- Page 1 and 2:

DraftAnnual Accounts and Reportas a

- Page 4 and 5:

C O N T E N T SConsolidated Account

- Page 6 and 7:

Page no.* * *Extraordinary business

- Page 8:

CONSOLIDATED ACCOUNTS

- Page 11 and 12:

— Retail and private banking (RPB

- Page 13 and 14:

DEVELOPMENTS IN CAPITAL MARKETSIn t

- Page 15 and 16:

comparing total assets with tangibl

- Page 17 and 18:

The market capitalization of listed

- Page 20 and 21:

RESTATED BALANCE SHEET30/6/10 30/6/

- Page 22 and 23:

30 June 2010Corporate &InvestmentBa

- Page 24 and 25:

Impaired assets (i.e. non-performin

- Page 26 and 27:

upward adjustments to reflect amort

- Page 28 and 29:

An updated list of the properties o

- Page 30 and 31:

12 mths to 30/6/10 12 mths to 30/6/

- Page 32 and 33:

Corporate and Investment Banking30

- Page 34 and 35:

This division reported a net profit

- Page 36 and 37:

Equity investments and AFS shares

- Page 38 and 39:

Mediobanca International (Luxembour

- Page 40 and 41:

Principal investing12 mths to 30/6/

- Page 42 and 43:

Retail and private bankingb12 mths

- Page 44 and 45:

A breakdown of this division’s re

- Page 46 and 47:

New loans for the twelve months tot

- Page 48 and 49:

Private banking30 June 2010CMB Banc

- Page 50 and 51:

transmission, investment advice and

- Page 52 and 53:

OTHER INFORMATIONRelated party disc

- Page 54 and 55:

Reconciliation of shareholders’ e

- Page 56 and 57:

AUDITORS’ REPORT

- Page 58 and 59:

CONSOLIDATED FINANCIAL STATEMENTS

- Page 60 and 61:

Liabilities and net equity30/6/11 3

- Page 62 and 63:

CONSOLIDATED COMPREHENSIVE PROFIT A

- Page 64 and 65:

STATEMENT OF CHANGES TO NET EQUITY

- Page 66 and 67:

RECONCILIATION OF MOVEMENTS IN CASH

- Page 68 and 69:

Page no.Part C -Notes to consolidat

- Page 70 and 71:

Sectction 3Area and methods of cons

- Page 72 and 73:

Section 4Significant accounting pol

- Page 74 and 75:

Assets are tested for impairment at

- Page 76 and 77:

HedgesThere are two types of hedge:

- Page 78 and 79:

and its related value of use, and a

- Page 80 and 81:

Staff severance indemnity provision

- Page 82 and 83:

Dividends and commissionsThese are

- Page 84 and 85:

A.3.2Fair value rankingA.3.2.1 Asse

- Page 86 and 87:

A.3.2.3 Annual changes in financial

- Page 88 and 89:

Section 2Heading 20: Financial asse

- Page 90 and 91:

2.3 Financial assets held for tradi

- Page 92 and 93:

4.3 AFS securities: assets subject

- Page 94 and 95:

5.2 Assets held to maturity: by bor

- Page 96 and 97:

Section 7Heading 70: Due from custo

- Page 98 and 99:

Section 8Heading 80: Hedging deriva

- Page 100 and 101: Section 10Heading 100: Equity inves

- Page 102 and 103: The book value of the investment in

- Page 104 and 105: Section 12Heading 120: Property, pl

- Page 106 and 107: 12.4 Tangible assets held for inves

- Page 108 and 109: 13.2 Intangible assets: movements d

- Page 110 and 111: 14.4 Changes in deferred tax during

- Page 112 and 113: 14.6 Changes in deferred tax during

- Page 114 and 115: LiabilitiesSection 1Heading 10: Due

- Page 116 and 117: Section 3Heading 30: Debt securitie

- Page 118 and 119: Section 6Heading 60: Hedging deriva

- Page 120 and 121: Section 11Heading 110: Staff severa

- Page 122 and 123: Section 13Heading 130: Technical re

- Page 124 and 125: Section 16Heading 210: Net equity a

- Page 126 and 127: PART C - NOTES TO CONSOLIDATEDPROFI

- Page 128 and 129: Section 2Headings 40 and 50: Net fe

- Page 130 and 131: Section 4Heading 80: Net trading in

- Page 132 and 133: Section 6Heading 100: Gains (losses

- Page 134 and 135: 8.3 Adjustments for impairment to f

- Page 136 and 137: Section 10Heading 160: Income less

- Page 138 and 139: Section 11Heading 180: Administrati

- Page 140 and 141: Section 12Heading 190: 1Net transfe

- Page 142 and 143: Section 16Heading 240: Gains (losse

- Page 144 and 145: 20.2 Reconciliation between theoret

- Page 146 and 147: PART D - CONSOLIDATED COMPREHENSIVE

- Page 148 and 149: Corporate banking (Mediobanca)The G

- Page 152 and 153: A.1.2.a Exposures to sovereign debt

- Page 154 and 155: A.1.5Cash exposures to banks: trend

- Page 156 and 157: A.1.8Banking Group - cash exposures

- Page 158 and 159: A.3 Secured exposures by type of se

- Page 160 and 161: B. Loan distribution and concentrat

- Page 162 and 163: B.3 Banking Group - cash and off-ba

- Page 164 and 165: C. Securitizations and asset dispos

- Page 166 and 167: Quantitative informationC.1.1Bankin

- Page 168 and 169: C.1.4Banking Group - exposures to s

- Page 170 and 171: C.1.7Banking Group - servicing: col

- Page 172 and 173: Under the terms of the sale contrac

- Page 174 and 175: C.2.2Banking Group - financial liab

- Page 176 and 177: QUANTITATIVE INFORMATIONThis year h

- Page 178 and 179: Table 2: Value at risk and expected

- Page 180 and 181: QUANTITATIVE INFORMATION1. Regulato

- Page 182 and 183: Currency of denomination: OTHERType

- Page 184 and 185: 1.2.2 INTEREST RATE RISK AND PRICE

- Page 186 and 187: the Bank’s various bodies was app

- Page 188 and 189: Currency of denomination: US DOLLAR

- Page 190 and 191: 2. Regulatory trading book: cash ex

- Page 192 and 193: QUANTITATIVE INFORMATION1. Assets,

- Page 194 and 195: A.2.A.2.1Banking book: average and

- Page 196 and 197: A.3 OTC financial derivatives: posi

- Page 198 and 199: A.5 OTC financial derivatives: trad

- Page 200 and 201:

A.7 OTC financial derivatives: bank

- Page 202 and 203:

A.9 OTC financial derivatives by ma

- Page 204 and 205:

B.2 OTC credit derivatives: gross p

- Page 206 and 207:

B.5 OTC credit derivatives: gross p

- Page 208 and 209:

1.3 BANKING GROUP: LIQUIDITY RISKQU

- Page 210 and 211:

Currency of denomination: US DOLLAR

- Page 212 and 213:

1.4 BANKING GROUP - OPERATING RISKQ

- Page 214 and 215:

PART F - INFORMATION ON CONSOLIDATE

- Page 216 and 217:

B.3 AFS valuation reserves: movemen

- Page 218 and 219:

2.2 Regulatory capital requirements

- Page 220 and 221:

B. Quantitative informainformationC

- Page 222 and 223:

credit as to €3.6m and credit car

- Page 224 and 225:

Situation at 30 June 2011Directors,

- Page 226 and 227:

Subsequent to the reporting date, o

- Page 228 and 229:

PART L - SEGMENT REPORTINGA. PRIMAR

- Page 230 and 231:

B. SECONDARY SEGMENT REPORTINGB.1 P

- Page 232 and 233:

ANNUALGENERALMEETING28 OCTOBER 2011

- Page 234 and 235:

Ordinary businessACCOUNTS OF THE BA

- Page 236 and 237:

Provisions for financial assets inc

- Page 238 and 239:

RESTATED BALANCE SHEET 30/6/10 30/6

- Page 240 and 241:

Loans and advances to Group compani

- Page 242 and 243:

Cash and bank balances include €1

- Page 244 and 245:

current prices). Further explanatio

- Page 246 and 247:

— Furniture and intangible assets

- Page 248 and 249:

Net fee and commission incomeThis h

- Page 250 and 251:

— the court of appeals in Milan h

- Page 252 and 253:

esearch project on medium-sized Eur

- Page 254 and 255:

Declaration in respect of individua

- Page 256 and 257:

STATUTORY AUDIT COMMITTEE’S REPOR

- Page 258 and 259:

vii)Finance Act, in the course of w

- Page 260 and 261:

Type of serviceRecontaErnst & Young

- Page 262 and 263:

The Statutory Audit Committee ascer

- Page 264 and 265:

AUDITORS’ REPORT

- Page 266 and 267:

INDIVIDUAL FINANCIAL STATEMENTS *(*

- Page 268 and 269:

Liabilities and net equity30/6/11 3

- Page 270 and 271:

COMPREHENSIVE PROFIT AND LOSS ACCOU

- Page 272 and 273:

STATEMENT OF CHANGES TO MEDIOBANCA

- Page 274 and 275:

RECONCILIATION OF MOVEMENTS IN CASH

- Page 276 and 277:

Page no.Part C - Notes to profit an

- Page 278 and 279:

Section 3Significant accounting pol

- Page 280 and 281:

Assets are tested for impairment at

- Page 282 and 283:

- cash flow hedges, which are inten

- Page 284 and 285:

Goodwill may be recognized where th

- Page 286 and 287:

All actuarial profits and/or losses

- Page 288 and 289:

Related parties (IAS 24)In accordan

- Page 290 and 291:

A.3.2A.3.2.1Fair value rankingAsset

- Page 292 and 293:

A.3.2.3 Annual changes in financial

- Page 294 and 295:

Section 2Heading 20: Financial asse

- Page 296 and 297:

2.3 Financial assets held for tradi

- Page 298 and 299:

4.4 AFS securities: movements durin

- Page 300 and 301:

Section 6Heading 60 - Due from bank

- Page 302 and 303:

7.2 Due from customers: by borrower

- Page 304 and 305:

Section 10Heading 100: Equity inves

- Page 306 and 307:

Significant data 1Total assetsTotal

- Page 308 and 309:

Section 11Heading 110: Property pla

- Page 310 and 311:

11.4 Tangible assets held for inves

- Page 312 and 313:

12.2 Core intangible assets: moveme

- Page 314 and 315:

13.4 Changes in deferred tax during

- Page 316 and 317:

Section 15Heading 150: Other assets

- Page 318 and 319:

Section 3Heading 30: Debt securitie

- Page 320 and 321:

Section 6Heading 60: Hedging deriva

- Page 322 and 323:

Section 11Heading 110: Staff severa

- Page 324 and 325:

14.2 Share capital: changes in no.

- Page 326 and 327:

Other information1. Guarantees and

- Page 328 and 329:

PART C - NOTES TO PROFIT AND LOSS A

- Page 330 and 331:

Section 2Headings 40 and 50: Net fe

- Page 332 and 333:

Section 3Heading 70: Dividends and

- Page 334 and 335:

Section 5Heading 90: Net hedging in

- Page 336 and 337:

Section 8Heading 130: Adjustments f

- Page 338 and 339:

Section 9Heading 150: Administrativ

- Page 340 and 341:

Section 11Heading 170: Net adjustme

- Page 342 and 343:

Section 17Heading 240: Net gain (lo

- Page 344 and 345:

PART D - COMPREHENSIVE PROFIT AND L

- Page 346 and 347:

1. General aspectsThe Bank’s inte

- Page 348 and 349:

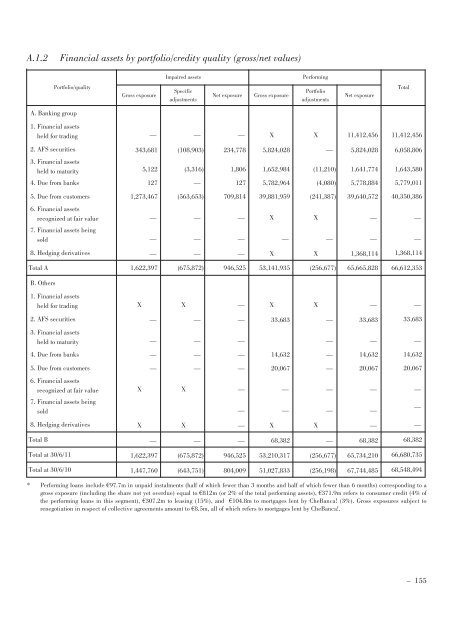

A.1.2 Financial assets by portfolio

- Page 350 and 351:

A.1.2. b Exposures to sovereign deb

- Page 352 and 353:

A.1.6 Cash and off-balance-sheet ex

- Page 354 and 355:

A.3 Secured exposures by type of se

- Page 356 and 357:

B. Loan distribution and concentrat

- Page 358 and 359:

B.3 Cash and off-balance-sheet expo

- Page 360 and 361:

C. Securitizations and asset dispos

- Page 362 and 363:

Quantitative informationC.1.1Exposu

- Page 364 and 365:

C.1.4 Exposures to securitizations

- Page 366 and 367:

C.2 Asset disposalsC.2.1 Financial

- Page 368 and 369:

Section 2Market risk2.1 INTEREST RA

- Page 370 and 371:

Table 1 - Value at risk and expecte

- Page 372 and 373:

Trend in VaR constituents The

- Page 374 and 375:

Currency of denomination: US DOLLAR

- Page 376 and 377:

2.1 Regulatory trading book: cash e

- Page 378 and 379:

HedgingFair value hedgesFair value

- Page 380 and 381:

Currency of denomination: US DOLLAR

- Page 382 and 383:

2. Banking book: cash exposures of

- Page 384 and 385:

2.4 FINANCIAL DERIVATIVE PRODUCTSA.

- Page 386 and 387:

A.2.2Other derivativesType of trans

- Page 388 and 389:

A.4 Financial derivatives: negative

- Page 390 and 391:

A.6 OTC financial derivatives: trad

- Page 392 and 393:

A.8 OTC financial derivatives: bank

- Page 394 and 395:

B. CREDIT DERIVATIVESB.1 Credit der

- Page 396 and 397:

B.4 OTC credit derivatives: gross p

- Page 398 and 399:

C. CREDIT AND FINANCIAL DERIVATIVES

- Page 400 and 401:

indicator generated for the Bank of

- Page 402 and 403:

Currency of denomination: US DOLLAR

- Page 404 and 405:

Section 4Operating riskDefinitionOp

- Page 406 and 407:

B.2 AFS valuation reserves: composi

- Page 408 and 409:

A. QUALITATIVE INFORMATIONTier 1 ca

- Page 410 and 411:

PART H - RELATED PARTY DISCLOSURE1.

- Page 412 and 413:

BENEFICIAL INTEREST OF BOARD MEMBER

- Page 414 and 415:

Situation at 30 June 2011Groupcompa

- Page 416 and 417:

Subsequent to the reporting date, o

- Page 418 and 419:

ANNEXES

- Page 420 and 421:

Liabilities and net equityIAS-compl

- Page 422 and 423:

MEDIOBANCA S.p.A. BALANCE SHEET *As

- Page 424 and 425:

MEDIOBANCA S.p.A. PROFIT AND LOSS A

- Page 426 and 427:

BANKS AND FINANCIAL COMPANIES (IAS/

- Page 428 and 429:

BANKS AND FINANCIAL COMPANIES (IAS/

- Page 430 and 431:

BANKS AND FINANCIAL COMPANIES (IAS/

- Page 432 and 433:

BANKS AND FINANCIAL COMPANIES (IAS/

- Page 434 and 435:

BANKSTABLE B (cont.)BALANCE SHEETSC

- Page 436 and 437:

OTHER GROUP COMPANIESTABLE B (cont.

- Page 438 and 439:

OTHER FINANCIAL COMPANIES (IAS/IFRS

- Page 440 and 441:

OTHER FINANCIAL COMPANIES (IAS/IFRS

- Page 442 and 443:

OTHER NON-FINANCIAL UNDERTAKINGS (I

- Page 444 and 445:

OTHER NON-FINANCIAL UNDERTAKINGS (I

- Page 446 and 447:

OTHERS (IAS/IFRS)TABLE B (cont.)462

- Page 448 and 449:

ASSOCIATE COMPANIESTABLE CBALANCE S

- Page 450 and 451:

ASSOCIATE COMPANIES TABLE C (cont.

- Page 452 and 453:

OTHER ASSOCIATED UNDERTAKINGSTABLE

- Page 454 and 455:

OTHER ASSOCIATED UNDERTAKINGSTABLE

- Page 456 and 457:

OTHER ASSOCIATED UNDERTAKINGSTABLE

- Page 458 and 459:

OTHER ASSOCIATED UNDERTAKINGSTABLE

- Page 460 and 461:

OTHER ASSOCIATED UNDERTAKINGSTABLE

- Page 462 and 463:

TABLE DSIGNIFICANT EQUITY INVESTMEN

- Page 464 and 465:

TABLE D (cont.)Sharecapital€mPar

- Page 466 and 467:

APPOINTMENT OF MEMBERS OF BOARD OF

- Page 468 and 469:

APPOINTMENT OF MEMBERS AND CHAIRMAN

- Page 470 and 471:

REPORT ON STAFF REMUNERATION POLICI

- Page 472 and 473:

. Criteria for calculation of bonus

- Page 474 and 475:

Restrictions have also been introdu

- Page 476 and 477:

ANNEXThe tables below shows the str

- Page 478 and 479:

II. Organizational governanceThe pr

- Page 480 and 481:

The typical components of remunerat

- Page 482 and 483:

- appraisal of the Mediobanca share

- Page 484 and 485:

the Bank, valuation criteria linked

- Page 486 and 487:

At a Board meeting held on 24 June

- Page 488 and 489:

l. Other informationCaps on variabl

- Page 490 and 491:

- in the area of related parties, t

- Page 492 and 493:

compliance with the terms and proce

- Page 494 and 495:

SECTION IIIGeneral MeetingsArticle

- Page 496 and 497:

general meeting or otherwise requir

- Page 498 and 499:

specified in the notice of general

- Page 500 and 501:

eing replaced had been elected from

- Page 502 and 503:

3) decisions concerning the acquisi

- Page 504 and 505:

transaction concerned, either thems

- Page 506 and 507:

Article 17, paragraph 2, points 3 a

- Page 508 and 509:

for its operations and the size of

- Page 510 and 511:

specifically designated by the Boar

- Page 512 and 513:

The proposals for appointments are

- Page 514 and 515:

Article 29The Statutory Audit Commi

- Page 516 and 517:

AUTHORIZATION TO THE BOARD OF DIREC

- Page 518 and 519:

The share capital may also be incre

- Page 520 and 521:

The Board of Directors is also auth

- Page 522 and 523:

ANNUAL STATEMENT SON CORPORATE GOVE

- Page 524 and 525:

At a general meeting held on 28 Oct

- Page 526 and 527:

Persons authorized to take part and

- Page 528 and 529:

All the Directors have made stateme

- Page 530 and 531:

DIRECTORSIRECTORS’ AND STRATEGIC

- Page 532 and 533:

With reference to risk management,

- Page 534 and 535:

Appointments committeeAppointments

- Page 536 and 537:

The Executive Committee is currentl

- Page 538 and 539:

HEAD OF COMPANY FINANCIAL REPORTING

- Page 540 and 541:

- expresses its opinion on the appo

- Page 542 and 543:

INTERNAL DEALINGThe Directors of Me

- Page 544 and 545:

In performing his duties, the head

- Page 546 and 547:

RISK MANAGEMENT AND INTERNAL ICONTR

- Page 548 and 549:

Table 1: BOARD OFMember ****OARD OF

- Page 550 and 551:

Table 3:3: OTHER REQUIREMENTS UNDER

- Page 552 and 553:

NamePosition held inMediobancaPosts

- Page 554:

NamePosition held inMediobancaPosts