MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

commodity prices, though the rise in sterling offsets<br />

this effect to some extent.<br />

The MPC will still have room for more QE<br />

The bottom line is that the August BoE forecast for<br />

consumer price inflation of 2.2% in the fourth quarter<br />

of this year is looking a bit of a stretch. Our own<br />

forecast is for the rate in Q4 to average 2.5%.<br />

But because most of the reasons for the upside news<br />

appear to be supply shock-driven price rises in<br />

energy and food, rather than anything more broadly<br />

based, this gives licence to the Monetary Policy<br />

Committee to look through the firmer headline rate.<br />

Average earnings growth remains at or below 2%,<br />

according to the most recent data. And as unit labour<br />

cost growth has been pushed up by falling GDP<br />

alongside still rising employment, we would not expect<br />

that productivity squeeze to last much longer. Indeed,<br />

a big rise in GDP in Q3 should provide an opportunity<br />

for some correction here. So, the underlying position<br />

on domestically generated inflationary pressure from<br />

the labour market is fairly benign.<br />

This all means that on the current constellation of<br />

data, the MPC is still likely to see room for more<br />

quantitative easing at its November meeting, when<br />

the current tranche of buying is completed.<br />

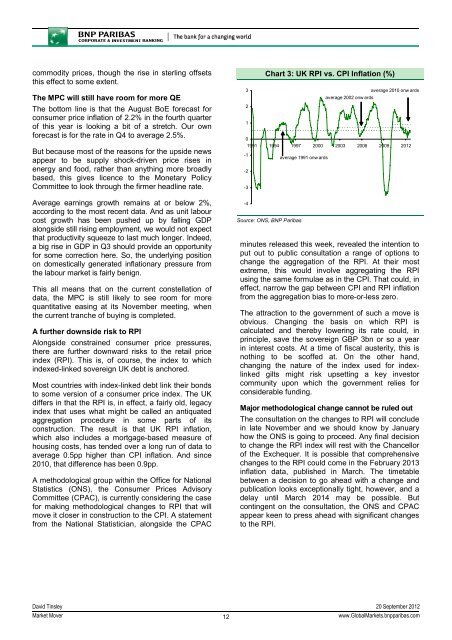

A further downside risk to RPI<br />

Alongside constrained consumer price pressures,<br />

there are further downward risks to the retail price<br />

index (RPI). This is, of course, the index to which<br />

indexed-linked sovereign UK debt is anchored.<br />

Most countries with index-linked debt link their bonds<br />

to some version of a consumer price index. The UK<br />

differs in that the RPI is, in effect, a fairly old, legacy<br />

index that uses what might be called an antiquated<br />

aggregation procedure in some parts of its<br />

construction. The result is that UK RPI inflation,<br />

which also includes a mortgage-based measure of<br />

housing costs, has tended over a long run of data to<br />

average 0.5pp higher than CPI inflation. And since<br />

2010, that difference has been 0.9pp.<br />

A methodological group within the Office for National<br />

Statistics (ONS), the Consumer Prices Advisory<br />

Committee (CPAC), is currently considering the case<br />

for making methodological changes to RPI that will<br />

move it closer in construction to the CPI. A statement<br />

from the National Statistician, alongside the CPAC<br />

3<br />

2<br />

1<br />

-1<br />

-2<br />

-3<br />

-4<br />

Chart 3: UK RPI vs. CPI Inflation (%)<br />

0<br />

1991 1994 1997 2000 2003 2006 2009 2012<br />

Source: ONS, <strong>BNP</strong> Paribas<br />

average 1991 onw ards<br />

average 2002 onw ards<br />

average 2010 onw ards<br />

minutes released this week, revealed the intention to<br />

put out to public consultation a range of options to<br />

change the aggregation of the RPI. At their most<br />

extreme, this would involve aggregating the RPI<br />

using the same formulae as in the CPI. That could, in<br />

effect, narrow the gap between CPI and RPI inflation<br />

from the aggregation bias to more-or-less zero.<br />

The attraction to the government of such a move is<br />

obvious. Changing the basis on which RPI is<br />

calculated and thereby lowering its rate could, in<br />

principle, save the sovereign GBP 3bn or so a year<br />

in interest costs. At a time of fiscal austerity, this is<br />

nothing to be scoffed at. On the other hand,<br />

changing the nature of the index used for indexlinked<br />

gilts might risk upsetting a key investor<br />

community upon which the government relies for<br />

considerable funding.<br />

Major methodological change cannot be ruled out<br />

The consultation on the changes to RPI will conclude<br />

in late November and we should know by January<br />

how the ONS is going to proceed. Any final decision<br />

to change the RPI index will rest with the Chancellor<br />

of the Exchequer. It is possible that comprehensive<br />

changes to the RPI could come in the February 2013<br />

inflation data, published in March. The timetable<br />

between a decision to go ahead with a change and<br />

publication looks exceptionally tight, however, and a<br />

delay until March 2014 may be possible. But<br />

contingent on the consultation, the ONS and CPAC<br />

appear keen to press ahead with significant changes<br />

to the RPI.<br />

David Tinsley 20 September 2012<br />

Market Mover<br />

12<br />

www.GlobalMarkets.bnpparibas.com