Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PARENT COMPANY ACCOUNTS<br />

ABBREVIATIONS AND DEFINITIONS<br />

Notes to the consolidated accounts continued<br />

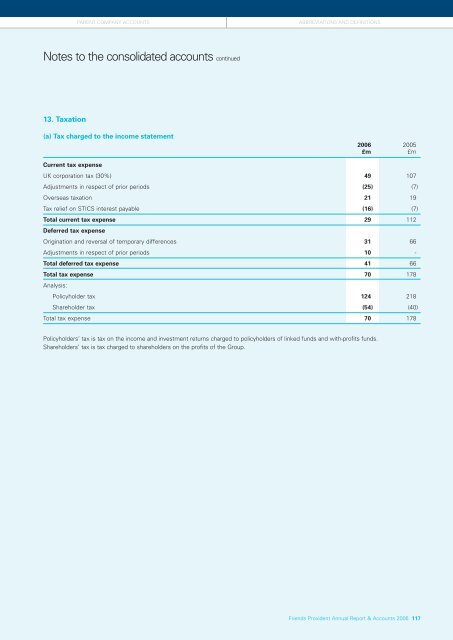

13. Taxation<br />

(a) Tax charged to the income statement<br />

2006 2005<br />

£m £m<br />

Current tax expense<br />

UK corporation tax (30%) 49 107<br />

Adjustments in respect of prior periods (25) (7)<br />

Overseas taxation 21 19<br />

Tax relief on STICS interest payable (16) (7)<br />

Total current tax expense 29 112<br />

Deferred tax expense<br />

Origination and reversal of temporary differences 31 66<br />

Adjustments in respect of prior periods 10 -<br />

Total deferred tax expense 41 66<br />

Total tax expense 70 178<br />

Analysis:<br />

Policyholder tax 124 218<br />

Shareholder tax (54) (40)<br />

Total tax expense 70 178<br />

Policyholders’ tax is tax on the income and investment returns charged to policyholders of linked funds and with-profits funds.<br />

Shareholders’ tax is tax charged to shareholders on the profits of the Group.<br />

<strong>Friends</strong> Provident Annual Report & Accounts 2006 117