MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This section is classified as non-objective research<br />

Recently, however, as MBS yields have come off<br />

considerably, primary mortgage rates offered to<br />

borrowers have not declined as much. Thus,<br />

origination occurs mainly in the 3% coupon, with<br />

reasonable pricing available for the 2.5% coupon.<br />

With the current coupon calculated at 2.02% as of<br />

Wednesday close by Bloomberg and the lack of<br />

availability of market pricing for the 2% coupon, we<br />

consider current coupon + 50bp a better benchmark<br />

than the current coupon itself.<br />

Fed Purchases at the Expense of Money<br />

Managers and GSEs<br />

The Fed would effectively be buying from money<br />

managers who are overweight MBS and GSEs, who<br />

have been forced to reduce their portfolios. Rather<br />

than explicit sales of MBS, we mainly expect<br />

reinvestments of mortgage prepayments into other<br />

products. The latest Federal Reserve Z1 report<br />

shows that mutual funds hold about USD 1.36trn in<br />

agency debt and MBS; while the breakdown is not<br />

available, we expect the share of MBS to be much<br />

larger than debt akin to their relative sizes in the<br />

bond market (USD 5.6trn agency MBS vs USD 2.3trn<br />

agency debt). We estimate that money managers<br />

could experience USD 150bn to USD 200bn in<br />

prepayments that could be reinvested in other asset<br />

classes over the next 12 months.<br />

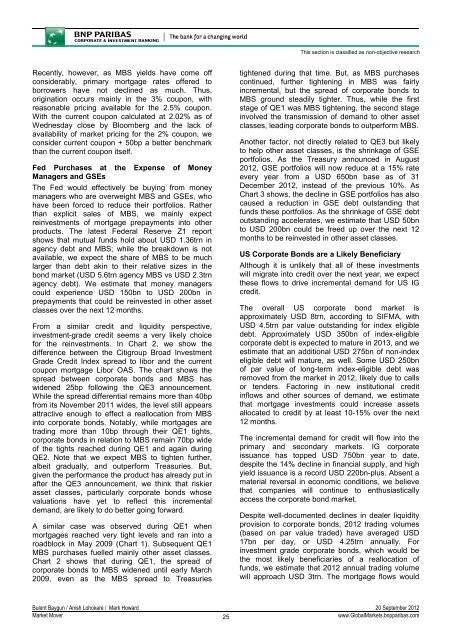

From a similar credit and liquidity perspective,<br />

investment-grade credit seems a very likely choice<br />

for the reinvestments. In Chart 2, we show the<br />

difference between the Citigroup Broad <strong>Investment</strong><br />

Grade Credit Index spread to libor and the current<br />

coupon mortgage Libor OAS. The chart shows the<br />

spread between corporate bonds and MBS has<br />

widened 25bp following the QE3 announcement.<br />

While the spread differential remains more than 40bp<br />

from its November 2011 wides, the level still appears<br />

attractive enough to effect a reallocation from MBS<br />

into corporate bonds. Notably, while mortgages are<br />

trading more than 10bp through their QE1 tights,<br />

corporate bonds in relation to MBS remain 70bp wide<br />

of the tights reached during QE1 and again during<br />

QE2. Note that we expect MBS to tighten further,<br />

albeit gradually, and outperform Treasuries. But,<br />

given the performance the product has already put in<br />

after the QE3 announcement, we think that riskier<br />

asset classes, particularly corporate bonds whose<br />

valuations have yet to reflect this incremental<br />

demand, are likely to do better going forward.<br />

A similar case was observed during QE1 when<br />

mortgages reached very tight levels and ran into a<br />

roadblock in May 2009 (Chart 1). Subsequent QE1<br />

MBS purchases fuelled mainly other asset classes.<br />

Chart 2 shows that during QE1, the spread of<br />

corporate bonds to MBS widened until early March<br />

2009, even as the MBS spread to Treasuries<br />

tightened during that time. But, as MBS purchases<br />

continued, further tightening in MBS was fairly<br />

incremental, but the spread of corporate bonds to<br />

MBS ground steadily tighter. Thus, while the first<br />

stage of QE1 was MBS tightening, the second stage<br />

involved the transmission of demand to other asset<br />

classes, leading corporate bonds to outperform MBS.<br />

Another factor, not directly related to QE3 but likely<br />

to help other asset classes, is the shrinkage of GSE<br />

portfolios. As the Treasury announced in August<br />

2012, GSE portfolios will now reduce at a 15% rate<br />

every year from a USD 650bn base as of 31<br />

December 2012, instead of the previous 10%. As<br />

Chart 3 shows, the decline in GSE portfolios has also<br />

caused a reduction in GSE debt outstanding that<br />

funds these portfolios. As the shrinkage of GSE debt<br />

outstanding accelerates, we estimate that USD 50bn<br />

to USD 200bn could be freed up over the next 12<br />

months to be reinvested in other asset classes.<br />

US Corporate Bonds are a Likely Beneficiary<br />

Although it is unlikely that all of these investments<br />

will migrate into credit over the next year, we expect<br />

these flows to drive incremental demand for US IG<br />

credit.<br />

The overall US corporate bond market is<br />

approximately USD 8trn, according to SIFMA, with<br />

USD 4.5trn par value outstanding for index eligible<br />

debt. Approximately USD 350bn of index-eligible<br />

corporate debt is expected to mature in 2013, and we<br />

estimate that an additional USD 275bn of non-index<br />

eligible debt will mature, as well. Some USD 250bn<br />

of par value of long-term index-eligible debt was<br />

removed from the market in 2012, likely due to calls<br />

or tenders. Factoring in new institutional credit<br />

inflows and other sources of demand, we estimate<br />

that mortgage investments could increase assets<br />

allocated to credit by at least 10-15% over the next<br />

12 months.<br />

The incremental demand for credit will flow into the<br />

primary and secondary markets. IG corporate<br />

issuance has topped USD 750bn year to date,<br />

despite the 14% decline in financial supply, and high<br />

yield issuance is a record USD 220bn-plus. Absent a<br />

material reversal in economic conditions, we believe<br />

that companies will continue to enthusiastically<br />

access the corporate bond market.<br />

Despite well-documented declines in dealer liquidity<br />

provision to corporate bonds, 2012 trading volumes<br />

(based on par value traded) have averaged USD<br />

17bn per day, or USD 4.25trn annually. For<br />

investment grade corporate bonds, which would be<br />

the most likely beneficiaries of a reallocation of<br />

funds, we estimate that 2012 annual trading volume<br />

will approach USD 3trn. The mortgage flows would<br />

Bulent Baygun / Anish Lohokare / Mark Howard 20 September 2012<br />

Market Mover<br />

25<br />

www.GlobalMarkets.bnpparibas.com