- Page 1 and 2: UNITED STATESSECURITIES AND EXCHANG

- Page 3 and 4: CITIGROUP’S 2010 ANNUAL REPORT ON

- Page 5 and 6: As described above, Citigroup is ma

- Page 7 and 8: Operating ExpensesCitigroup operati

- Page 9 and 10: FIVE-YEAR SUMMARY OF SELECTED FINAN

- Page 11: CITIGROUP REVENUESIn millions of do

- Page 15 and 16: 2009 vs. 2008Revenues, net of inter

- Page 17 and 18: 2009 vs. 2008Revenues, net of inter

- Page 19 and 20: 2009 vs. 2008Revenues, net of inter

- Page 21 and 22: 2009 vs. 2008Revenues, net of inter

- Page 23 and 24: SECURITIES AND BANKINGSecurities an

- Page 25 and 26: TRANSACTION SERVICESTransaction Ser

- Page 27 and 28: BROKERAGE AND ASSET MANAGEMENTBroke

- Page 29 and 30: Japan Consumer FinanceCitigroup con

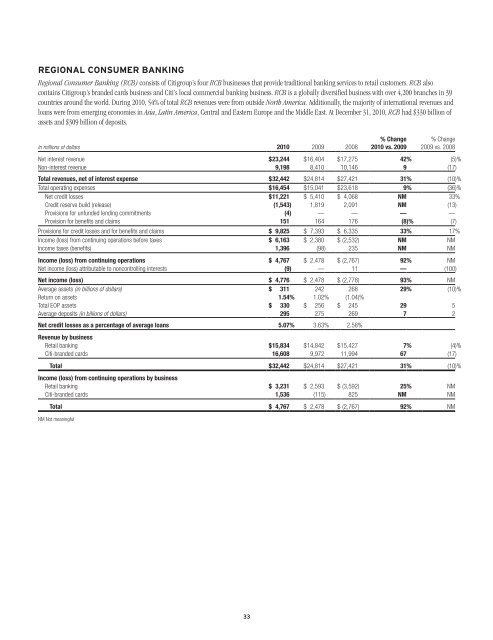

- Page 31 and 32: The following table provides detail

- Page 33 and 34: CORPORATE/OTHERCorporate/Other incl

- Page 35 and 36: During 2010, average Consumer loans

- Page 37 and 38: SEGMENT BALANCE SHEET AT DECEMBER 3

- Page 39 and 40: Citigroup Regulatory Capital Ratios

- Page 41 and 42: Capital Resources of Citigroup’s

- Page 43 and 44: Regulatory Capital Standards Develo

- Page 45 and 46: DepositsCiti continues to focus on

- Page 47 and 48: Secured financing is primarily cond

- Page 49 and 50: Each of the credit rating agencies

- Page 51 and 52: RISK FACTORSThe ongoing implementat

- Page 53 and 54: The emerging markets in which Citi

- Page 55 and 56: is largely uncertain. However, any

- Page 57 and 58: a short-term Liquidity Coverage Rat

- Page 59 and 60: understanding or cause confusion ac

- Page 61 and 62: MANAGING GLOBAL RISKRISK MANAGEMENT

- Page 63 and 64:

CREDIT RISKCredit risk is the poten

- Page 65 and 66:

[This page intentionally left blank

- Page 67 and 68:

(1) 2010 primarily includes an addi

- Page 69 and 70:

Non-Accrual Loans and AssetsThe tab

- Page 71 and 72:

Renegotiated LoansThe following tab

- Page 73 and 74:

Citi’s first mortgage portfolio i

- Page 75 and 76:

Consumer Mortgage FICO and LTVData

- Page 77 and 78:

Second Mortgages: December 31, 2010

- Page 79 and 80:

Interest Rate Risk Associated with

- Page 81 and 82:

North America Cards—FICO Informat

- Page 83 and 84:

CONSUMER LOAN DETAILSConsumer Loan

- Page 85 and 86:

Consumer Loan Modification Programs

- Page 87 and 88:

North America CardsNorth America ca

- Page 89 and 90:

Payment deferrals that do not conti

- Page 91 and 92:

Repurchase ReserveCiti has recorded

- Page 93 and 94:

Securities and Banking-Sponsored Pr

- Page 95 and 96:

The following table presents the co

- Page 97 and 98:

MARKET RISKMarket risk encompasses

- Page 99 and 100:

Trading PortfoliosPrice risk in tra

- Page 101 and 102:

INTEREST REVENUE/EXPENSE AND YIELDS

- Page 103 and 104:

AVERAGE BALANCES AND INTEREST RATES

- Page 105 and 106:

ANALYSIS OF CHANGES IN INTEREST EXP

- Page 107 and 108:

[This page intentionally left blank

- Page 109 and 110:

As required by SEC rules, the table

- Page 111 and 112:

The credit valuation adjustment amo

- Page 113 and 114:

The fair values shown are prior to

- Page 115 and 116:

Key Controls over Fair Value Measur

- Page 117 and 118:

The following table reflects the in

- Page 119 and 120:

The results of the July 1, 2010 tes

- Page 121 and 122:

As a result of the losses incurred

- Page 123 and 124:

MANAGEMENT’S ANNUAL REPORT ON INT

- Page 125 and 126:

• an “ownership change” under

- Page 127 and 128:

REPORT OF INDEPENDENT REGISTERED PU

- Page 129 and 130:

FINANCIAL STATEMENTS AND NOTES TABL

- Page 131 and 132:

CONSOLIDATED FINANCIAL STATEMENTSCO

- Page 133 and 134:

CONSOLIDATED BALANCE SHEET(Continue

- Page 135 and 136:

CONSOLIDATED STATEMENT OF CHANGES I

- Page 137 and 138:

CITIBANK CONSOLIDATED BALANCE SHEET

- Page 139 and 140:

NOTES TO CONSOLIDATED FINANCIAL STA

- Page 141 and 142:

Repurchase and Resale AgreementsSec

- Page 143 and 144:

ecoveries are added. Securities rec

- Page 145 and 146:

Consumer Mortgage Representations a

- Page 147 and 148:

Transfers of Financial AssetsFor a

- Page 149 and 150:

ACCOUNTING CHANGESChange in Account

- Page 151 and 152:

The following table reflects the in

- Page 153 and 154:

Measuring Liabilities at Fair Value

- Page 155 and 156:

Revisions to the Earnings-per-Share

- Page 157 and 158:

FUTURE APPLICATION OF ACCOUNTING ST

- Page 159 and 160:

3. DISCONTINUED OPERATIONSSale of T

- Page 161 and 162:

CitiCapitalOn July 31, 2008, Citigr

- Page 163 and 164:

5. INTEREST REVENUE AND EXPENSEFor

- Page 165 and 166:

Stock Award ProgramsCitigroup issue

- Page 167 and 168:

In January 2009, members of the Man

- Page 169 and 170:

Information with respect to stock o

- Page 171 and 172:

9. RETIREMENT BENEFITSThe Company h

- Page 173 and 174:

The following table shows the chang

- Page 175 and 176:

A one-percentage-point change in th

- Page 177 and 178:

Level 3 Roll ForwardThe reconciliat

- Page 179 and 180:

10. INCOME TAXESIn millions of doll

- Page 181 and 182:

The Company is currently under audi

- Page 183 and 184:

11. EARNINGS PER SHAREThe following

- Page 185 and 186:

13. BROKERAGE RECEIVABLES AND BROKE

- Page 187 and 188:

The table below shows the fair valu

- Page 189 and 190:

Debt Securities Held-to-MaturityThe

- Page 191 and 192:

Evaluating Investments for Other-Th

- Page 193 and 194:

The following is a 12-month roll-fo

- Page 195 and 196:

16. LOANSCitigroup loans are report

- Page 197 and 198:

Residential Mortgage Loan to Values

- Page 199 and 200:

The following table presents Corpor

- Page 201 and 202:

Included in the Corporate and Consu

- Page 203 and 204:

18. GOODWILL AND INTANGIBLE ASSETSG

- Page 205 and 206:

Intangible AssetsThe components of

- Page 207 and 208:

CGMHI has committed long-term finan

- Page 209 and 210:

20. Regulatory CapitalCitigroup is

- Page 211 and 212:

22. SECURITIZATIONS AND VARIABLE IN

- Page 213 and 214:

In millions of dollars As of Decemb

- Page 215 and 216:

Funding Commitments for Significant

- Page 217 and 218:

Credit Card SecuritizationsThe Comp

- Page 219 and 220:

Managed Loans—Citi HoldingsThe fo

- Page 221 and 222:

Key assumptions used in measuring t

- Page 223 and 224:

Mortgage Servicing RightsIn connect

- Page 225 and 226:

The Company administers one conduit

- Page 227 and 228:

Key Assumptions and Retained Intere

- Page 229 and 230:

Municipal InvestmentsMunicipal inve

- Page 231 and 232:

Derivative NotionalsIn millions of

- Page 233 and 234:

activities together with gains and

- Page 235 and 236:

Cash Flow HedgesHedging of benchmar

- Page 237 and 238:

The range of credit derivatives sol

- Page 239 and 240:

24. CONCENTRATIONS OF CREDIT RISKCo

- Page 241 and 242:

Trading account assets and liabilit

- Page 243 and 244:

The internal valuation techniques u

- Page 245 and 246:

In millions of dollars at December

- Page 247 and 248:

Changes in Level 3 Fair Value Categ

- Page 249 and 250:

In millions of dollarsDecember 31,2

- Page 251 and 252:

26. FAIR VALUE ELECTIONSThe Company

- Page 253 and 254:

The following table provides inform

- Page 255 and 256:

Certain structured liabilitiesThe C

- Page 257 and 258:

28. PLEDGED SECURITIES, COLLATERAL,

- Page 259 and 260:

The repurchase reserve estimation p

- Page 261 and 262:

CollateralCash collateral available

- Page 263 and 264:

29. CONTINGENCIESOverviewIn additio

- Page 265 and 266:

pursuant to which Citigroup agreed

- Page 267 and 268:

court filings under docket number 0

- Page 269 and 270:

30. CITIBANK, N.A. STOCKHOLDER’S

- Page 271 and 272:

Condensed Consolidating Statements

- Page 273 and 274:

Condensed Consolidating Statements

- Page 275 and 276:

Condensed Consolidating Balance She

- Page 277 and 278:

Condensed Consolidating Statements

- Page 279 and 280:

33. SELECTED QUARTERLY FINANCIAL DA

- Page 281 and 282:

SUPERVISION AND REGULATIONCitigroup

- Page 283 and 284:

Citigroup continues to evaluate its

- Page 285 and 286:

CORPORATE INFORMATIONCITIGROUP EXEC

- Page 287 and 288:

SignaturesPursuant to the requireme