Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011-12<br />

II.6.15 Service Tax (Cenvat Credit) Rules amendment<br />

introduced in 2011 relating to Motor Authorized Repair<br />

Centers had the unintended impact on the disallowance<br />

of Cenvat input credit to insurers on the Motor OD<br />

claims paid to Authorized Repair Centers. This and<br />

other service tax related issues were taken up on<br />

priority with <strong>IRDA</strong>, Ministry of Finance and were<br />

highlighted by the Council to Chairman, Central Board<br />

of Excise and Customs (CBEC) during the pre-budget<br />

meeting. These efforts of the CFOs and the Council<br />

have been successful and the Service tax amendment<br />

in 2012 has rectifi ed this for insurance companies.<br />

These amendments have also clarifi ed the ambiguity<br />

as regards to Cenvat credit in respect of reinsurance<br />

premium paid to GIC Re.<br />

II.6.16 Insurance Information Bureau (IIB)<br />

The Council officials ensured that in every meeting<br />

of the underwriters / claims offi cials, the status of data<br />

upload to IIB is discussed. The Council is striving to<br />

ensure that the data formats for transfer of data to IIB<br />

is uniform and that the time lag gets reduced. Stress<br />

on quality and timely submission of data were<br />

repeatedly made.<br />

The IIB Officials confirmed that the status and the<br />

quality of data submission have improved a lot. Data<br />

upload in respect of the two major retail businesses -<br />

Health and Motor classes have stabilized upto a large<br />

extent. The Property class has also witnessed good<br />

improvement during the year.<br />

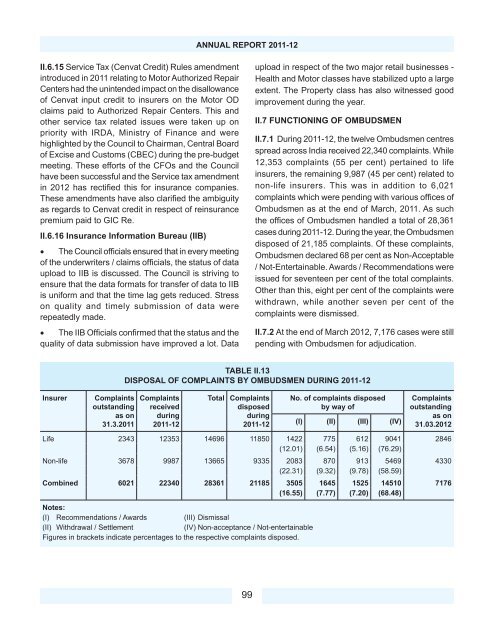

II.7 FUNCTIONING OF OMBUDSMEN<br />

II.7.1 During 2011-12, the twelve Ombudsmen centres<br />

spread across India received 22,340 complaints. While<br />

12,353 complaints (55 per cent) pertained to life<br />

insurers, the remaining 9,987 (45 per cent) related to<br />

non-life insurers. This was in addition to 6,021<br />

complaints which were pending with various offi ces of<br />

Ombudsmen as at the end of March, 2011. As such<br />

the offi ces of Ombudsmen handled a total of 28,361<br />

cases during 2011-12. During the year, the Ombudsmen<br />

disposed of 21,185 complaints. Of these complaints,<br />

Ombudsmen declared 68 per cent as Non-Acceptable<br />

/ Not-Entertainable. Awards / Recommendations were<br />

issued for seventeen per cent of the total complaints.<br />

Other than this, eight per cent of the complaints were<br />

withdrawn, while another seven per cent of the<br />

complaints were dismissed.<br />

II.7.2 At the end of March 2012, 7,176 cases were still<br />

pending with Ombudsmen for adjudication.<br />

TABLE II.13<br />

DISPOSAL OF COMPLAINTS BY OMBUDSMEN DURING 2011-12<br />

Insurer<br />

Complaints<br />

outstanding<br />

as on<br />

31.3.2011<br />

Complaints<br />

received<br />

during<br />

2011-12<br />

Total Complaints<br />

disposed<br />

during<br />

2011-12<br />

No. of complaints disposed<br />

by way of<br />

(I) (II) (III) (IV)<br />

Complaints<br />

outstanding<br />

as on<br />

31.03.2012<br />

Life 2343 12353 14696 11850 1422 775 612 9041 2846<br />

(12.01) (6.54) (5.16) (76.29)<br />

Non-life 3678 9987 13665 9335 2083 870 913 5469 4330<br />

(22.31) (9.32) (9.78) (58.59)<br />

Combined 6021 22340 28361 21185 3505 1645 1525 14510 7176<br />

(16.55) (7.77) (7.20) (68.48)<br />

Notes:<br />

(I) Recommendations / Awards<br />

(III) Dismissal<br />

(II) Withdrawal / Settlement<br />

(IV) Non-acceptance / Not-entertainable<br />

Figures in brackets indicate percentages to the respective complaints disposed.<br />

99