MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

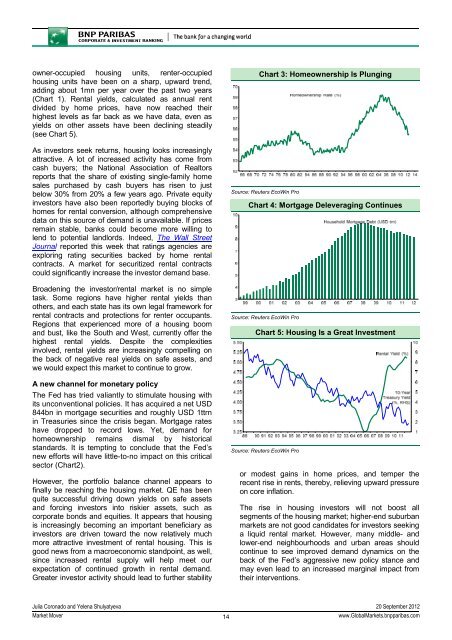

owner-occupied housing units, renter-occupied<br />

housing units have been on a sharp, upward trend,<br />

adding about 1mn per year over the past two years<br />

(Chart 1). Rental yields, calculated as annual rent<br />

divided by home prices, have now reached their<br />

highest levels as far back as we have data, even as<br />

yields on other assets have been declining steadily<br />

(see Chart 5).<br />

As investors seek returns, housing looks increasingly<br />

attractive. A lot of increased activity has come from<br />

cash buyers; the National Association of Realtors<br />

reports that the share of existing single-family home<br />

sales purchased by cash buyers has risen to just<br />

below 30% from 20% a few years ago. Private equity<br />

investors have also been reportedly buying blocks of<br />

homes for rental conversion, although comprehensive<br />

data on this source of demand is unavailable. If prices<br />

remain stable, banks could become more willing to<br />

lend to potential landlords. Indeed, The Wall Street<br />

Journal reported this week that ratings agencies are<br />

exploring rating securities backed by home rental<br />

contracts. A market for securitized rental contracts<br />

could significantly increase the investor demand base.<br />

Broadening the investor/rental market is no simple<br />

task. Some regions have higher rental yields than<br />

others, and each state has its own legal framework for<br />

rental contracts and protections for renter occupants.<br />

Regions that experienced more of a housing boom<br />

and bust, like the South and West, currently offer the<br />

highest rental yields. Despite the complexities<br />

involved, rental yields are increasingly compelling on<br />

the back of negative real yields on safe assets, and<br />

we would expect this market to continue to grow.<br />

A new channel for monetary policy<br />

The Fed has tried valiantly to stimulate housing with<br />

its unconventional policies. It has acquired a net USD<br />

844bn in mortgage securities and roughly USD 1ttrn<br />

in Treasuries since the crisis began. Mortgage rates<br />

have dropped to record lows. Yet, demand for<br />

homeownership remains dismal by historical<br />

standards. It is tempting to conclude that the Fed’s<br />

new efforts will have little-to-no impact on this critical<br />

sector (Chart2).<br />

However, the portfolio balance channel appears to<br />

finally be reaching the housing market. QE has been<br />

quite successful driving down yields on safe assets<br />

and forcing investors into riskier assets, such as<br />

corporate bonds and equities. It appears that housing<br />

is increasingly becoming an important beneficiary as<br />

investors are driven toward the now relatively much<br />

more attractive investment of rental housing. This is<br />

good news from a macroeconomic standpoint, as well,<br />

since increased rental supply will help meet our<br />

expectation of continued growth in rental demand.<br />

Greater investor activity should lead to further stability<br />

Chart 3: Homeownership Is Plunging<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Mortgage Deleveraging Continues<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Housing Is a Great <strong>Investment</strong><br />

Source: Reuters EcoWin Pro<br />

or modest gains in home prices, and temper the<br />

recent rise in rents, thereby, relieving upward pressure<br />

on core inflation.<br />

The rise in housing investors will not boost all<br />

segments of the housing market; higher-end suburban<br />

markets are not good candidates for investors seeking<br />

a liquid rental market. However, many middle- and<br />

lower-end neighbourhoods and urban areas should<br />

continue to see improved demand dynamics on the<br />

back of the Fed’s aggressive new policy stance and<br />

may even lead to an increased marginal impact from<br />

their interventions.<br />

Julia Coronado and Yelena Shulyatyeva 20 September 2012<br />

Market Mover<br />

14<br />

www.GlobalMarkets.bnpparibas.com