MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This section is classified as non-objective research<br />

evidence suggests that GBP will not weaken in<br />

response.<br />

We considered establishing a long GBPUSD<br />

recommendation simultaneously with our long<br />

NZDUSD position prior to the Fed’s announcement<br />

last week. We shied away from the GBPUSD idea,<br />

because the pair had already rallied sharply in<br />

contrast to NZDUSD, which had lagged. Long<br />

NZDUSD has performed strongly, however;<br />

GBPUSD would have, too. Still, opportunity may<br />

have knocked twice, as there are several factors that<br />

now suggest GBPUSD may retrace to allow for an<br />

attractive entry level. First, our <strong>BNP</strong> Paribas STEER<br />

model suggests that GBPUSD is overvalued on a<br />

short-term basis (see chart), signalling that fair value<br />

is around 1.60 (vs. spot at 1.62). Second, our <strong>BNP</strong><br />

Paribas positioning indicator signals that FX investors<br />

are still long GBP. However, long GBP positioning<br />

has retreated sharply over the past week. The GBP<br />

was the most owned currency a week ago, but has<br />

fallen to rank sixth. This move suggests that the GBP<br />

is approaching a level at which extreme positioning<br />

may no longer present a barrier to further<br />

appreciation.<br />

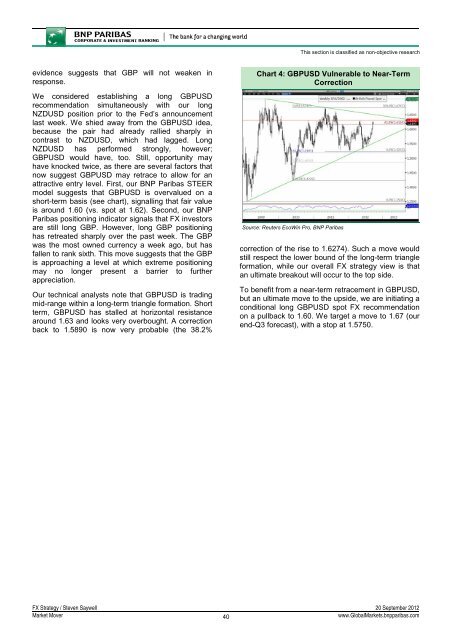

Our technical analysts note that GBPUSD is trading<br />

mid-range within a long-term triangle formation. Short<br />

term, GBPUSD has stalled at horizontal resistance<br />

around 1.63 and looks very overbought. A correction<br />

back to 1.5890 is now very probable (the 38.2%<br />

Chart 4: GBPUSD Vulnerable to Near-Term<br />

Correction<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

correction of the rise to 1.6274). Such a move would<br />

still respect the lower bound of the long-term triangle<br />

formation, while our overall FX strategy view is that<br />

an ultimate breakout will occur to the top side.<br />

To benefit from a near-term retracement in GBPUSD,<br />

but an ultimate move to the upside, we are initiating a<br />

conditional long GBPUSD spot FX recommendation<br />

on a pullback to 1.60. We target a move to 1.67 (our<br />

end-Q3 forecast), with a stop at 1.5750.<br />

FX Strategy / Steven Saywell 20 September 2012<br />

Market Mover<br />

40<br />

www.GlobalMarkets.bnpparibas.com