Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REVIEW<br />

CHAIRMAN’S STATEMENT GROUP CHIEF EXECUTIVE’S REVIEW ABOUT THE FRIENDS PROVIDENT GROUP UK LIFE & PENSIONS<br />

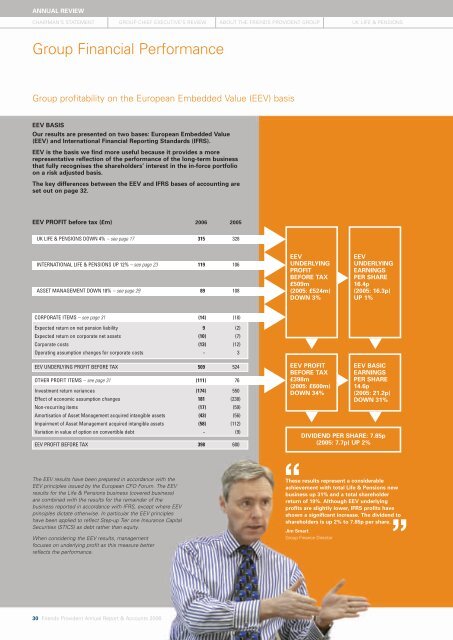

Group Financial Performance<br />

Group profitability on the European Embedded Value (EEV) basis<br />

EEV BASIS<br />

Our results are presented on two bases: European Embedded Value<br />

(EEV) and International Financial Reporting Standards (IFRS).<br />

EEV is the basis we find more useful because it provides a more<br />

representative reflection of the performance of the long-term business<br />

that fully recognises the shareholders’ interest in the in-force portfolio<br />

on a risk adjusted basis.<br />

The key differences between the EEV and IFRS bases of accounting are<br />

set out on page 32.<br />

EEV PROFIT before tax (£m) 2006 2005<br />

UK LIFE & PENSIONS DOWN 4% – see page 17 315 328<br />

INTERNATIONAL LIFE & PENSIONS UP 12% – see page 23 119 106<br />

ASSET MANAGEMENT DOWN 18% – see page 29 89 108<br />

EEV<br />

UNDERLYING<br />

PROFIT<br />

BEFORE TAX<br />

£509m<br />

(2005: £524m)<br />

DOWN 3%<br />

EEV<br />

UNDERLYING<br />

EARNINGS<br />

PER SHARE<br />

16.4p<br />

(2005: 16.3p)<br />

UP 1%<br />

CORPORATE ITEMS – see page 31 (14) (18)<br />

Expected return on net pension liability 9 (2)<br />

Expected return on corporate net assets (10) (7)<br />

Corporate costs (13) (12)<br />

Operating assumption changes for corporate costs - 3<br />

EEV UNDERLYING PROFIT BEFORE TAX 509 524<br />

OTHER PROFIT ITEMS – see page 31 (111) 76<br />

Investment return variances (174) 550<br />

Effect of economic assumption changes 181 (238)<br />

Non-recurring items (17) (59)<br />

Amortisation of Asset Management acquired intangible assets (43) (56)<br />

Impairment of Asset Management acquired intangible assets (58) (112)<br />

Variation in value of option on convertible debt - (9)<br />

EEV PROFIT BEFORE TAX 398 600<br />

EEV PROFIT<br />

BEFORE TAX<br />

£398m<br />

(2005: £600m)<br />

DOWN 34%<br />

EEV BASIC<br />

EARNINGS<br />

PER SHARE<br />

14.6p<br />

(2005: 21.2p)<br />

DOWN 31%<br />

DIVIDEND PER SHARE: 7.85p<br />

(2005: 7.7p) UP 2%<br />

The EEV results have been prepared in accordance with the<br />

EEV principles issued by the European CFO Forum. The EEV<br />

results for the <strong>Life</strong> & Pensions business (covered business)<br />

are combined with the results for the remainder of the<br />

business reported in accordance with IFRS, except where EEV<br />

principles dictate otherwise. In particular the EEV principles<br />

have been applied to reflect Step-up Tier one Insurance Capital<br />

Securities (STICS) as debt rather than equity.<br />

When considering the EEV results, management<br />

focuses on underlying profit as this measure better<br />

reflects the performance.<br />

“<br />

These results represent a considerable<br />

achievement with total <strong>Life</strong> & Pensions <strong>new</strong><br />

business up 31% and a total shareholder<br />

return of 19%. Although EEV underlying<br />

profits are slightly lower, IFRS profits have<br />

shown a significant increase. The dividend to<br />

shareholders is up 2% to 7.85p per share.<br />

”<br />

Jim Smart<br />

Group Finance Director<br />

30 <strong>Friends</strong> Provident Annual Report & Accounts 2006