MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Potential cash shortages ahead<br />

But if the debt-financing legislation remains blocked by<br />

the time December comes, drastic spending cuts and<br />

a partial shutdown of government will be unavoidable.<br />

The impact on the economy would be severe.<br />

Budgetary outlays are prevalent in December. For<br />

example, in December 2011, expenditures exceeded<br />

revenue (excluding government bonds) by almost JPY<br />

7trn (equivalent to roughly 5.7% of Q4 GDP). In the<br />

final quarter of FY2011, revenue exceeded spending<br />

by roughly JPY 2trn in January, but this was followed<br />

by shortfalls of more than JPY 5trn in February and<br />

roughly JPY 10trn in March, for a combined quarterly<br />

shortage of JPY 13trn (equivalent to about 11.1% of<br />

Q1 GDP). As the budget balance this fiscal year will<br />

likely be similar, very drastic spending cuts could<br />

become necessary. Of course, all spending does not<br />

directly affect the economy (delaying transfers to<br />

special accounts absorbs the reserve surpluses<br />

parked in some special accounts). But even if the<br />

amount were reduced by half, the impact on the<br />

economy would be substantial. Currently, with exports<br />

trending lower as a result of the slowing global<br />

economy and with economic support ending from the<br />

eco-car subsidy programme and income transfers to<br />

households in quake-hit areas, we expect the<br />

economy to enter another soft patch from Q3. But if<br />

the deficit-financing bill is not enacted by December,<br />

cuts in government spending will make conditions far<br />

worse than just a soft patch.<br />

Election by year end seems likely<br />

To avoid this, the debt-financing legislation needs to<br />

be enacted as soon as possible. But that is easier<br />

said than done. To win cooperation from the<br />

opposition LDP and New Komeito, Prime Minister<br />

Noda will have to make some kind of deal, and we<br />

see two main possibilities here. The most<br />

straightforward deal under current circumstances and<br />

based on past experience would be to agree to<br />

dissolve the lower house in exchange for opposition<br />

support of the debt-financing legislation and another<br />

vital bill involving electoral reform to rectify vote-value<br />

disparities. As both the DPJ and LDP are slated to<br />

hold leadership elections shortly (the DPJ on 21<br />

September, the LDP on 26 September), followed by<br />

an extraordinary Diet session in early October, such<br />

a deal would likely mean passing the debt-financing<br />

bill and electoral reform in October, then dissolving<br />

the lower house in November for an election by year<br />

end. While this election scenario is probable, there is<br />

a possibility that Prime Minister Noda (who looks set<br />

to be re-elected DPJ head) could put off calling an<br />

election until the last minute, as he is also eager to<br />

enact a supplementary budget. In this case, the<br />

election would be pushed back to January or so.<br />

Another condition for the LDP’s cooperation<br />

The second potential deal involves the LDP making<br />

its cooperation on the debt-financing legislation<br />

contingent on an agreement to forswear using such<br />

legislation as a political trump card, in other words,<br />

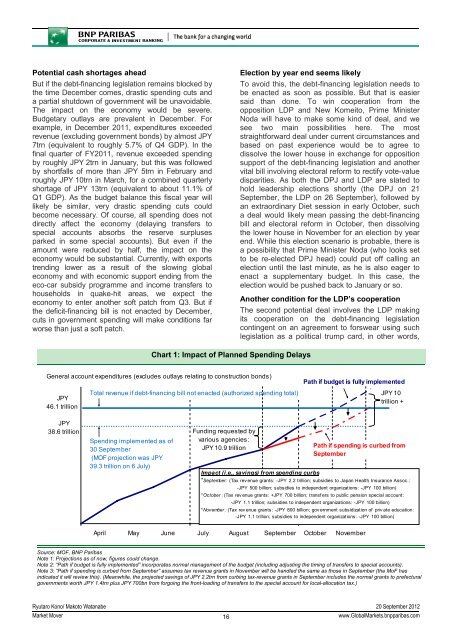

Chart 1: Impact of Planned Spending Delays<br />

General account expenditures (excludes outlays relating to construction bonds)<br />

Path if budget is fully implemented<br />

JPY<br />

46.1 trillion<br />

Total revenue if debt-financing bill not enacted (authorized spending total)<br />

JPY 10<br />

trillion +<br />

JPY<br />

38.6 trillion<br />

Spending implemented as of<br />

30 September<br />

(MOF projection was JPY<br />

39.3 trillion on 6 July)<br />

Funding requested by<br />

various agencies:<br />

JPY 10.9 trillion<br />

Path if spending is curbed from<br />

September<br />

Impact (i.e., savings) from spending curbs<br />

*September: (Tax rev enue grants: -JPY 2.2 trillion; subsidies to Japan Health Insurance Assoc.:<br />

-JPY 500 billion; subsidies to independent organizations: -JPY 100 billion)<br />

*October: (Tax rev enue grants: +JPY 700 billion; transf ers to public pension special account:<br />

-JPY 1.1 trillion; subsidies to independent organizations: -JPY 100 billion)<br />

*November : (Tax rev enue grants: -JPY 800 billion; gov ernment subsidization of priv ate education:<br />

-JPY 1.1 trillion; subsidies to independent organizations: -JPY 100 billion)<br />

April May June<br />

July August September October November<br />

Source: MOF, <strong>BNP</strong> Paribas<br />

Note 1: Projections as of now, figures could change.<br />

Note 2: “Path if budget is fully implemented” incorporates normal management of the budget (including adjusting the timing of transfers to special accounts).<br />

Note 3: “Path if spending is curbed from September” assumes tax revenue grants in November will be handled the same as those in September (the MoF has<br />

indicated it will review this). (Meanwhile, the projected savings of JPY 2.2trn from curbing tax-revenue grants in September includes the normal grants to prefectural<br />

governments worth JPY 1.4trn plus JPY 700bn from forgoing the front-loading of transfers to the special account for local-allocation tax.)<br />

Ryutaro Kono/ Makoto Watanabe 20 September 2012<br />

Market Mover<br />

16<br />

www.GlobalMarkets.bnpparibas.com