Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS<br />

IFRS FINANCIAL STATEMENTS<br />

EEV SUPPLEMENTARY INFORMATION<br />

Notes to the consolidated accounts continued<br />

10. Staff pension schemes continued<br />

Overseas schemes<br />

Given possible changes in overseas pension provision (for example the <strong>new</strong> schemes set-up), there is some uncertainty on the future level of<br />

employer contributions that may be required. The figures in the table below assume that contributions at the level paid in 2006 continue for<br />

the overseas schemes.<br />

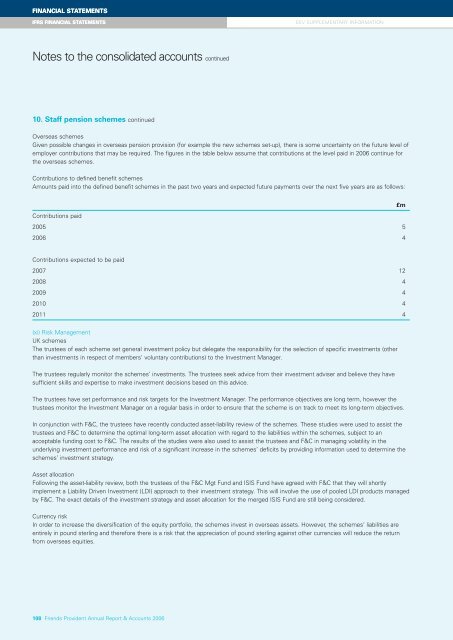

Contributions to defined benefit schemes<br />

Amounts paid into the defined benefit schemes in the past two years and expected future payments over the next five years are as follows:<br />

£m<br />

Contributions paid<br />

2005 5<br />

2006 4<br />

Contributions expected to be paid<br />

2007 12<br />

2008 4<br />

2009 4<br />

2010 4<br />

2011 4<br />

(xi) Risk Management<br />

UK schemes<br />

The trustees of each scheme set general investment policy but delegate the responsibility for the selection of specific investments (other<br />

than investments in respect of members’ voluntary contributions) to the Investment Manager.<br />

The trustees regularly monitor the schemes’ investments. The trustees seek advice from their investment adviser and believe they have<br />

sufficient skills and expertise to make investment decisions based on this advice.<br />

The trustees have set performance and risk targets for the Investment Manager. The performance objectives are long term, however the<br />

trustees monitor the Investment Manager on a regular basis in order to ensure that the scheme is on track to meet its long-term objectives.<br />

In conjunction with F&C, the trustees have recently conducted asset-liability review of the schemes. These studies were used to assist the<br />

trustees and F&C to determine the optimal long-term asset allocation with regard to the liabilities within the schemes, subject to an<br />

acceptable funding cost to F&C. The results of the studies were also used to assist the trustees and F&C in managing volatility in the<br />

underlying investment performance and risk of a significant increase in the schemes’ deficits by providing information used to determine the<br />

schemes’ investment strategy.<br />

Asset allocation<br />

Following the asset-liability review, both the trustees of the F&C Mgt Fund and ISIS Fund have agreed with F&C that they will shortly<br />

implement a Liability Driven Investment (LDI) approach to their investment strategy. This will involve the use of pooled LDI products managed<br />

by F&C. The exact details of the investment strategy and asset allocation for the merged ISIS Fund are still being considered.<br />

Currency risk<br />

In order to increase the diversification of the equity portfolio, the schemes invest in overseas assets. However, the schemes’ liabilities are<br />

entirely in pound sterling and therefore there is a risk that the appreciation of pound sterling against other currencies will reduce the return<br />

from overseas equities.<br />

108 <strong>Friends</strong> Provident Annual Report & Accounts 2006