COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

23. RELATED PARTIES (Continued)<br />

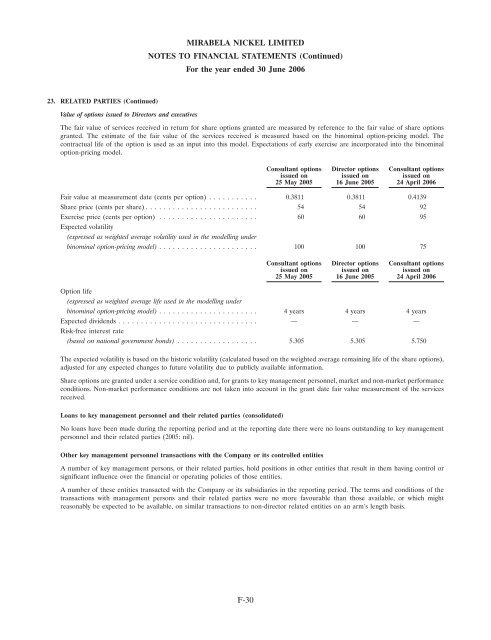

Value of options issued to Directors and executives<br />

The fair value of services received in return for share options granted are measured by reference to the fair value of share options<br />

granted. The estimate of the fair value of the services received is measured based on the binominal option-pricing model. The<br />

contractual life of the option is used as an input into this model. Expectations of early exercise are incorporated into the binominal<br />

option-pricing model.<br />

Consultant options Director options Consultant options<br />

issued on issued on issued on<br />

25 May 2005 16 June 2005 24 April 2006<br />

Fair value at measurement date (cents per option) ........... 0.3811 0.3811 0.4139<br />

Share price (cents per share) ......................... 54 54 92<br />

Exercise price (cents per option) ...................... 60 60 95<br />

Expected volatility<br />

(expressed as weighted average volatility used in the modelling under<br />

binominal option-pricing model) ...................... 100 100 75<br />

Consultant options Director options Consultant options<br />

issued on issued on issued on<br />

25 May 2005 16 June 2005 24 April 2006<br />

Option life<br />

(expressed as weighted average life used in the modelling under<br />

binominal option-pricing model) ...................... 4 years 4 years 4 years<br />

Expected dividends ............................... — — —<br />

Risk-free interest rate<br />

(based on national government bonds) .................. 5.305 5.305 5.750<br />

The expected volatility is based on the historic volatility (calculated based on the weighted average remaining life of the share options),<br />

adjusted for any expected changes to future volatility due to publicly available information.<br />

Share options are granted under a service condition and, for grants to key management personnel, market and non-market performance<br />

conditions. Non-market performance conditions are not taken into account in the grant date fair value measurement of the services<br />

received.<br />

Loans to key management personnel and their related parties (consolidated)<br />

No loans have been made during the reporting period and at the reporting date there were no loans outstanding to key management<br />

personnel and their related parties (2005: nil).<br />

Other key management personnel transactions with the Company or its controlled entities<br />

A number of key management persons, or their related parties, hold positions in other entities that result in them having control or<br />

significant influence over the financial or operating policies of those entities.<br />

A number of these entities transacted with the Company or its subsidiaries in the reporting period. The terms and conditions of the<br />

transactions with management persons and their related parties were no more favourable than those available, or which might<br />

reasonably be expected to be available, on similar transactions to non-director related entities on an arm’s length basis.<br />

F-30