Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REVIEW<br />

CHAIRMAN’S STATEMENT GROUP CHIEF EXECUTIVE’S REVIEW ABOUT THE FRIENDS PROVIDENT GROUP UK LIFE & PENSIONS<br />

Our trading performance and outlook<br />

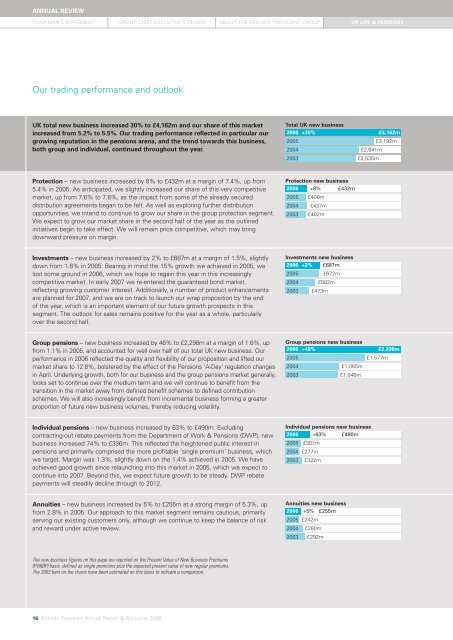

UK total <strong>new</strong> business increased 30% to £4,162m and our share of this market<br />

increased from 5.2% to 5.5%. Our trading performance reflected in particular our<br />

growing reputation in the pensions arena, and the trend towards this business,<br />

both group and individual, continued throughout the year.<br />

Total UK <strong>new</strong> business<br />

2006 +30% £4,162m<br />

2005 £3,192m<br />

2004 £2,641m<br />

2003 £2,535m<br />

Protection – <strong>new</strong> business increased by 8% to £432m at a margin of 7.4%, up from<br />

5.4% in 2005. As anticipated, we slightly increased our share of this very competitive<br />

market, up from 7.6% to 7.8%, as the impact from some of the already secured<br />

distribution agreements began to be felt. As well as exploring further distribution<br />

opportunities, we intend to continue to grow our share in the group protection segment.<br />

We expect to grow our market share in the second half of the year as the outlined<br />

initiatives begin to take effect. We will remain price competitive, which may bring<br />

downward pressure on margin.<br />

Protection <strong>new</strong> business<br />

2006 +8% £432m<br />

2005 £400m<br />

2004 £437m<br />

2003 £402m<br />

Investments – <strong>new</strong> business increased by 2% to £687m at a margin of 1.5%, slightly<br />

down from 1.6% in 2005. Bearing in mind the 15% growth we achieved in 2005, we<br />

lost some ground in 2006, which we hope to regain this year in this increasingly<br />

competitive market. In early 2007 we re-entered the guaranteed bond market,<br />

reflecting growing customer interest. Additionally, a number of product enhancements<br />

are planned for 2007, and we are on track to launch our wrap proposition by the end<br />

of the year, which is an important element of our future growth prospects in this<br />

segment. The outlook for sales remains positive for the year as a whole, particularly<br />

over the second half.<br />

Investments <strong>new</strong> business<br />

2006 +2% £687m<br />

2005 £672m<br />

2004 £582m<br />

2003 £473m<br />

Group pensions – <strong>new</strong> business increased by 46% to £2,298m at a margin of 1.6%, up<br />

from 1.1% in 2005, and accounted for well over half of our total UK <strong>new</strong> business. Our<br />

performance in 2006 reflected the quality and flexibility of our proposition and lifted our<br />

market share to 12.8%, bolstered by the effect of the Pensions ‘A-Day’ regulation changes<br />

in April. Underlying growth, both for our business and the group pensions market generally,<br />

looks set to continue over the medium term and we will continue to benefit from the<br />

transition in the market away from defined benefit schemes to defined contribution<br />

schemes. We will also increasingly benefit from incremental business forming a greater<br />

proportion of future <strong>new</strong> business volumes, thereby reducing volatility.<br />

Group pensions <strong>new</strong> business<br />

2006 +46% £2,298m<br />

2005 £1,577m<br />

2004 £1,065m<br />

2003 £1,046m<br />

Individual pensions – <strong>new</strong> business increased by 63% to £490m. Excluding<br />

contracting-out rebate payments from the Department of Work & Pensions (DWP), <strong>new</strong><br />

business increased 74% to £336m. This reflected the heightened public interest in<br />

pensions and primarily comprised the more profitable ‘single premium’ business, which<br />

we target. Margin was 1.3%, slightly down on the 1.4% achieved in 2005. We have<br />

achieved good growth since relaunching into this market in 2005, which we expect to<br />

continue into 2007. Beyond this, we expect future growth to be steady. DWP rebate<br />

payments will steadily decline through to 2012.<br />

Individual pensions <strong>new</strong> business<br />

2006 +63% £490m<br />

2005 £301m<br />

2004 £277m<br />

2003 £322m<br />

Annuities – <strong>new</strong> business increased by 5% to £255m at a strong margin of 5.3%, up<br />

from 2.8% in 2005. Our approach to this market segment remains cautious, primarily<br />

serving our existing customers only, although we continue to keep the balance of risk<br />

and reward under active review.<br />

Annuities <strong>new</strong> business<br />

2006 +5% £255m<br />

2005 £242m<br />

2004 £280m<br />

2003 £292m<br />

The <strong>new</strong> business figures on this page are reported on the Present Value of New Business Premiums<br />

(PVNBP) basis, defined as single premiums plus the expected present value of <strong>new</strong> regular premiums.<br />

The 2003 bars on the charts have been estimated on this basis to indicate a comparison.<br />

16 <strong>Friends</strong> Provident Annual Report & Accounts 2006