January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

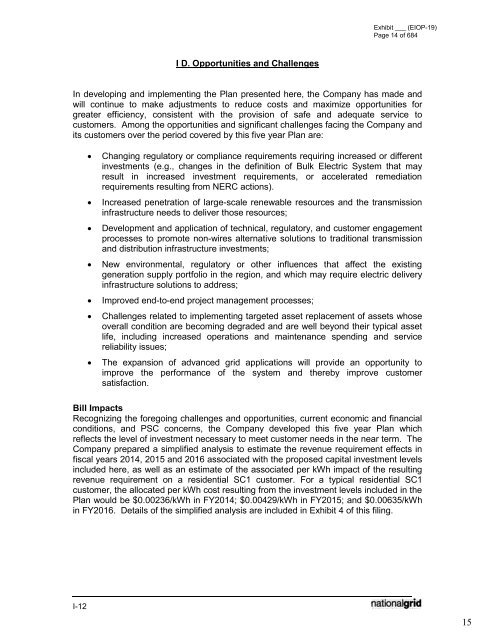

Exhibit ___ (EIOP-19)Page 14 of 684I D. Opportunities and ChallengesIn developing and implementing the Plan presented here, the Company has made andwill continue to make adjustments to reduce costs and maximize opportunities forgreater efficiency, consistent with the provision of safe and adequate service tocustomers. Among the opportunities and significant challenges facing the Company andits customers over the period covered by this five year Plan are:Changing regulatory or compliance requirements requiring increased or differentinvestments (e.g., changes in the definition of Bulk Electric System that mayresult in increased investment requirements, or accelerated remediationrequirements resulting from NERC actions).Increased penetration of large-scale renewable resources and the transmissioninfrastructure needs to deliver those resources;Development and application of technical, regulatory, and customer engagementprocesses to promote non-wires alternative solutions to traditional transmissionand distribution infrastructure investments;New environmental, regulatory or other influences that affect the existinggeneration supply portfolio in the region, and which may require electric deliveryinfrastructure solutions to address;Improved end-to-end project management processes;Challenges related to implementing targeted asset replacement of assets whoseoverall condition are becoming degraded and are well beyond their typical assetlife, including increased operations and maintenance spending and servicereliability issues;The expansion of advanced grid applications will provide an opportunity toimprove the performance of the system and thereby improve customersatisfaction.Bill ImpactsRecognizing the foregoing challenges and opportunities, current economic and financialconditions, and PSC concerns, the Company developed this five year Plan whichreflects the level of investment necessary to meet customer needs in the near term. TheCompany prepared a simplified analysis to estimate the revenue requirement effects infiscal years 2014, 2015 and 2016 associated with the proposed capital investment levelsincluded here, as well as an estimate of the associated per kWh impact of the resultingrevenue requirement on a residential SC1 customer. For a typical residential SC1customer, the allocated per kWh cost resulting from the investment levels included in thePlan would be $0.00236/kWh in FY2014; $0.00429/kWh in FY2015; and $0.00635/kWhin FY2016. Details of the simplified analysis are included in Exhibit 4 of this filing.I-1215