MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

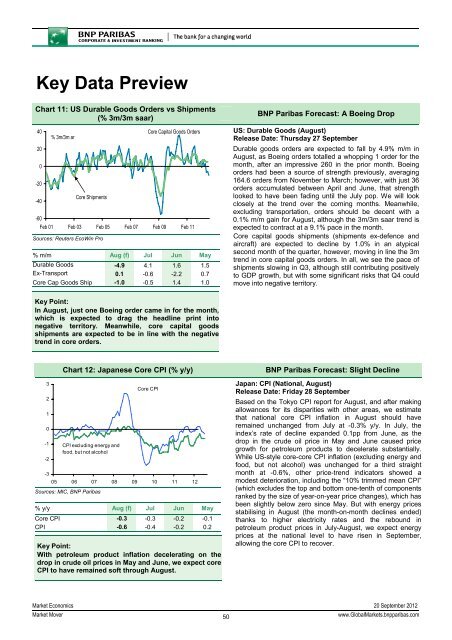

Chart 11: US Durable Goods Orders vs Shipments<br />

(% 3m/3m saar)<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

% 3m/3m ar<br />

Core Shipments<br />

Core Capital Goods Orders<br />

Feb 01 Feb 03 Feb 05 Feb 07 Feb 09 Feb 11<br />

Sources: Reuters EcoWin Pro<br />

% m/m Aug (f) Jul Jun May<br />

Durable Goods -4.9 4.1 1.6 1.5<br />

Ex-Transport 0.1 -0.6 -2.2 0.7<br />

Core Cap Goods Ship -1.0 -0.5 1.4 1.0<br />

<strong>BNP</strong> Paribas Forecast: A Boeing Drop<br />

US: Durable Goods (August)<br />

Release Date: Thursday 27 September<br />

Durable goods orders are expected to fall by 4.9% m/m in<br />

August, as Boeing orders totalled a whopping 1 order for the<br />

month, after an impressive 260 in the prior month. Boeing<br />

orders had been a source of strength previously, averaging<br />

164.6 orders from November to March; however, with just 36<br />

orders accumulated between April and June, that strength<br />

looked to have been fading until the July pop. We will look<br />

closely at the trend over the coming months. Meanwhile,<br />

excluding transportation, orders should be decent with a<br />

0.1% m/m gain for August, although the 3m/3m saar trend is<br />

expected to contract at a 9.1% pace in the month.<br />

Core capital goods shipments (shipments ex-defence and<br />

aircraft) are expected to decline by 1.0% in an atypical<br />

second month of the quarter, however, moving in line the 3m<br />

trend in core capital goods orders. In all, we see the pace of<br />

shipments slowing in Q3, although still contributing positively<br />

to GDP growth, but with some significant risks that Q4 could<br />

move into negative territory.<br />

Key Point:<br />

In August, just one Boeing order came in for the month,<br />

which is expected to drag the headline print into<br />

negative territory. Meanwhile, core capital goods<br />

shipments are expected to be in line with the negative<br />

trend in core orders.<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

Chart 12: Japanese Core CPI (% y/y)<br />

CPI excluding energy and<br />

food, but not alcohol<br />

Core CPI<br />

05 06 07 08 09 10 11 12<br />

Sources: MIC, <strong>BNP</strong> Paribas<br />

% y/y Aug (f) Jul Jun May<br />

Core CPI -0.3 -0.3 -0.2 -0.1<br />

CPI -0.6 -0.4 -0.2 0.2<br />

Key Point:<br />

With petroleum product inflation decelerating on the<br />

drop in crude oil prices in May and June, we expect core<br />

CPI to have remained soft through August.<br />

<strong>BNP</strong> Paribas Forecast: Slight Decline<br />

Japan: CPI (National, August)<br />

Release Date: Friday 28 September<br />

Based on the Tokyo CPI report for August, and after making<br />

allowances for its disparities with other areas, we estimate<br />

that national core CPI inflation in August should have<br />

remained unchanged from July at -0.3% y/y. In July, the<br />

index’s rate of decline expanded 0.1pp from June, as the<br />

drop in the crude oil price in May and June caused price<br />

growth for petroleum products to decelerate substantially.<br />

While US-style core-core CPI inflation (excluding energy and<br />

food, but not alcohol) was unchanged for a third straight<br />

month at -0.6%, other price-trend indicators showed a<br />

modest deterioration, including the “10% trimmed mean CPI”<br />

(which excludes the top and bottom one-tenth of components<br />

ranked by the size of year-on-year price changes), which has<br />

been slightly below zero since May. But with energy prices<br />

stabilising in August (the month-on-month declines ended)<br />

thanks to higher electricity rates and the rebound in<br />

petroleum product prices in July-August, we expect energy<br />

prices at the national level to have risen in September,<br />

allowing the core CPI to recover.<br />

Market Economics 20 September 2012<br />

Market Mover<br />

50<br />

www.GlobalMarkets.bnpparibas.com