transfer to the next stage of education - Sitelines

transfer to the next stage of education - Sitelines

transfer to the next stage of education - Sitelines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

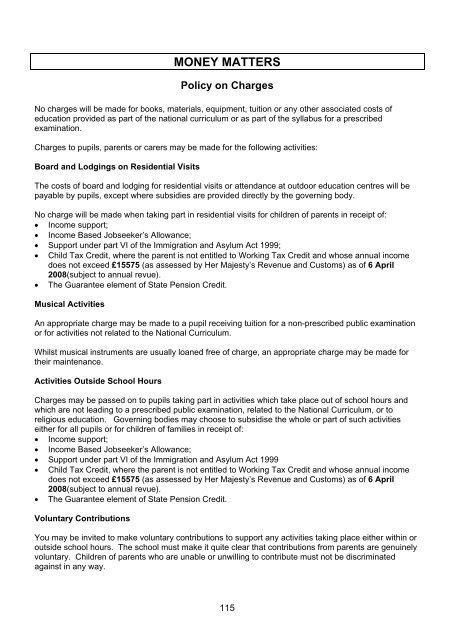

MONEY MATTERSPolicy on ChargesNo charges will be made for books, materials, equipment, tuition or any o<strong>the</strong>r associated costs <strong>of</strong><strong>education</strong> provided as part <strong>of</strong> <strong>the</strong> national curriculum or as part <strong>of</strong> <strong>the</strong> syllabus for a prescribedexamination.Charges <strong>to</strong> pupils, parents or carers may be made for <strong>the</strong> following activities:Board and Lodgings on Residential VisitsThe costs <strong>of</strong> board and lodging for residential visits or attendance at outdoor <strong>education</strong> centres will bepayable by pupils, except where subsidies are provided directly by <strong>the</strong> governing body.No charge will be made when taking part in residential visits for children <strong>of</strong> parents in receipt <strong>of</strong>:• Income support;• Income Based Jobseeker’s Allowance;• Support under part VI <strong>of</strong> <strong>the</strong> Immigration and Asylum Act 1999;• Child Tax Credit, where <strong>the</strong> parent is not entitled <strong>to</strong> Working Tax Credit and whose annual incomedoes not exceed £15575 (as assessed by Her Majesty’s Revenue and Cus<strong>to</strong>ms) as <strong>of</strong> 6 April2008(subject <strong>to</strong> annual revue).• The Guarantee element <strong>of</strong> State Pension Credit.Musical ActivitiesAn appropriate charge may be made <strong>to</strong> a pupil receiving tuition for a non-prescribed public examinationor for activities not related <strong>to</strong> <strong>the</strong> National Curriculum.Whilst musical instruments are usually loaned free <strong>of</strong> charge, an appropriate charge may be made for<strong>the</strong>ir maintenance.Activities Outside School HoursCharges may be passed on <strong>to</strong> pupils taking part in activities which take place out <strong>of</strong> school hours andwhich are not leading <strong>to</strong> a prescribed public examination, related <strong>to</strong> <strong>the</strong> National Curriculum, or <strong>to</strong>religious <strong>education</strong>. Governing bodies may choose <strong>to</strong> subsidise <strong>the</strong> whole or part <strong>of</strong> such activitiesei<strong>the</strong>r for all pupils or for children <strong>of</strong> families in receipt <strong>of</strong>:• Income support;• Income Based Jobseeker’s Allowance;• Support under part VI <strong>of</strong> <strong>the</strong> Immigration and Asylum Act 1999• Child Tax Credit, where <strong>the</strong> parent is not entitled <strong>to</strong> Working Tax Credit and whose annual incomedoes not exceed £15575 (as assessed by Her Majesty’s Revenue and Cus<strong>to</strong>ms) as <strong>of</strong> 6 April2008(subject <strong>to</strong> annual revue).• The Guarantee element <strong>of</strong> State Pension Credit.Voluntary ContributionsYou may be invited <strong>to</strong> make voluntary contributions <strong>to</strong> support any activities taking place ei<strong>the</strong>r within oroutside school hours. The school must make it quite clear that contributions from parents are genuinelyvoluntary. Children <strong>of</strong> parents who are unable or unwilling <strong>to</strong> contribute must not be discriminatedagainst in any way.115