January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

January 2012 Capital Investment - National Grid

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

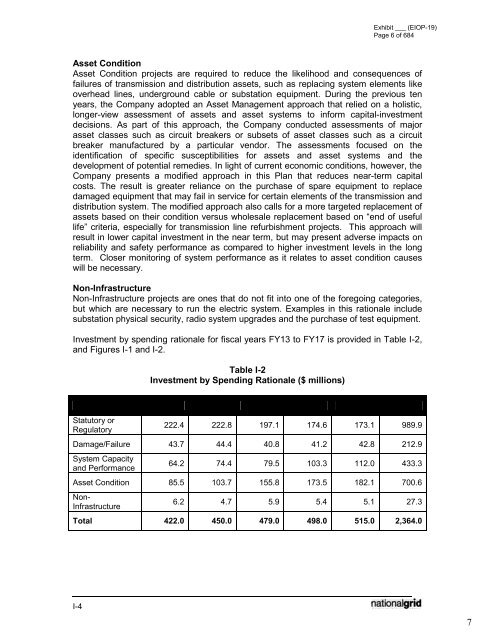

Exhibit ___ (EIOP-19)Page 6 of 684Asset ConditionAsset Condition projects are required to reduce the likelihood and consequences offailures of transmission and distribution assets, such as replacing system elements likeoverhead lines, underground cable or substation equipment. During the previous tenyears, the Company adopted an Asset Management approach that relied on a holistic,longer-view assessment of assets and asset systems to inform capital-investmentdecisions. As part of this approach, the Company conducted assessments of majorasset classes such as circuit breakers or subsets of asset classes such as a circuitbreaker manufactured by a particular vendor. The assessments focused on theidentification of specific susceptibilities for assets and asset systems and thedevelopment of potential remedies. In light of current economic conditions, however, theCompany presents a modified approach in this Plan that reduces near-term capitalcosts. The result is greater reliance on the purchase of spare equipment to replacedamaged equipment that may fail in service for certain elements of the transmission anddistribution system. The modified approach also calls for a more targeted replacement ofassets based on their condition versus wholesale replacement based on “end of usefullife” criteria, especially for transmission line refurbishment projects. This approach willresult in lower capital investment in the near term, but may present adverse impacts onreliability and safety performance as compared to higher investment levels in the longterm. Closer monitoring of system performance as it relates to asset condition causeswill be necessary.Non-InfrastructureNon-Infrastructure projects are ones that do not fit into one of the foregoing categories,but which are necessary to run the electric system. Examples in this rationale includesubstation physical security, radio system upgrades and the purchase of test equipment.<strong>Investment</strong> by spending rationale for fiscal years FY13 to FY17 is provided in Table I-2,and Figures I-1 and I-2.Table I-2<strong>Investment</strong> by Spending Rationale ($ millions)Rationale FY13 FY14 FY15 FY16 FY17 TotalStatutory orRegulatory222.4 222.8 197.1 174.6 173.1 989.9Damage/Failure 43.7 44.4 40.8 41.2 42.8 212.9System Capacityand Performance64.2 74.4 79.5 103.3 112.0 433.3Asset Condition 85.5 103.7 155.8 173.5 182.1 700.6Non-Infrastructure6.2 4.7 5.9 5.4 5.1 27.3Total 422.0 450.0 479.0 498.0 515.0 2,364.0I-47