Citigroup Inc.

Citigroup Inc.

Citigroup Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

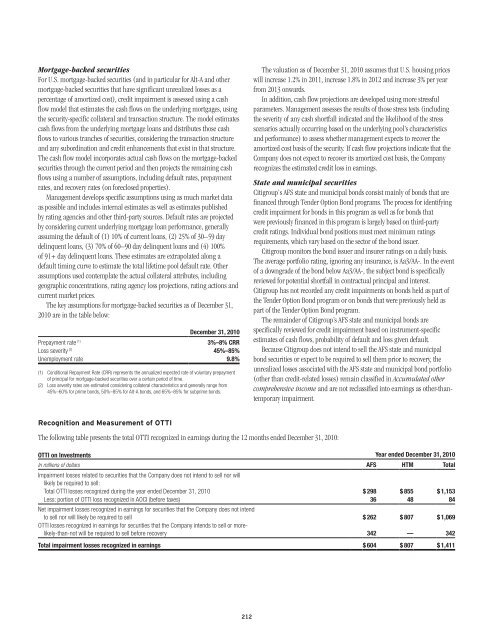

Mortgage-backed securitiesFor U.S. mortgage-backed securities (and in particular for Alt-A and othermortgage-backed securities that have significant unrealized losses as apercentage of amortized cost), credit impairment is assessed using a cashflow model that estimates the cash flows on the underlying mortgages, usingthe security-specific collateral and transaction structure. The model estimatescash flows from the underlying mortgage loans and distributes those cashflows to various tranches of securities, considering the transaction structureand any subordination and credit enhancements that exist in that structure.The cash flow model incorporates actual cash flows on the mortgage-backedsecurities through the current period and then projects the remaining cashflows using a number of assumptions, including default rates, prepaymentrates, and recovery rates (on foreclosed properties).Management develops specific assumptions using as much market dataas possible and includes internal estimates as well as estimates publishedby rating agencies and other third-party sources. Default rates are projectedby considering current underlying mortgage loan performance, generallyassuming the default of (1) 10% of current loans, (2) 25% of 30–59 daydelinquent loans, (3) 70% of 60–90 day delinquent loans and (4) 100%of 91+ day delinquent loans. These estimates are extrapolated along adefault timing curve to estimate the total lifetime pool default rate. Otherassumptions used contemplate the actual collateral attributes, includinggeographic concentrations, rating agency loss projections, rating actions andcurrent market prices.The key assumptions for mortgage-backed securities as of December 31,2010 are in the table below:December 31, 2010Prepayment rate (1)3%–8% CRRLoss severity (2) 45%–85%Unemployment rate 9.8%(1) Conditional Repayment Rate (CRR) represents the annualized expected rate of voluntary prepaymentof principal for mortgage-backed securities over a certain period of time.(2) Loss severity rates are estimated considering collateral characteristics and generally range from45%–60% for prime bonds, 50%–85% for Alt-A bonds, and 65%–85% for subprime bonds.The valuation as of December 31, 2010 assumes that U.S. housing priceswill increase 1.2% in 2011, increase 1.8% in 2012 and increase 3% per yearfrom 2013 onwards.In addition, cash flow projections are developed using more stressfulparameters. Management assesses the results of those stress tests (includingthe severity of any cash shortfall indicated and the likelihood of the stressscenarios actually occurring based on the underlying pool’s characteristicsand performance) to assess whether management expects to recover theamortized cost basis of the security. If cash flow projections indicate that theCompany does not expect to recover its amortized cost basis, the Companyrecognizes the estimated credit loss in earnings.State and municipal securities<strong>Citigroup</strong>’s AFS state and municipal bonds consist mainly of bonds that arefinanced through Tender Option Bond programs. The process for identifyingcredit impairment for bonds in this program as well as for bonds thatwere previously financed in this program is largely based on third-partycredit ratings. Individual bond positions must meet minimum ratingsrequirements, which vary based on the sector of the bond issuer.<strong>Citigroup</strong> monitors the bond issuer and insurer ratings on a daily basis.The average portfolio rating, ignoring any insurance, is Aa3/AA-. In the eventof a downgrade of the bond below Aa3/AA-, the subject bond is specificallyreviewed for potential shortfall in contractual principal and interest.<strong>Citigroup</strong> has not recorded any credit impairments on bonds held as part ofthe Tender Option Bond program or on bonds that were previously held aspart of the Tender Option Bond program.The remainder of <strong>Citigroup</strong>’s AFS state and municipal bonds arespecifically reviewed for credit impairment based on instrument-specificestimates of cash flows, probability of default and loss given default.Because <strong>Citigroup</strong> does not intend to sell the AFS state and municipalbond securities or expect to be required to sell them prior to recovery, theunrealized losses associated with the AFS state and municipal bond portfolio(other than credit-related losses) remain classified in Accumulated othercomprehensive income and are not reclassified into earnings as other-thantemporaryimpairment.Recognition and Measurement of OTTIThe following table presents the total OTTI recognized in earnings during the 12 months ended December 31, 2010:OTTI on Investments Year ended December 31, 2010In millions of dollars AFS HTM TotalImpairment losses related to securities that the Company does not intend to sell nor willlikely be required to sell:Total OTTI losses recognized during the year ended December 31, 2010 $ 298 $ 855 $ 1,153Less: portion of OTTI loss recognized in AOCI (before taxes) 36 48 84Net impairment losses recognized in earnings for securities that the Company does not intendto sell nor will likely be required to sell $ 262 $ 807 $ 1,069OTTI losses recognized in earnings for securities that the Company intends to sell or morelikely-than-notwill be required to sell before recovery 342 — 342Total impairment losses recognized in earnings $ 604 $ 807 $ 1,411212