Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REVIEW<br />

CHAIRMAN’S STATEMENT GROUP CHIEF EXECUTIVE’S REVIEW ABOUT THE FRIENDS PROVIDENT GROUP UK LIFE & PENSIONS<br />

Our trading performance and outlook<br />

International <strong>new</strong> business, achieved through <strong>Friends</strong> Provident International<br />

and Lombard combined, increased by 32% to £2,912m, representing more than<br />

40% of the <strong>Friends</strong> Provident Group’s total life and pensions sales.<br />

Over the longer term, we continue to expect the pace of growth in our<br />

International operations to exceed that of the UK <strong>Life</strong> & Pensions business, with<br />

future trend growth rate for <strong>new</strong> business profit expected to be in double digits.<br />

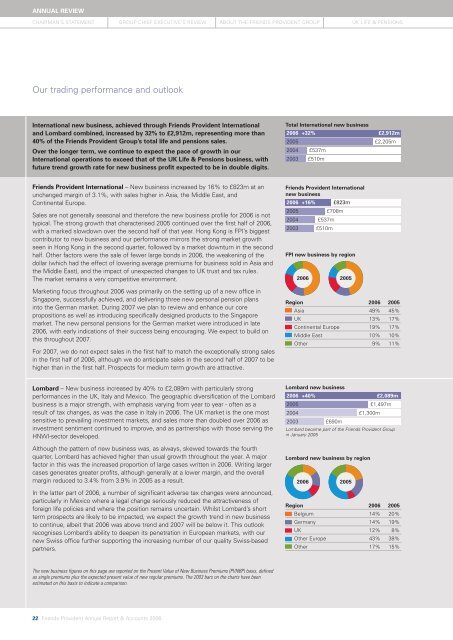

Total International <strong>new</strong> business<br />

2005 2006 +311% +32% £2,205m £2,912m<br />

2005 +311% £2,205m £2,205m<br />

2004 £537m<br />

2003 £510m<br />

<strong>Friends</strong> Provident International – New business increased by 16% to £823m at an<br />

unchanged margin of 3.1%, with sales higher in Asia, the Middle East, and<br />

Continental Europe.<br />

Sales are not generally seasonal and therefore the <strong>new</strong> business profile for 2006 is not<br />

typical. The strong growth that characterised 2005 continued over the first half of 2006,<br />

with a marked slowdown over the second half of that year. Hong Kong is FPI’s biggest<br />

contributor to <strong>new</strong> business and our performance mirrors the strong market growth<br />

seen in Hong Kong in the second quarter, followed by a market downturn in the second<br />

half. Other factors were the sale of fewer large bonds in 2006, the weakening of the<br />

dollar (which had the effect of lowering average premiums for business sold in Asia and<br />

the Middle East), and the impact of unexpected changes to UK trust and tax rules.<br />

The market remains a very competitive environment.<br />

Marketing focus throughout 2006 was primarily on the setting up of a <strong>new</strong> office in<br />

Singapore, successfully achieved, and delivering three <strong>new</strong> personal pension plans<br />

into the German market. During 2007 we plan to review and enhance our core<br />

propositions as well as introducing specifically designed products to the Singapore<br />

market. The <strong>new</strong> personal pensions for the German market were introduced in late<br />

2006, with early indications of their success being encouraging. We expect to build on<br />

this throughout 2007.<br />

For 2007, we do not expect sales in the first half to match the exceptionally strong sales<br />

in the first half of 2006, although we do anticipate sales in the second half of 2007 to be<br />

higher than in the first half. Prospects for medium term growth are attractive.<br />

<strong>Friends</strong> Provident International<br />

<strong>new</strong> business<br />

2006 +16% £823m<br />

2005 £708m<br />

2004 £537m<br />

2003 £510m<br />

FPI <strong>new</strong> business by region<br />

2006 2005<br />

Region 2006 2005<br />

Asia 49% 45%<br />

UK 13% 17%<br />

Continental Europe 19% 17%<br />

Middle East 10% 10%<br />

Other 9% 11%<br />

Lombard – New business increased by 40% to £2,089m with particularly strong<br />

performances in the UK, Italy and Mexico. The geographic diversification of the Lombard<br />

business is a major strength, with emphasis varying from year to year - often as a<br />

result of tax changes, as was the case in Italy in 2006. The UK market is the one most<br />

sensitive to prevailing investment markets, and sales more than doubled over 2006 as<br />

investment sentiment continued to improve, and as partnerships with those serving the<br />

HNWI-sector developed.<br />

Although the pattern of <strong>new</strong> business was, as always, skewed towards the fourth<br />

quarter, Lombard has achieved higher than usual growth throughout the year. A major<br />

factor in this was the increased proportion of large cases written in 2006. Writing larger<br />

cases generates greater profits, although generally at a lower margin, and the overall<br />

margin reduced to 3.4% from 3.9% in 2005 as a result.<br />

In the latter part of 2006, a number of significant adverse tax changes were announced,<br />

particularly in Mexico where a legal change seriously reduced the attractiveness of<br />

foreign life policies and where the position remains uncertain. Whilst Lombard’s short<br />

term prospects are likely to be impacted, we expect the growth trend in <strong>new</strong> business<br />

to continue, albeit that 2006 was above trend and 2007 will be below it. This outlook<br />

recognises Lombard’s ability to deepen its penetration in European markets, with our<br />

<strong>new</strong> Swiss office further supporting the increasing number of our quality Swiss-based<br />

partners.<br />

Lombard <strong>new</strong> business<br />

2006 +40% £2,089m<br />

2005 £1,497m<br />

2004 £1,300m<br />

2003 £690m<br />

Lombard became part of the <strong>Friends</strong> Provident Group<br />

in January 2005<br />

Lombard <strong>new</strong> business by region<br />

2006<br />

2005<br />

Region 2006 2005<br />

Belgium 14% 20%<br />

Germany 14% 19%<br />

UK 12% 8%<br />

Other Europe 43% 38%<br />

Other 17% 15%<br />

The <strong>new</strong> business figures on this page are reported on the Present Value of New Business Premiums (PVNBP) basis, defined<br />

as single premiums plus the expected present value of <strong>new</strong> regular premiums. The 2003 bars on the charts have been<br />

estimated on this basis to indicate a comparison.<br />

22 <strong>Friends</strong> Provident Annual Report & Accounts 2006