Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT 2011-12<br />

14(2) Sub Section (f) of the <strong>IRDA</strong> Act, 1999 as well as<br />

Sections 34F, 101A, 101B and 101C of the Insurance<br />

Act, 1938. In addition, the Authority has framed<br />

regulations pertaining to reinsurance for both life and<br />

non-life insurers, which lay down the ground rules for<br />

placing reinsurance.<br />

I.4.3.2 Every insurer needs a comprehensive and<br />

efficient reinsurance programme to enable it to operate<br />

within the constraints of its fi nancial strength. This is<br />

important to maintain the solvency of the insurer and<br />

to ensure that the clauses are honoured as and when<br />

they arise. Hence, the Authority has stipulated that<br />

every insurer shall obtain the approval of its Board for<br />

its reinsurance programme. The regulatory framework<br />

also provides for fi ling of the reinsurance programme<br />

for the next fi nancial year with the Authority at least 45<br />

days before the commencement of the said year. The<br />

insurers are further required to fi le the treaty slips or<br />

cover notes relating to the reinsurance arrangements<br />

with the Authority within 30 days of the commencement<br />

of the fi nancial year. These measures highlight the<br />

importance attached to the existence of adequate and<br />

effi cient reinsurance arrangements for an insurance<br />

company. It would be recalled that the solvency<br />

position of an insurance company is assessed on a<br />

“net of reinsurance” basis.<br />

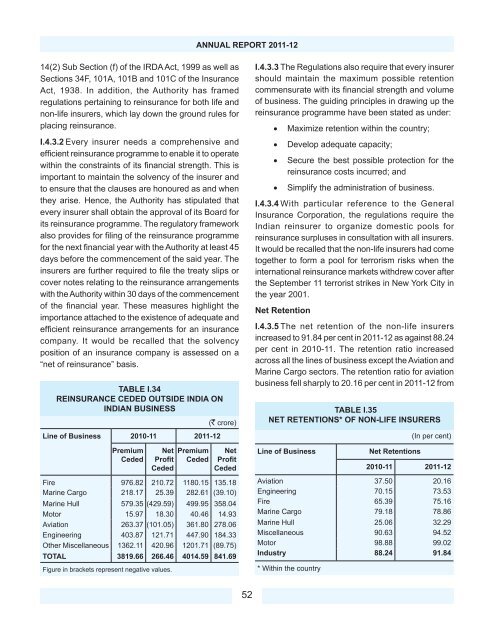

TABLE I.34<br />

REINSURANCE CEDED OUTSIDE INDIA ON<br />

INDIAN BUSINESS<br />

(` crore)<br />

Line of Business 2010-11 2011-12<br />

Premium<br />

Ceded<br />

Net<br />

Profit<br />

Ceded<br />

Premium<br />

Ceded<br />

Net<br />

Profit<br />

Ceded<br />

Fire 976.82 210.72 1180.15 135.18<br />

Marine Cargo 218.17 25.39 282.61 (39.10)<br />

Marine Hull 579.35 (429.59) 499.95 358.04<br />

Motor 15.97 18.30 40.46 14.93<br />

Aviation 263.37 (101.05) 361.80 278.06<br />

Engineering 403.87 121.71 447.90 184.33<br />

Other Miscellaneous 1362.11 420.96 1201.71 (89.75)<br />

TOTAL 3819.66 266.46 4014.59 841.69<br />

Figure in brackets represent negative values.<br />

I.4.3.3 The Regulations also require that every insurer<br />

should maintain the maximum possible retention<br />

commensurate with its fi nancial strength and volume<br />

of business. The guiding principles in drawing up the<br />

reinsurance programme have been stated as under:<br />

Maximize retention within the country;<br />

Develop adequate capacity;<br />

Secure the best possible protection for the<br />

reinsurance costs incurred; and<br />

Simplify the administration of business.<br />

I.4.3.4 With particular reference to the General<br />

Insurance Corporation, the regulations require the<br />

Indian reinsurer to organize domestic pools for<br />

reinsurance surpluses in consultation with all insurers.<br />

It would be recalled that the non-life insurers had come<br />

together to form a pool for terrorism risks when the<br />

international reinsurance markets withdrew cover after<br />

the September 11 terrorist strikes in New York City in<br />

the year 2001.<br />

Net Retention<br />

I.4.3.5 The net retention of the non-life insurers<br />

increased to 91.84 per cent in 2011-12 as against 88.24<br />

per cent in 2010-11. The retention ratio increased<br />

across all the lines of business except the Aviation and<br />

Marine Cargo sectors. The retention ratio for aviation<br />

business fell sharply to 20.16 per cent in 2011-12 from<br />

TABLE I.35<br />

NET RETENTIONS* OF NON-LIFE INSURERS<br />

Line of Business<br />

Net Retentions<br />

(In per cent)<br />

2010-11 2011-12<br />

Aviation 37.50 20.16<br />

Engineering 70.15 73.53<br />

Fire 65.39 75.16<br />

Marine Cargo 79.18 78.86<br />

Marine Hull 25.06 32.29<br />

Miscellaneous 90.63 94.52<br />

Motor 98.88 99.02<br />

Industry 88.24 91.84<br />

* Within the country<br />

52