Download PDF - IRDA

Download PDF - IRDA

Download PDF - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011-12<br />

Contd.... BOX ITEM 6<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The ceding company shall retain 20 per cent of the premium to its account, cede as per the obligatory cessions in<br />

force to GIC (currently 10 per cent of the premium) and cede the balance (currently working to 70 per cent of the<br />

premium) to the declined risk pool.<br />

The estimates of ULR for the business written by the insurer for the declined pool shall be as per above bullet<br />

point 2. The estimates of ULR for the business written to its own account fully may be as per their Appointed Actuary’s<br />

estimate.<br />

The pool actuary shall estimate the ULR for the declined risks based on the data that exists for the past fi ve years<br />

and the insurers shall make provisions as per the latest year ULR, until the underwriting year’s ULR is estimated.<br />

These estimates shall be provided by 31 st March, 2012.<br />

The estimation of ULR for the declined pool risks shall be completed by the pool actuary by following May of each<br />

underwriting year starting from 31 st May, 2013.<br />

The ULR may be determined by the pool’s appointed actuary and approved by the <strong>IRDA</strong> based on a peer review, if<br />

required.<br />

The declined risk pool shall make quarterly provisional cash settlements amongst its participants.<br />

Such quarterly settlements shall be on a year to date basis and to be fi nally adjusted based on the year-end ULR as<br />

approved by the Authority.<br />

The quarterly settlements shall be done in 45 days from the end of the quarter and the fi nal settlements shall be done<br />

45 days from the date on which the ULR is approved by the Authority.<br />

The non-life insurers participating in the declined risk pool shall take up an advertisement campaign on the declined<br />

risk pool with the message focused in English, Hindi and other Indian languages intensively. The message should<br />

be simple and shall be in the form of cut & keep.<br />

GIC Re shall also participate in the declined risk pool as a member and shall also follow the clean cut methodology<br />

of the declined risk pool.<br />

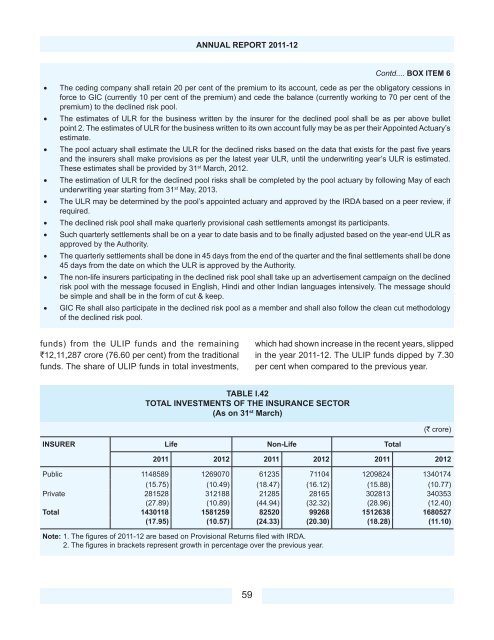

funds) from the ULIP funds and the remaining<br />

`12,11,287 crore (76.60 per cent) from the traditional<br />

funds. The share of ULIP funds in total investments,<br />

which had shown increase in the recent years, slipped<br />

in the year 2011-12. The ULIP funds dipped by 7.30<br />

per cent when compared to the previous year.<br />

TABLE I.42<br />

TOTAL INVESTMENTS OF THE INSURANCE SECTOR<br />

(As on 31 st March)<br />

(` crore)<br />

INSURER Life Non-Life Total<br />

2011 2012 2011 2012 2011 2012<br />

Public 1148589 1269070 61235 71104 1209824 1340174<br />

(15.75) (10.49) (18.47) (16.12) (15.88) (10.77)<br />

Private 281528 312188 21285 28165 302813 340353<br />

(27.89) (10.89) (44.94) (32.32) (28.96) (12.40)<br />

Total 1430118 1581259 82520 99268 1512638 1680527<br />

(17.95) (10.57) (24.33) (20.30) (18.28) (11.10)<br />

Note: 1. The fi gures of 2011-12 are based on Provisional Returns fi led with <strong>IRDA</strong>.<br />

2. The fi gures in brackets represent growth in percentage over the previous year.<br />

59