MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This section is classified as non-objective research<br />

QE Impacts on Spread Sector Relative Value<br />

• Steep MBS demand from the Fed in the face<br />

of negative net MBS issuance has driven MBS<br />

to negative Treasury OASs. While we expect<br />

MBS to further outperform Treasuries, riskier<br />

asset classes, particularly corporate bonds,<br />

with their similar credit quality and liquidity, are<br />

likely to do even better.<br />

• A broad range of global debt investors who<br />

employ benchmarks will face asset shortages in<br />

the face of this QE-induced contraction in<br />

available investment grade assets. This is<br />

expected to provide technical support to US IG<br />

credit, despite low yields and historically full<br />

valuations, and will help to perpetuate the<br />

current strong demand for high-quality new<br />

issue paper. High yield and emerging markets<br />

credit also benefit from this dynamic.<br />

• This incremental demand from non-credit<br />

sectors combined with significant re-investment<br />

cash flows from the shrinkage of the large bank<br />

balance sheets is expected to drive relative<br />

outperformance of bank/finance bonds, quasisovereign/yankee<br />

securities and select BBB's<br />

over the next 6 months.<br />

MBS Rich as Demand Far Outstrips Supply<br />

Our economists expect QE3 MBS purchases to<br />

continue at the USD 40bn per month pace at least<br />

until year-end 2013, and possibly tapering into 2014.<br />

Including reinvestments of maturing agency debt in<br />

the Fed's portfolio into agency MBS, the net demand<br />

from the Fed would exceed USD 500bn over the next<br />

12 months. The issuance of the TBA deliverable<br />

bonds where Fed purchases have been concentrated<br />

was negative USD 172bn over the past 12 months,<br />

roughly a negative USD 14.3bn per month average.<br />

Thus, the Fed demand for MBS is particularly high in<br />

relation to the negative supply of the bonds that the<br />

Fed has traditionally purchased.<br />

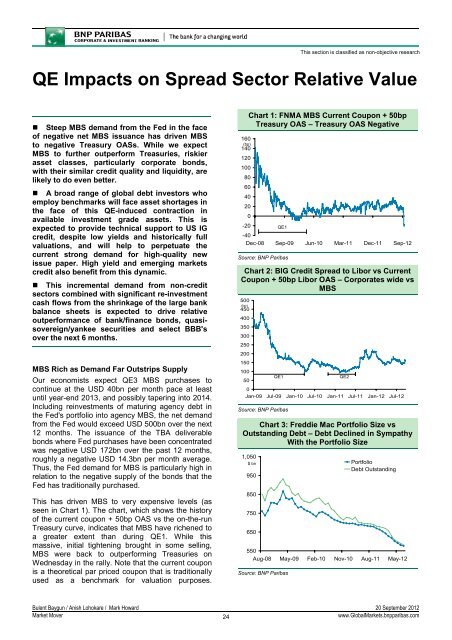

This has driven MBS to very expensive levels (as<br />

seen in Chart 1). The chart, which shows the history<br />

of the current coupon + 50bp OAS vs the on-the-run<br />

Treasury curve, indicates that MBS have richened to<br />

a greater extent than during QE1. While this<br />

massive, initial tightening brought in some selling,<br />

MBS were back to outperforming Treasuries on<br />

Wednesday in the rally. Note that the current coupon<br />

is a theoretical par priced coupon that is traditionally<br />

used as a benchmark for valuation purposes.<br />

Chart 1: FNMA MBS Current Coupon + 50bp<br />

Treasury OAS – Treasury OAS Negative<br />

160<br />

(bp)<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

QE1<br />

-40<br />

Dec-08 Sep-09 Jun-10 Mar-11 Dec-11 Sep-12<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: BIG Credit Spread to Libor vs Current<br />

Coupon + 50bp Libor OAS – Corporates wide vs<br />

MBS<br />

500<br />

(bp)<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

QE1<br />

QE2<br />

0<br />

Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 3: Freddie Mac Portfolio Size vs<br />

Outstanding Debt – Debt Declined in Sympathy<br />

With the Portfolio Size<br />

1,050<br />

$ bn<br />

950<br />

850<br />

750<br />

650<br />

Portfolio<br />

Debt Outstanding<br />

550<br />

Aug-08 May-09 Feb-10 Nov-10 Aug-11 May-12<br />

Source: <strong>BNP</strong> Paribas<br />

Bulent Baygun / Anish Lohokare / Mark Howard 20 September 2012<br />

Market Mover<br />

24<br />

www.GlobalMarkets.bnpparibas.com