COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

25. EXPLANATION <strong>OF</strong> TRANSITION TO AUSTRALIAN EQUIVALENTS TO IFRS (Continued)<br />

Deferred tax asset and deferred tax liability<br />

Under AIFRS the balance sheet method of tax effect accounting is adopted rather than the liability method previously applied<br />

under GAAP.<br />

Under the balance sheet approach, income tax on the profit and loss for the year comprises current and deferred taxes.<br />

Income tax is recognised in the income statement except to the extent that it relates to items recognised directly in equity, in<br />

which case it is recognised in equity.<br />

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at<br />

reporting date, and any adjustments to tax payable in respect of previous years.<br />

Deferred tax is provided using the balance sheet liability method, providing for temporary differences between the carrying<br />

amount of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. The Group<br />

presently offsets deferred tax assets and deferred tax liabilities relating to the same taxation authority.<br />

The residual of any deferred tax assets are not presently recognised as they do not meet the ‘highly probable’ requirements of<br />

AASB 112.<br />

Deferred tax assets will be reduced to the extent it is no longer probable that the related tax benefit will be realised.<br />

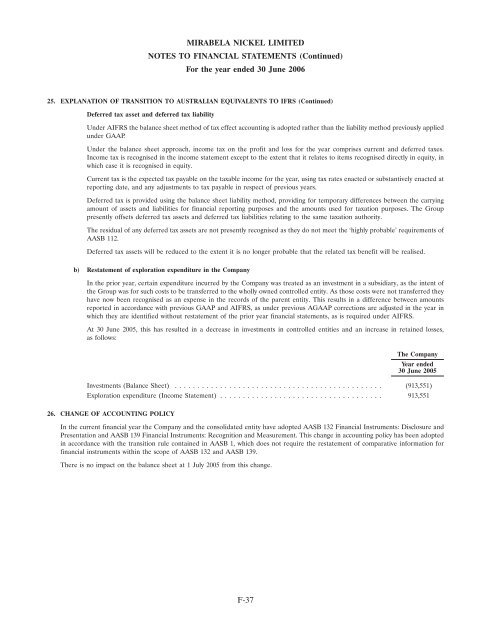

b) Restatement of exploration expenditure in the Company<br />

In the prior year, certain expenditure incurred by the Company was treated as an investment in a subsidiary, as the intent of<br />

the Group was for such costs to be transferred to the wholly owned controlled entity. As those costs were not transferred they<br />

have now been recognised as an expense in the records of the parent entity. This results in a difference between amounts<br />

reported in accordance with previous GAAP and AIFRS, as under previous AGAAP corrections are adjusted in the year in<br />

which they are identified without restatement of the prior year financial statements, as is required under AIFRS.<br />

At 30 June 2005, this has resulted in a decrease in investments in controlled entities and an increase in retained losses,<br />

as follows:<br />

The Company<br />

Year ended<br />

30 June 2005<br />

Investments (Balance Sheet) .............................................. (913,551)<br />

Exploration expenditure (Income Statement) .................................... 913,551<br />

26. CHANGE <strong>OF</strong> ACCOUNTING POLICY<br />

In the current financial year the Company and the consolidated entity have adopted AASB 132 Financial Instruments: Disclosure and<br />

Presentation and AASB 139 Financial Instruments: Recognition and Measurement. This change in accounting policy has been adopted<br />

in accordance with the transition rule contained in AASB 1, which does not require the restatement of comparative information for<br />

financial instruments within the scope of AASB 132 and AASB 139.<br />

There is no impact on the balance sheet at 1 July 2005 from this change.<br />

F-37