Setting new standards - Friends Life

Setting new standards - Friends Life

Setting new standards - Friends Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REVIEW<br />

CHAIRMAN’S STATEMENT GROUP CHIEF EXECUTIVE’S REVIEW ABOUT THE FRIENDS PROVIDENT GROUP UK LIFE & PENSIONS<br />

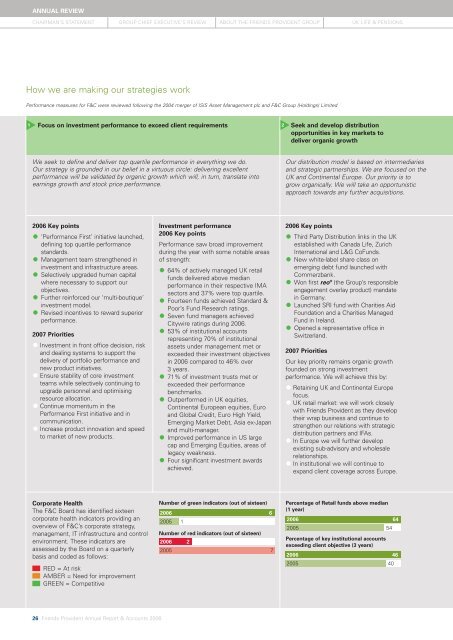

How we are making our strategies work<br />

Performance measures for F&C were reviewed following the 2004 merger of ISIS Asset Management plc and F&C Group (Holdings) Limited<br />

Focus on investment performance to exceed client requirements<br />

1 2<br />

Seek and develop distribution<br />

opportunities in key markets to<br />

deliver organic growth<br />

We seek to define and deliver top quartile performance in everything we do.<br />

Our strategy is grounded in our belief in a virtuous circle: delivering excellent<br />

performance will be validated by organic growth which will, in turn, translate into<br />

earnings growth and stock price performance.<br />

Our distribution model is based on intermediaries<br />

and strategic partnerships. We are focused on the<br />

UK and Continental Europe. Our priority is to<br />

grow organically. We will take an opportunistic<br />

approach towards any further acquisitions.<br />

2006 Key points<br />

•<br />

‘Performance First’ initiative launched,<br />

defining top quartile performance<br />

<strong>standards</strong>.<br />

• Management team strengthened in<br />

investment and infrastructure areas.<br />

•<br />

Selectively upgraded human capital<br />

where necessary to support our<br />

objectives.<br />

• Further reinforced our ‘multi-boutique’<br />

investment model.<br />

•<br />

Revised incentives to reward superior<br />

performance.<br />

2007 Priorities<br />

• Investment in front office decision, risk<br />

and dealing systems to support the<br />

delivery of portfolio performance and<br />

<strong>new</strong> product initiatives.<br />

• Ensure stability of core investment<br />

teams while selectively continuing to<br />

upgrade personnel and optimising<br />

resource allocation.<br />

• Continue momentum in the<br />

Performance First initiative and in<br />

communication.<br />

• Increase product innovation and speed<br />

to market of <strong>new</strong> products.<br />

Investment performance<br />

2006 Key points<br />

Performance saw broad improvement<br />

during the year with some notable areas<br />

of strength:<br />

• 64% of actively managed UK retail<br />

funds delivered above median<br />

performance in their respective IMA<br />

sectors and 37% were top quartile.<br />

• Fourteen funds achieved Standard &<br />

Poor’s Fund Research ratings.<br />

• Seven fund managers achieved<br />

Citywire ratings during 2006.<br />

•<br />

53% of institutional accounts<br />

representing 70% of institutional<br />

assets under management met or<br />

exceeded their investment objectives<br />

in 2006 compared to 46% over<br />

3 years.<br />

•<br />

71% of investment trusts met or<br />

exceeded their performance<br />

benchmarks.<br />

•<br />

Outperformed in UK equities,<br />

Continental European equities, Euro<br />

and Global Credit, Euro High Yield,<br />

Emerging Market Debt, Asia ex-Japan<br />

and multi-manager.<br />

•<br />

Improved performance in US large<br />

cap and Emerging Equities, areas of<br />

legacy weakness.<br />

•<br />

Four significant investment awards<br />

achieved.<br />

2006 Key points<br />

• Third Party Distribution links in the UK<br />

established with Canada <strong>Life</strong>, Zurich<br />

International and L&G CoFunds.<br />

• New white-label share class on<br />

emerging debt fund launched with<br />

Commerzbank.<br />

• Won first reo® (the Group’s responsible<br />

engagement overlay product) mandate<br />

in Germany.<br />

• Launched SRI fund with Charities Aid<br />

Foundation and a Charities Managed<br />

Fund in Ireland.<br />

• Opened a representative office in<br />

Switzerland.<br />

2007 Priorities<br />

Our key priority remains organic growth<br />

founded on strong investment<br />

performance. We will achieve this by:<br />

• Retaining UK and Continental Europe<br />

focus.<br />

• UK retail market: we will work closely<br />

with <strong>Friends</strong> Provident as they develop<br />

their wrap business and continue to<br />

strengthen our relations with strategic<br />

distribution partners and IFAs.<br />

• In Europe we will further develop<br />

existing sub-advisory and wholesale<br />

relationships.<br />

• In institutional we will continue to<br />

expand client coverage across Europe.<br />

Corporate Health<br />

The F&C Board has identified sixteen<br />

corporate health indicators providing an<br />

overview of F&C’s corporate strategy,<br />

management, IT infrastructure and control<br />

environment. These indicators are<br />

assessed by the Board on a quarterly<br />

basis and coded as follows:<br />

RED = At risk<br />

AMBER = Need for improvement<br />

GREEN = Competitive<br />

Number of green indicators (out of sixteen)<br />

2006 6<br />

2005 1<br />

Number of red indicators (out of sixteen)<br />

2006 2<br />

2005 7<br />

Percentage of Retail funds above median<br />

(1 year)<br />

2006 64<br />

2005 54<br />

Percentage of key institutional accounts<br />

exceeding client objective (3 years)<br />

2006 46<br />

2005 40<br />

26 <strong>Friends</strong> Provident Annual Report & Accounts 2006