Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011-12<br />

increased by 25.27 per cent to `2,999 crore in 2011-12<br />

from `2,394 crore in 2010-11. The increase in<br />

underwriting losses of the private sector insurers is<br />

mainly due to increase in the reserve for unexpired<br />

risks.<br />

TABLE I.23<br />

UNDERWRITING LOSSES : NON-LIFE INSURERS<br />

Expenses of Non-Life Insurers<br />

(` crore)<br />

2010-11 2011-12<br />

Public Sector 7549.50 5817.39<br />

(66.24) (-22.94)<br />

Private Sector 2394.03 2999.45<br />

(72.51) (25.29)<br />

Total 9943.53 8816.84<br />

(67.72) (-11.33)<br />

Note : Figure in brackets indicate growth in per cent over<br />

previous year.<br />

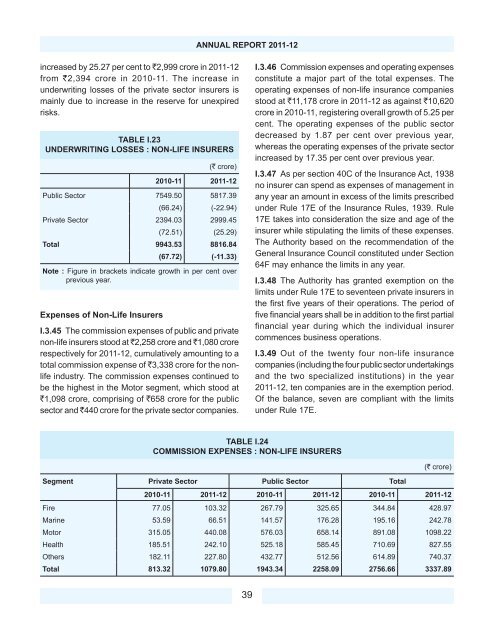

I.3.45 The commission expenses of public and private<br />

non-life insurers stood at `2,258 crore and `1,080 crore<br />

respectively for 2011-12, cumulatively amounting to a<br />

total commission expense of `3,338 crore for the nonlife<br />

industry. The commission expenses continued to<br />

be the highest in the Motor segment, which stood at<br />

`1,098 crore, comprising of `658 crore for the public<br />

sector and `440 crore for the private sector companies.<br />

I.3.46 Commission expenses and operating expenses<br />

constitute a major part of the total expenses. The<br />

operating expenses of non-life insurance companies<br />

stood at `11,178 crore in 2011-12 as against `10,620<br />

crore in 2010-11, registering overall growth of 5.25 per<br />

cent. The operating expenses of the public sector<br />

decreased by 1.87 per cent over previous year,<br />

whereas the operating expenses of the private sector<br />

increased by 17.35 per cent over previous year.<br />

I.3.47 As per section 40C of the Insurance Act, 1938<br />

no insurer can spend as expenses of management in<br />

any year an amount in excess of the limits prescribed<br />

under Rule 17E of the Insurance Rules, 1939. Rule<br />

17E takes into consideration the size and age of the<br />

insurer while stipulating the limits of these expenses.<br />

The Authority based on the recommendation of the<br />

General Insurance Council constituted under Section<br />

64F may enhance the limits in any year.<br />

I.3.48 The Authority has granted exemption on the<br />

limits under Rule 17E to seventeen private insurers in<br />

the fi rst fi ve years of their operations. The period of<br />

five financial years shall be in addition to the first partial<br />

financial year during which the individual insurer<br />

commences business operations.<br />

I.3.49 Out of the twenty four non-life insurance<br />

companies (including the four public sector undertakings<br />

and the two specialized institutions) in the year<br />

2011-12, ten companies are in the exemption period.<br />

Of the balance, seven are compliant with the limits<br />

under Rule 17E.<br />

TABLE I.24<br />

COMMISSION EXPENSES : NON-LIFE INSURERS<br />

(` crore)<br />

Segment Private Sector Public Sector Total<br />

2010-11 2011-12 2010-11 2011-12 2010-11 2011-12<br />

Fire 77.05 103.32 267.79 325.65 344.84 428.97<br />

Marine 53.59 66.51 141.57 176.28 195.16 242.78<br />

Motor 315.05 440.08 576.03 658.14 891.08 1098.22<br />

Health 185.51 242.10 525.18 585.45 710.69 827.55<br />

Others 182.11 227.80 432.77 512.56 614.89 740.37<br />

Total 813.32 1079.80 1943.34 2258.09 2756.66 3337.89<br />

39