MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

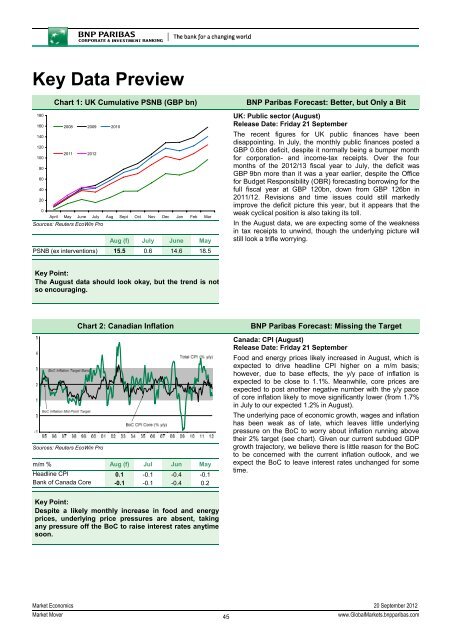

Chart 1: UK Cumulative PSNB (GBP bn)<br />

180<br />

160 2008 2009 2010<br />

140<br />

120<br />

2011 2012<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

April May June July Aug Sept Oct Nov Dec Jan Feb Mar<br />

Sources: Reuters EcoWin Pro<br />

Aug (f) July June May<br />

PSNB (ex interventions) 15.5 0.6 14.6 18.5<br />

<strong>BNP</strong> Paribas Forecast: Better, but Only a Bit<br />

UK: Public sector (August)<br />

Release Date: Friday 21 September<br />

The recent figures for UK public finances have been<br />

disappointing. In July, the monthly public finances posted a<br />

GBP 0.6bn deficit, despite it normally being a bumper month<br />

for corporation- and income-tax receipts. Over the four<br />

months of the 2012/13 fiscal year to July, the deficit was<br />

GBP 9bn more than it was a year earlier, despite the Office<br />

for Budget Responsibility (OBR) forecasting borrowing for the<br />

full fiscal year at GBP 120bn, down from GBP 126bn in<br />

2011/12. Revisions and time issues could still markedly<br />

improve the deficit picture this year, but it appears that the<br />

weak cyclical position is also taking its toll.<br />

In the August data, we are expecting some of the weakness<br />

in tax receipts to unwind, though the underlying picture will<br />

still look a trifle worrying.<br />

Key Point:<br />

The August data should look okay, but the trend is not<br />

so encouraging.<br />

Sources: Reuters EcoWin Pro<br />

Chart 2: Canadian Inflation<br />

m/m % Aug (f) Jul Jun May<br />

Headline CPI 0.1 -0.1 -0.4 -0.1<br />

Bank of Canada Core -0.1 -0.1 -0.4 0.2<br />

<strong>BNP</strong> Paribas Forecast: Missing the Target<br />

Canada: CPI (August)<br />

Release Date: Friday 21 September<br />

Food and energy prices likely increased in August, which is<br />

expected to drive headline CPI higher on a m/m basis;<br />

however, due to base effects, the y/y pace of inflation is<br />

expected to be close to 1.1%. Meanwhile, core prices are<br />

expected to post another negative number with the y/y pace<br />

of core inflation likely to move significantly lower (from 1.7%<br />

in July to our expected 1.2% in August).<br />

The underlying pace of economic growth, wages and inflation<br />

has been weak as of late, which leaves little underlying<br />

pressure on the BoC to worry about inflation running above<br />

their 2% target (see chart). Given our current subdued GDP<br />

growth trajectory, we believe there is little reason for the BoC<br />

to be concerned with the current inflation outlook, and we<br />

expect the BoC to leave interest rates unchanged for some<br />

time.<br />

Key Point:<br />

Despite a likely monthly increase in food and energy<br />

prices, underlying price pressures are absent, taking<br />

any pressure off the BoC to raise interest rates anytime<br />

soon.<br />

Market Economics 20 September 2012<br />

Market Mover<br />

45<br />

www.GlobalMarkets.bnpparibas.com