MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This section is classified as non-objective research<br />

Commodity Market Outlook<br />

• We expect a rise in oil prices over the next<br />

18 months.<br />

• Base metals prices have moved in a pack in<br />

2012, but are expected to diverge in 2013.<br />

• Higher demand and Black Sea trade barriers<br />

may lead to a leg up in agriculture.<br />

Oil and natural gas<br />

Despite the economic headwinds, we expect world oil<br />

demand to prove resilient, notably in emerging<br />

markets. Tighter sanctions on Iranian oil are likely to<br />

be accompanied by greater geopolitical tension and<br />

an erosion of spare production capacity in the OPEC<br />

countries. In non-OPEC countries, the only oil supply<br />

growth will come from the US but it will remain<br />

confined to the domestic market, while outages and<br />

declines in mature fields will persist elsewhere. The<br />

forthcoming global monetary-policy easing should<br />

bring about lower volatility, greater risk appetite and, in<br />

the case of the Fed, a weaker US dollar. All of this<br />

suggests a higher price for oil for the balance of 2012<br />

and into 2013. In the US natural gas markets, the<br />

oversupply from shale plays will continue to dominate<br />

market direction over the next quarter, but eventually<br />

ebb in 2013. We will only see demand-driven price<br />

support when winter demand picks up, eroding the<br />

overhang in stocks. We expect switches in baseload<br />

electricity generation and producer cutbacks to tighten<br />

balances progressively, suggesting gas prices will<br />

strengthen markedly in the second half of 2013.<br />

Metals<br />

A strong rally late in the quarter looks set to leave<br />

base metal prices down no more than 3-4%, on<br />

average, in Q3 2012. Monetary easing, other stimulus<br />

measures and tight supply in the flagship copper<br />

market are expected to drive further price recovery in<br />

Q4. Base metals have mostly moved in a pack this<br />

year, but we expect greater divergence in 2013.<br />

Copper prices may come under downward pressure<br />

due to faster supply growth, but the fundamentals of<br />

other metals should improve. We expect monetary<br />

accommodation to support gold and silver in Q4 2012.<br />

Higher liquidity and inflation expectations, plus a<br />

depreciating USD, should be positive factors. Officialsector<br />

purchases and a rebound in Chinese demand<br />

should more than offset shrinking <strong>India</strong>n jewellery<br />

demand. Platinum and palladium, too, should benefit<br />

from higher liquidity and risk appetite, while South<br />

African supply disruptions will erode market surpluses.<br />

Agriculture<br />

Grains and oilseeds prices surged by more than 50%<br />

this summer, as July was the hottest month on<br />

record in 48 US states. As a result, the US 2012-13<br />

corn yield may be at least 22% below its historical<br />

trend dating back to 1965, while the soybean yield<br />

may be cut further in Q4. Feed demand destruction,<br />

a stronger US dollar than last year and seasonal<br />

pressure linked to crop harvests across the northern<br />

hemisphere may offset part of US field losses short<br />

term and push prices down slightly by November.<br />

But, tight global stocks-to-use ratios, reviving biofuel<br />

demand and trade barriers in the Black Sea region<br />

may trigger a new leg up in agriculture this winter.<br />

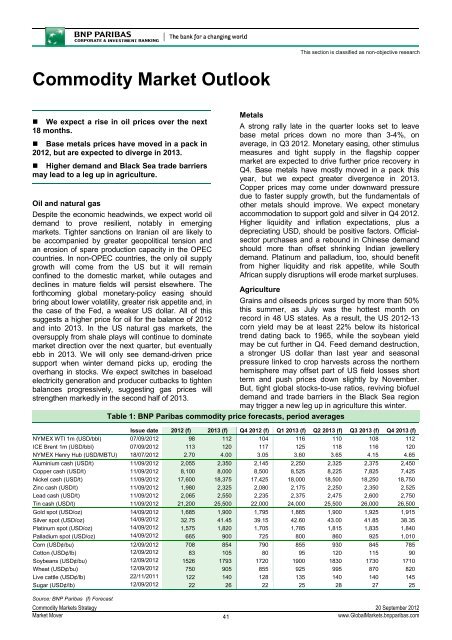

Table 1: <strong>BNP</strong> Paribas commodity price forecasts, period averages<br />

Issue date 2012 (f) 2013 (f) Q4 2012 (f) Q1 2013 (f) Q2 2013 (f) Q3 2013 (f) Q4 2013 (f)<br />

NYMEX WTI 1m (USD/bbl) 07/09/2012 98 112 104 116 110 108 112<br />

ICE Brent 1m (USD/bbl) 07/09/2012 113 120 117 125 118 116 120<br />

NYMEX Henry Hub (USD/MBTU) 18/07/2012 2.70 4.00 3.05 3.60 3.65 4.15 4.65<br />

Aluminium cash (USD/t) 11/09/2012 2,055 2,350 2,145 2,250 2,325 2,375 2,450<br />

Copper cash (USD/t) 11/09/2012 8,100 8,000 8,500 8,525 8,225 7,825 7,425<br />

Nickel cash (USD/t) 11/09/2012 17,600 18,375 17,425 18,000 18,500 18,250 18,750<br />

Zinc cash (USD/t) 11/09/2012 1,980 2,325 2,080 2,175 2,250 2,350 2,525<br />

Lead cash (USD/t) 11/09/2012 2,065 2,550 2,235 2,375 2,475 2,600 2,750<br />

Tin cash (USD/t) 11/09/2012 21,200 25,500 22,000 24,000 25,500 26,000 26,500<br />

Gold spot (USD/oz) 14/09/2012 1,685 1,900 1,795 1,865 1,900 1,925 1,915<br />

Silver spot (USD/oz) 14/09/2012 32.75 41.45 39.15 42.60 43.00 41.85 38.35<br />

Platinum spot (USD/oz) 14/09/2012 1,575 1,820 1,705 1,785 1,815 1,835 1,840<br />

Palladium spot (USD/oz) 14/09/2012 665 900 725 800 860 925 1,010<br />

Corn (USD¢/bu) 12/09/2012 708 854 790 855 930 845 785<br />

Cotton (USD¢/lb) 12/09/2012 83 105 80 95 120 115 90<br />

Soybeans (USD¢/bu) 12/09/2012 1526 1793 1720 1900 1830 1730 1710<br />

Wheat (USD¢/bu) 12/09/2012 750 905 855 925 995 870 820<br />

Live cattle (USD¢/lb) 22/11/2011 122 140 128 135 140 140 145<br />

Sugar (USD¢/lb) 12/09/2012 22 26 22 25 28 27 25<br />

Source: <strong>BNP</strong> Paribas (f) Forecast<br />

Commodity Markets Strategy 20 September 2012<br />

Market Mover<br />

41<br />

www.GlobalMarkets.bnpparibas.com