Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REVIEW<br />

CHAIRMAN’S STATEMENT GROUP CHIEF EXECUTIVE’S REVIEW ABOUT THE FRIENDS PROVIDENT GROUP UK LIFE & PENSIONS<br />

Provisions<br />

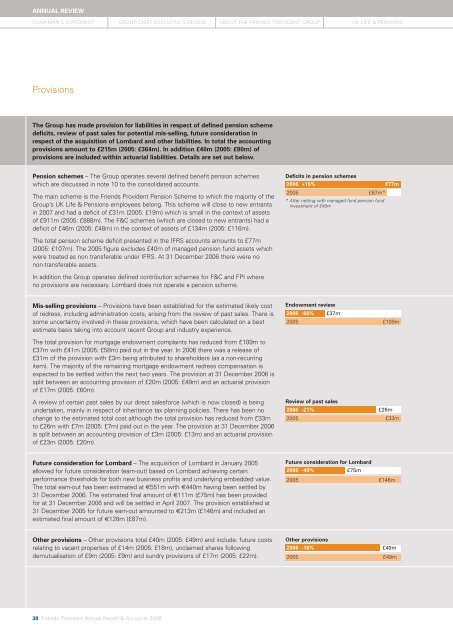

The Group has made provision for liabilities in respect of defined pension scheme<br />

deficits, review of past sales for potential mis-selling, future consideration in<br />

respect of the acquisition of Lombard and other liabilities. In total the accounting<br />

provisions amount to £215m (2005: £364m). In addition £40m (2005: £80m) of<br />

provisions are included within actuarial liabilities. Details are set out below.<br />

Pension schemes – The Group operates several defined benefit pension schemes<br />

which are discussed in note 10 to the consolidated accounts.<br />

The main scheme is the <strong>Friends</strong> Provident Pension Scheme to which the majority of the<br />

Group’s UK <strong>Life</strong> & Pensions employees belong. This scheme will close to <strong>new</strong> entrants<br />

in 2007 and had a deficit of £31m (2005: £19m) which is small in the context of assets<br />

of £911m (2005: £888m). The F&C schemes (which are closed to <strong>new</strong> entrants) had a<br />

deficit of £46m (2005: £48m) in the context of assets of £134m (2005: £116m).<br />

Deficits in pension schemes<br />

2006 +15% £77m<br />

2005 £67m*<br />

* After netting with managed fund pension fund<br />

investment of £40m<br />

The total pension scheme deficit presented in the IFRS accounts amounts to £77m<br />

(2005: £107m). The 2005 figure excludes £40m of managed pension fund assets which<br />

were treated as non transferable under IFRS. At 31 December 2006 there were no<br />

non-transferable assets.<br />

In addition the Group operates defined contribution schemes for F&C and FPI where<br />

no provisions are necessary. Lombard does not operate a pension scheme.<br />

Mis-selling provisions – Provisions have been established for the estimated likely cost<br />

of redress, including administration costs, arising from the review of past sales. There is<br />

some uncertainty involved in these provisions, which have been calculated on a best<br />

estimate basis taking into account recent Group and industry experience.<br />

Endowment review<br />

2006 -66% £37m<br />

2005 £109m<br />

The total provision for mortgage endowment complaints has reduced from £109m to<br />

£37m with £41m (2005: £58m) paid out in the year. In 2006 there was a release of<br />

£31m of the provision with £3m being attributed to shareholders (as a non-recurring<br />

item). The majority of the remaining mortgage endowment redress compensation is<br />

expected to be settled within the next two years. The provision at 31 December 2006 is<br />

split between an accounting provision of £20m (2005: £49m) and an actuarial provision<br />

of £17m (2005: £60m).<br />

A review of certain past sales by our direct salesforce (which is now closed) is being<br />

undertaken, mainly in respect of inheritance tax planning policies. There has been no<br />

change to the estimated total cost although the total provision has reduced from £33m<br />

to £26m with £7m (2005: £7m) paid out in the year. The provision at 31 December 2006<br />

is split between an accounting provision of £3m (2005: £13m) and an actuarial provision<br />

of £23m (2005: £20m).<br />

Review of past sales<br />

2006 -21% £26m<br />

2005 £33m<br />

Future consideration for Lombard – The acquisition of Lombard in January 2005<br />

allowed for future consideration (earn-out) based on Lombard achieving certain<br />

performance thresholds for both <strong>new</strong> business profits and underlying embedded value.<br />

The total earn-out has been estimated at €551m with €440m having been settled by<br />

31 December 2006. The estimated final amount of €111m (£75m) has been provided<br />

for at 31 December 2006 and will be settled in April 2007. The provision established at<br />

31 December 2005 for future earn-out amounted to €213m (£146m) and included an<br />

estimated final amount of €128m (£87m).<br />

Future consideration for Lombard<br />

2006 -49% £75m<br />

2005 £146m<br />

Other provisions – Other provisions total £40m (2005: £49m) and include: future costs<br />

relating to vacant properties of £14m (2005: £18m), unclaimed shares following<br />

demutualisation of £9m (2005: £9m) and sundry provisions of £17m (2005: £22m).<br />

Other provisions<br />

2006 -18% £40m<br />

2005 £49m<br />

38 <strong>Friends</strong> Provident Annual Report & Accounts 2006