MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This section is classified as non-objective research<br />

trend. The only variable of the GDP formula that will<br />

remain flat is government consumption as the<br />

government continues to cut its fiscal deficit in a bid<br />

to achieve a balanced budget by late 2014/early<br />

2015.<br />

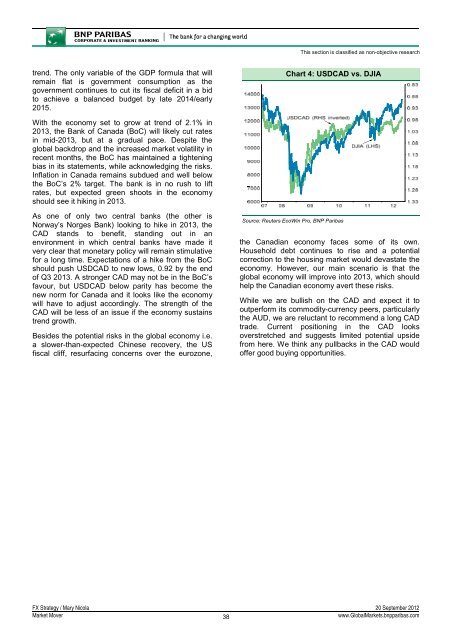

Chart 4: USDCAD vs. DJIA<br />

With the economy set to grow at trend of 2.1% in<br />

2013, the Bank of Canada (BoC) will likely cut rates<br />

in mid-2013, but at a gradual pace. Despite the<br />

global backdrop and the increased market volatility in<br />

recent months, the BoC has maintained a tightening<br />

bias in its statements, while acknowledging the risks.<br />

Inflation in Canada remains subdued and well below<br />

the BoC’s 2% target. The bank is in no rush to lift<br />

rates, but expected green shoots in the economy<br />

should see it hiking in 2013.<br />

As one of only two central banks (the other is<br />

Norway’s Norges Bank) looking to hike in 2013, the<br />

CAD stands to benefit, standing out in an<br />

environment in which central banks have made it<br />

very clear that monetary policy will remain stimulative<br />

for a long time. Expectations of a hike from the BoC<br />

should push USDCAD to new lows, 0.92 by the end<br />

of Q3 2013. A stronger CAD may not be in the BoC’s<br />

favour, but USDCAD below parity has become the<br />

new norm for Canada and it looks like the economy<br />

will have to adjust accordingly. The strength of the<br />

CAD will be less of an issue if the economy sustains<br />

trend growth.<br />

Besides the potential risks in the global economy i.e.<br />

a slower-than-expected Chinese recovery, the US<br />

fiscal cliff, resurfacing concerns over the eurozone,<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

the Canadian economy faces some of its own.<br />

Household debt continues to rise and a potential<br />

correction to the housing market would devastate the<br />

economy. However, our main scenario is that the<br />

global economy will improve into 2013, which should<br />

help the Canadian economy avert these risks.<br />

While we are bullish on the CAD and expect it to<br />

outperform its commodity-currency peers, particularly<br />

the AUD, we are reluctant to recommend a long CAD<br />

trade. Current positioning in the CAD looks<br />

overstretched and suggests limited potential upside<br />

from here. We think any pullbacks in the CAD would<br />

offer good buying opportunities.<br />

FX Strategy / Mary Nicola 20 September 2012<br />

Market Mover<br />

38<br />

www.GlobalMarkets.bnpparibas.com