Citigroup Inc.

Citigroup Inc.

Citigroup Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

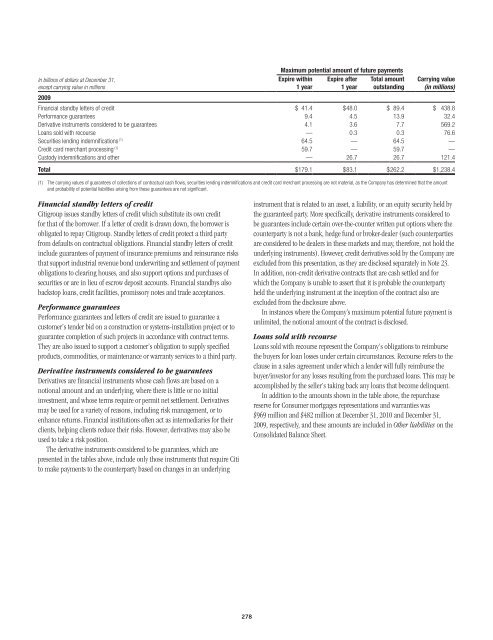

In billions of dollars at December 31,except carrying value in millions2009Maximum potential amount of future paymentsExpire within Expire after Total amount1 year 1 year outstandingCarrying value(in millions)Financial standby letters of credit $ 41.4 $48.0 $ 89.4 $ 438.8Performance guarantees 9.4 4.5 13.9 32.4Derivative instruments considered to be guarantees 4.1 3.6 7.7 569.2Loans sold with recourse — 0.3 0.3 76.6Securities lending indemnifications (1) 64.5 — 64.5 —Credit card merchant processing (1) 59.7 — 59.7 —Custody indemnifications and other — 26.7 26.7 121.4Total $179.1 $83.1 $262.2 $1,238.4(1) The carrying values of guarantees of collections of contractual cash flows, securities lending indemnifications and credit card merchant processing are not material, as the Company has determined that the amountand probability of potential liabilities arising from these guarantees are not significant.Financial standby letters of credit<strong>Citigroup</strong> issues standby letters of credit which substitute its own creditfor that of the borrower. If a letter of credit is drawn down, the borrower isobligated to repay <strong>Citigroup</strong>. Standby letters of credit protect a third partyfrom defaults on contractual obligations. Financial standby letters of creditinclude guarantees of payment of insurance premiums and reinsurance risksthat support industrial revenue bond underwriting and settlement of paymentobligations to clearing houses, and also support options and purchases ofsecurities or are in lieu of escrow deposit accounts. Financial standbys alsobackstop loans, credit facilities, promissory notes and trade acceptances.Performance guaranteesPerformance guarantees and letters of credit are issued to guarantee acustomer’s tender bid on a construction or systems-installation project or toguarantee completion of such projects in accordance with contract terms.They are also issued to support a customer’s obligation to supply specifiedproducts, commodities, or maintenance or warranty services to a third party.Derivative instruments considered to be guaranteesDerivatives are financial instruments whose cash flows are based on anotional amount and an underlying, where there is little or no initialinvestment, and whose terms require or permit net settlement. Derivativesmay be used for a variety of reasons, including risk management, or toenhance returns. Financial institutions often act as intermediaries for theirclients, helping clients reduce their risks. However, derivatives may also beused to take a risk position.The derivative instruments considered to be guarantees, which arepresented in the tables above, include only those instruments that require Citito make payments to the counterparty based on changes in an underlyinginstrument that is related to an asset, a liability, or an equity security held bythe guaranteed party. More specifically, derivative instruments considered tobe guarantees include certain over-the-counter written put options where thecounterparty is not a bank, hedge fund or broker-dealer (such counterpartiesare considered to be dealers in these markets and may, therefore, not hold theunderlying instruments). However, credit derivatives sold by the Company areexcluded from this presentation, as they are disclosed separately in Note 23.In addition, non-credit derivative contracts that are cash settled and forwhich the Company is unable to assert that it is probable the counterpartyheld the underlying instrument at the inception of the contract also areexcluded from the disclosure above.In instances where the Company’s maximum potential future payment isunlimited, the notional amount of the contract is disclosed.Loans sold with recourseLoans sold with recourse represent the Company’s obligations to reimbursethe buyers for loan losses under certain circumstances. Recourse refers to theclause in a sales agreement under which a lender will fully reimburse thebuyer/investor for any losses resulting from the purchased loans. This may beaccomplished by the seller’s taking back any loans that become delinquent.In addition to the amounts shown in the table above, the repurchasereserve for Consumer mortgages representations and warranties was$969 million and $482 million at December 31, 2010 and December 31,2009, respectively, and these amounts are included in Other liabilities on theConsolidated Balance Sheet.278