Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011-12<br />

condition. Other conditions applicable to the credit<br />

insurance policy are that - an insurer shall appoint a<br />

credit management agency for assessing credit<br />

worthiness of the policyholder and that the agency<br />

shall have no confl ict of interest with the policyholder;<br />

No specifi c trade credit insurance policy can be sold<br />

to a single prospect; Trade credit insurance shall not<br />

offer indemnity which is more than 80 per cent of the<br />

trade receivable of the buyer or ninety per cent of the<br />

cost incurred by the seller for the previous year,<br />

whichever is lower; and that the insurer will have well<br />

defi ned internal underwriting, risk management and<br />

claims settlement guidelines duly approved by the<br />

Board of Directors for writing this class of business.<br />

II.1.10 In addition, the guidelines also prescribe the<br />

framework for the creation of premium, claims, IBNR<br />

and IBNER reserves on actuarial basis. The net<br />

retention of the insurer for trade credit shall not exceed<br />

two per cent of its net worth. The guidelines require<br />

that the insurer shall have qualifi ed, experienced and<br />

trained employees dealing with trade credit insurance.<br />

To monitor the performance of the insurers in this line<br />

of business, reporting requirements have been<br />

prescribed by the Authority.<br />

II.1.11 In terms of the new framework, insurers have<br />

to fi le revised products in line with both File & Use<br />

guidelines and the trade credit guidelines.<br />

Relaxation in the Terms & Conditions of erstwhile<br />

tariff coverage effective from 1 st January, 2009<br />

II.1.12 After de-tariffi cation of the General Insurance<br />

Industry, another major decision taken by the Authority<br />

was to allow relaxations in erstwhile tariff products. In<br />

a series of steps taken to promote innovations in<br />

products and to increase insurance penetration, the<br />

Authority vide its Circular dated 6 th November, 2010<br />

has allowed insurers to fi le<br />

Variations in deductibles set out in tariffs,<br />

<br />

<br />

<br />

New add-on covers over and above the erstwhile<br />

tariff covers,<br />

Extension of engineering insurance coverage to<br />

movable/portable equipments, and<br />

Removal of minimum Total Sum Insured (TSI)<br />

limit of `100 crore for Industrial All Risk (IAR)<br />

policies and has also allowed IAR cover for<br />

petrochemical industry.<br />

II.1.13 However, the scope of standard covers available<br />

under the existing tariffs cannot be abridged beyond<br />

the options permitted in different categories and any<br />

such new cover proposed is required to be subject to<br />

fi ling with the <strong>IRDA</strong> under the F&U guidelines. The<br />

relaxation of norms have been beneficial for the<br />

customers while at the same time allowing the<br />

companies to broaden their offerings; facilitate offer of<br />

tailor-made products to different customers; and design<br />

risk/industry specifi c cover.<br />

Submission of compliance report for facultative<br />

reinsurance placements<br />

II.1.14 The Authority on review of the reinsurance<br />

programme of the companies for the year 2008-09<br />

advised all non-life insurance companies to place<br />

“unplaced reinsurance” abroad only after offering it to<br />

other Indian insurers and reinsurer. In order to monitor<br />

compliance, the Authority has sought half-yearly report<br />

on compliance with the stipulations by seeking details<br />

of facultative placements made by the respective<br />

company.<br />

II.2 INTERMEDIARIES ASSOCIATED WITH THE<br />

INSURANCE BUSINESS<br />

Insurance Agents<br />

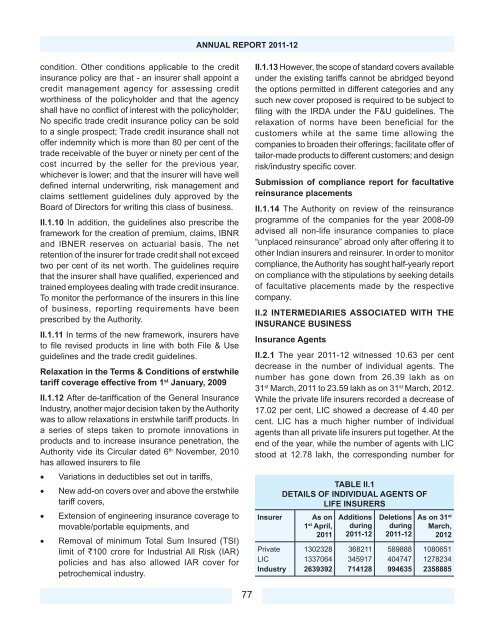

II.2.1 The year 2011-12 witnessed 10.63 per cent<br />

decrease in the number of individual agents. The<br />

number has gone down from 26.39 lakh as on<br />

31 st March, 2011 to 23.59 lakh as on 31 st March, 2012.<br />

While the private life insurers recorded a decrease of<br />

17.02 per cent, LIC showed a decrease of 4.40 per<br />

cent. LIC has a much higher number of individual<br />

agents than all private life insurers put together. At the<br />

end of the year, while the number of agents with LIC<br />

stood at 12.78 lakh, the corresponding number for<br />

Insurer<br />

TABLE II.1<br />

DETAILS OF INDIVIDUAL AGENTS OF<br />

LIFE INSURERS<br />

As on<br />

1 st April,<br />

2011<br />

Additions<br />

during<br />

2011-12<br />

Deletions<br />

during<br />

2011-12<br />

As on 31 st<br />

March,<br />

2012<br />

Private 1302328 368211 589888 1080651<br />

LIC 1337064 345917 404747 1278234<br />

Industry 2639392 714128 994635 2358885<br />

77