January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

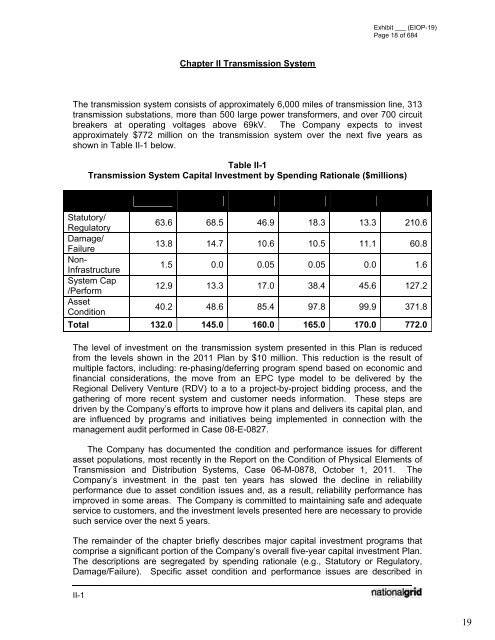

Exhibit ___ (EIOP-19)Page 18 of 684Chapter II Transmission SystemThe transmission system consists of approximately 6,000 miles of transmission line, 313transmission substations, more than 500 large power transformers, and over 700 circuitbreakers at operating voltages above 69kV. The Company expects to investapproximately $772 million on the transmission system over the next five years asshown in Table II-1 below.Table II-1Transmission System <strong>Capital</strong> <strong>Investment</strong> by Spending Rationale ($millions)SpendingRationaleFY13 FY14 FY15 FY16 FY17 TotalStatutory/Regulatory63.6 68.5 46.9 18.3 13.3 210.6Damage/Failure13.8 14.7 10.6 10.5 11.1 60.8Non-Infrastructure1.5 0.0 0.05 0.05 0.0 1.6System Cap/Perform12.9 13.3 17.0 38.4 45.6 127.2AssetCondition40.2 48.6 85.4 97.8 99.9 371.8Total 132.0 145.0 160.0 165.0 170.0 772.0The level of investment on the transmission system presented in this Plan is reducedfrom the levels shown in the 2011 Plan by $10 million. This reduction is the result ofmultiple factors, including: re-phasing/deferring program spend based on economic andfinancial considerations, the move from an EPC type model to be delivered by theRegional Delivery Venture (RDV) to a to a project-by-project bidding process, and thegathering of more recent system and customer needs information. These steps aredriven by the Company’s efforts to improve how it plans and delivers its capital plan, andare influenced by programs and initiatives being implemented in connection with themanagement audit performed in Case 08-E-0827.The Company has documented the condition and performance issues for differentasset populations, most recently in the Report on the Condition of Physical Elements ofTransmission and Distribution Systems, Case 06-M-0878, October 1, 2011. TheCompany’s investment in the past ten years has slowed the decline in reliabilityperformance due to asset condition issues and, as a result, reliability performance hasimproved in some areas. The Company is committed to maintaining safe and adequateservice to customers, and the investment levels presented here are necessary to providesuch service over the next 5 years.The remainder of the chapter briefly describes major capital investment programs thatcomprise a significant portion of the Company’s overall five-year capital investment Plan.The descriptions are segregated by spending rationale (e.g., Statutory or Regulatory,Damage/Failure). Specific asset condition and performance issues are described inII-119