br />

6. PROPERTY, PLANT AND EQUIPMENT<br />

During the six months ended 31 December 2006, the consolidated entity acquired assets with a cost of $721,758 (six months ended<br />

31 December 2005: $43,362). Of the acquisitions made in the period to 31 December 2006, $648,562 (2005: nil) relates to the purchase<br />

arrangements for surface rights to four properties which include the Santa Rita project area in Brazil. Under the contract arrangements<br />

a total of $7,341,766 remains to be paid as non-refundable amounts to the vendors, of which $1,609,433 is payable within 12 months.<br />

The title transfers are to take place on the sooner of the final scheduled payment date or the receipt of a valid mining permit.<br />

FF-6