Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011-12<br />

TABLE I.19<br />

RATIO OF OUTSIDE INDIA PREMIUM<br />

TO TOTAL PREMIUM<br />

(Per cent)<br />

Insurer 2010-11 2011-12<br />

National 0.39 0.32<br />

New India 13.72 15.19<br />

Oriental 2.02 2.37<br />

United* - -<br />

* Ceased operations in 2003-04<br />

TABLE I.20<br />

GROSS DIRECT PREMIUM FROM BUSINESS<br />

OUTSIDE INDIA : NON-LIFE INSURERS<br />

(` crore)<br />

Insurer 2010-11 2011-12<br />

National 24.47 25.00<br />

(17.56) (2.18)<br />

New India 1128.37 1531.01<br />

(6.79) (35.68)<br />

Oriental 112.54 146.71<br />

(-4.60) (30.45)<br />

Total 1265.38<br />

(5.85)<br />

1702.72<br />

(34.56)<br />

Note : Figures in bracket indicate the growth (in per cent)<br />

over previous year.<br />

underwritten in 2010-11, reporting an increase of 8.07<br />

per cent over 2010-11. The public sector insurers<br />

TABLE I.21<br />

NUMBER OF NEW POLICIES ISSUED :<br />

NON-LIFE INSURERS<br />

(In Lakhs)<br />

Insurer 2010-11 2011-12<br />

Public Sector 505.76<br />

(16.52)<br />

528.14<br />

(4.43)<br />

Private Sector 287.65 329.30<br />

(19.44) (14.48)<br />

Total 793.41<br />

(17.56)<br />

857.44<br />

(8.07)<br />

Note : Figures in brackets indicate the growth (in per cent)<br />

over previous year.<br />

witnessed a marginal growth in the number of policies<br />

issued. They reported a 4.43 per cent increase in<br />

number of policies issued during 2011-12 compared<br />

to 16.52 per cent in 2010-11. The private sector<br />

insurers also reported a growth in number of policies<br />

issued at 14.48 per cent in 2011-12 (19.44 per cent in<br />

2010-11).<br />

Paid-up Capital<br />

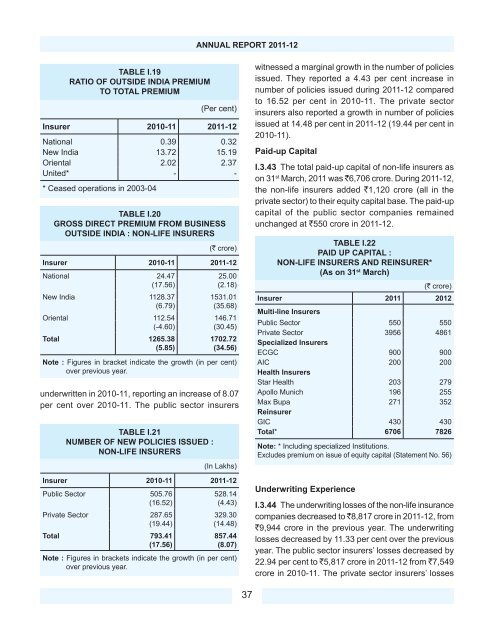

I.3.43 The total paid-up capital of non-life insurers as<br />

on 31 st March, 2011 was `6,706 crore. During 2011-12,<br />

the non-life insurers added `1,120 crore (all in the<br />

private sector) to their equity capital base. The paid-up<br />

capital of the public sector companies remained<br />

unchanged at `550 crore in 2011-12.<br />

TABLE I.22<br />

PAID UP CAPITAL :<br />

NON-LIFE INSURERS AND REINSURER*<br />

(As on 31 st March)<br />

(` crore)<br />

Insurer 2011 2012<br />

Multi-line Insurers<br />

Public Sector 550 550<br />

Private Sector 3956 4861<br />

Specialized Insurers<br />

ECGC 900 900<br />

AIC 200 200<br />

Health Insurers<br />

Star Health 203 279<br />

Apollo Munich 196 255<br />

Max Bupa 271 352<br />

Reinsurer<br />

GIC 430 430<br />

Total* 6706 7826<br />

Note: * Including specialized Institutions.<br />

Excludes premium on issue of equity capital (Statement No. 56)<br />

Underwriting Experience<br />

I.3.44 The underwriting losses of the non-life insurance<br />

companies decreased to `8,817 crore in 2011-12, from<br />

`9,944 crore in the previous year. The underwriting<br />

losses decreased by 11.33 per cent over the previous<br />

year. The public sector insurers’ losses decreased by<br />

22.94 per cent to `5,817 crore in 2011-12 from `7,549<br />

crore in 2010-11. The private sector insurers’ losses<br />

37