Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT 2011-12<br />

I.3.27 Bajaj Allianz reported net profi t of `1,311 crore<br />

for the third consecutive year (`1,057 crore in 2010-11).<br />

SBI Life reported profi t of `556 crore; the insurer<br />

reported profits for 6 out of last 7 years, i.e., other than<br />

in 2008-09. Kotak Mahindra reported profi t of `203<br />

crore for the fourth year in a row (`102 crore in 2010-<br />

11); it reported profi t for the fi rst time in 2008-09. Aviva<br />

reported profi t of `74 crore for the second time a row<br />

(`29 crore in 2010-11). Sahara India had reported a<br />

profit of `29 crore as against a profit of `28 crore during<br />

2010-11. Sahara India had reported profi ts for the fi rst<br />

time in 2007-08. Shriram Life reported net profit of `56<br />

crore (`17 crore in 2010-11). Except, in the year 2009-<br />

10 Shriram Life reported profi ts from 2007-08 for 5<br />

years in a row.<br />

I.3.28 HDFC Standard reported net profi ts of `271<br />

crore for the first time in the current year, after incurring<br />

losses continuously for ten years. Reliance Life<br />

reported net profi ts of `373 crore after remaining in<br />

losses for eight years, the company had exhibited<br />

profi ts in the fi rst two years of its operations. MetLife<br />

reported a profi t of `33 crore, thus reporting profi ts<br />

continuously in the last fi ve fi nancial years. However,<br />

MetLife is carrying deficit in the Policyholders’ Account<br />

from 2007-08 to 2011-12. The cumulative losses of the<br />

company at the end of financial year 2011-12 stood at<br />

`1,646 crore.<br />

I.3.29 The cumulative losses of the life insurance<br />

industry for the financial year 2011-12 stood at `17,945<br />

crore (`20,177 crore in 2010-11). The cumulative<br />

losses reduced by `376 crore and `1,856 crore in the<br />

policyholders account and shareholders account<br />

respectively in the year 2011-12.<br />

Returns to shareholders<br />

I.3.30 For the year 2011-12, LIC paid `1,281 crore as<br />

dividend to Government of India. This is 97.55 per cent<br />

of its net profit reported during the year. This is<br />

consistent with the year 2010-11 when LIC had paid<br />

97.08 per cent of its net profi t as dividend to the<br />

exchequer (`1,138 crore). For the fi rst time after the<br />

opening up of the insurance sector, private life insurers<br />

paid dividends. ICICI Prudential paid `414.37 crore,<br />

Birla Sunlife paid `98.48 crore, Reliance life paid<br />

`47.85 crore and SBI Life paid `50 crore as dividends<br />

during the year.<br />

Expansion of Offices<br />

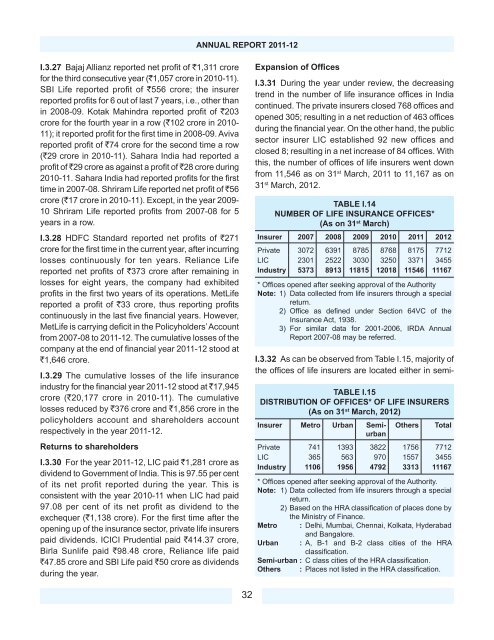

I.3.31 During the year under review, the decreasing<br />

trend in the number of life insurance offi ces in India<br />

continued. The private insurers closed 768 offices and<br />

opened 305; resulting in a net reduction of 463 offi ces<br />

during the financial year. On the other hand, the public<br />

sector insurer LIC established 92 new offi ces and<br />

closed 8; resulting in a net increase of 84 offi ces. With<br />

this, the number of offices of life insurers went down<br />

from 11,546 as on 31 st March, 2011 to 11,167 as on<br />

31 st March, 2012.<br />

TABLE I.14<br />

NUMBER OF LIFE INSURANCE OFFICES*<br />

(As on 31 st March)<br />

Insurer 2007 2008 2009 2010 2011 2012<br />

Private 3072 6391 8785 8768 8175 7712<br />

LIC 2301 2522 3030 3250 3371 3455<br />

Industry 5373 8913 11815 12018 11546 11167<br />

* Offi ces opened after seeking approval of the Authority<br />

Note: 1) Data collected from life insurers through a special<br />

return.<br />

2) Offi ce as defi ned under Section 64VC of the<br />

Insurance Act, 1938.<br />

3) For similar data for 2001-2006, <strong>IRDA</strong> Annual<br />

Report 2007-08 may be referred.<br />

I.3.32 As can be observed from Table I.15, majority of<br />

the offi ces of life insurers are located either in semi-<br />

TABLE I.15<br />

DISTRIBUTION OF OFFICES* OF LIFE INSURERS<br />

(As on 31 st March, 2012)<br />

Insurer Metro Urban Semiurban<br />

Others<br />

Total<br />

Private 741 1393 3822 1756 7712<br />

LIC 365 563 970 1557 3455<br />

Industry 1106 1956 4792 3313 11167<br />

* Offi ces opened after seeking approval of the Authority.<br />

Note: 1) Data collected from life insurers through a special<br />

return.<br />

2) Based on the HRA classifi cation of places done by<br />

the Ministry of Finance.<br />

Metro : Delhi, Mumbai, Chennai, Kolkata, Hyderabad<br />

Urban<br />

and Bangalore.<br />

: A, B-1 and B-2 class cities of the HRA<br />

classifi cation.<br />

Semi-urban : C class cities of the HRA classifi cation.<br />

Others : Places not listed in the HRA classifi cation.<br />

32