Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIRECTORS’ REPORT<br />

CORPORATE GOVERNANCE REPORTS<br />

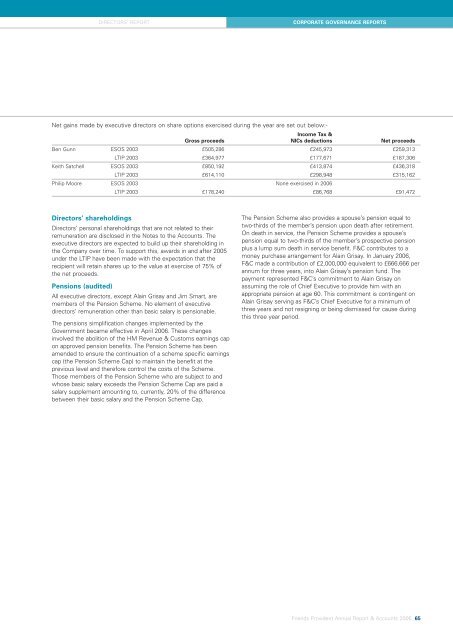

Net gains made by executive directors on share options exercised during the year are set out below:-<br />

Income Tax &<br />

Gross proceeds NICs deductions Net proceeds<br />

Ben Gunn ESOS 2003 £505,286 £245,973 £259,313<br />

LTIP 2003 £364,977 £177,671 £187,306<br />

Keith Satchell ESOS 2003 £850,192 £413,874 £436,318<br />

LTIP 2003 £614,110 £298,948 £315,162<br />

Philip Moore ESOS 2003 None exercised in 2006<br />

LTIP 2003 £178,240 £86,768 £91,472<br />

Directors’ shareholdings<br />

Directors’ personal shareholdings that are not related to their<br />

remuneration are disclosed in the Notes to the Accounts. The<br />

executive directors are expected to build up their shareholding in<br />

the Company over time. To support this, awards in and after 2005<br />

under the LTIP have been made with the expectation that the<br />

recipient will retain shares up to the value at exercise of 75% of<br />

the net proceeds.<br />

Pensions (audited)<br />

All executive directors, except Alain Grisay and Jim Smart, are<br />

members of the Pension Scheme. No element of executive<br />

directors’ remuneration other than basic salary is pensionable.<br />

The pensions simplification changes implemented by the<br />

Government became effective in April 2006. These changes<br />

involved the abolition of the HM Revenue & Customs earnings cap<br />

on approved pension benefits. The Pension Scheme has been<br />

amended to ensure the continuation of a scheme specific earnings<br />

cap (the Pension Scheme Cap) to maintain the benefit at the<br />

previous level and therefore control the costs of the Scheme.<br />

Those members of the Pension Scheme who are subject to and<br />

whose basic salary exceeds the Pension Scheme Cap are paid a<br />

salary supplement amounting to, currently, 20% of the difference<br />

between their basic salary and the Pension Scheme Cap.<br />

The Pension Scheme also provides a spouse’s pension equal to<br />

two-thirds of the member’s pension upon death after retirement.<br />

On death in service, the Pension Scheme provides a spouse’s<br />

pension equal to two-thirds of the member’s prospective pension<br />

plus a lump sum death in service benefit. F&C contributes to a<br />

money purchase arrangement for Alain Grisay. In January 2006,<br />

F&C made a contribution of £2,000,000 equivalent to £666,666 per<br />

annum for three years, into Alain Grisay’s pension fund. The<br />

payment represented F&C’s commitment to Alain Grisay on<br />

assuming the role of Chief Executive to provide him with an<br />

appropriate pension at age 60. This commitment is contingent on<br />

Alain Grisay serving as F&C’s Chief Executive for a minimum of<br />

three years and not resigning or being dismissed for cause during<br />

this three year period.<br />

<strong>Friends</strong> Provident Annual Report & Accounts 2006 65