Citigroup Inc.

Citigroup Inc.

Citigroup Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

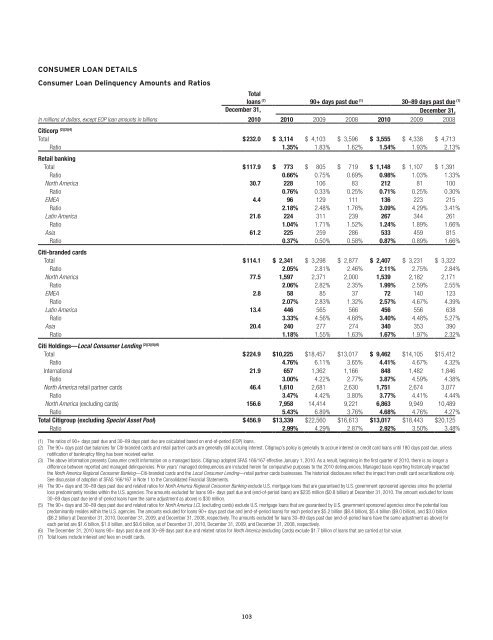

CONSUMER LOAN DETAILSConsumer Loan Delinquency Amounts and RatiosTotalloans (7) 90+ days past due (1) 30–89 days past due (1)December 31, December 31,In millions of dollars, except EOP loan amounts in billions 2010 2010 2009 2008 2010 2009 2008Citicorp (2)(3)(4)Total $ 232.0 $ 3,114 $ 4,103 $ 3,596 $ 3,555 $ 4,338 $ 4,713Ratio 1.35% 1.83% 1.62% 1.54% 1.93% 2.13%Retail bankingTotal $ 117.9 $ 773 $ 805 $ 719 $ 1,148 $ 1,107 $ 1,391Ratio 0.66% 0.75% 0.69% 0.98% 1.03% 1.33%North America 30.7 228 106 83 212 81 100Ratio 0.76% 0.33% 0.25% 0.71% 0.25% 0.30%EMEA 4.4 96 129 111 136 223 215Ratio 2.18% 2.48% 1.76% 3.09% 4.29% 3.41%Latin America 21.6 224 311 239 267 344 261Ratio 1.04% 1.71% 1.52% 1.24% 1.89% 1.66%Asia 61.2 225 259 286 533 459 815Ratio 0.37% 0.50% 0.58% 0.87% 0.89% 1.66%Citi-branded cardsTotal $ 114.1 $ 2,341 $ 3,298 $ 2,877 $ 2,407 $ 3,231 $ 3,322Ratio 2.05% 2.81% 2.46% 2.11% 2.75% 2.84%North America 77.5 1,597 2,371 2,000 1,539 2,182 2,171Ratio 2.06% 2.82% 2.35% 1.99% 2.59% 2.55%EMEA 2.8 58 85 37 72 140 123Ratio 2.07% 2.83% 1.32% 2.57% 4.67% 4.39%Latin America 13.4 446 565 566 456 556 638Ratio 3.33% 4.56% 4.68% 3.40% 4.48% 5.27%Asia 20.4 240 277 274 340 353 390Ratio 1.18% 1.55% 1.63% 1.67% 1.97% 2.32%Citi Holdings—Local Consumer Lending (2)(3)(5)(6)Total $ 224.9 $10,225 $18,457 $13,017 $ 9,462 $14,105 $15,412Ratio 4.76% 6.11% 3.65% 4.41% 4.67% 4.32%International 21.9 657 1,362 1,166 848 1,482 1,846Ratio 3.00% 4.22% 2.77% 3.87% 4.59% 4.38%North America retail partner cards 46.4 1,610 2,681 2,630 1,751 2,674 3,077Ratio 3.47% 4.42% 3.80% 3.77% 4.41% 4.44%North America (excluding cards) 156.6 7,958 14,414 9,221 6,863 9,949 10,489Ratio 5.43% 6.89% 3.76% 4.68% 4.76% 4.27%Total <strong>Citigroup</strong> (excluding Special Asset Pool) $ 456.9 $13,339 $22,560 $16,613 $13,017 $18,443 $20,125Ratio 2.99% 4.29% 2.87% 2.92% 3.50% 3.48%(1) The ratios of 90+ days past due and 30–89 days past due are calculated based on end-of-period (EOP) loans.(2) The 90+ days past due balances for Citi-branded cards and retail partner cards are generally still accruing interest. <strong>Citigroup</strong>’s policy is generally to accrue interest on credit card loans until 180 days past due, unlessnotification of bankruptcy filing has been received earlier.(3) The above information presents Consumer credit information on a managed basis. <strong>Citigroup</strong> adopted SFAS 166/167 effective January 1, 2010. As a result, beginning in the first quarter of 2010, there is no longer adifference between reported and managed delinquencies. Prior years’ managed delinquencies are included herein for comparative purposes to the 2010 delinquencies. Managed basis reporting historically impactedthe North America Regional Consumer Banking—Citi-branded cards and the Local Consumer Lending—retail partner cards businesses. The historical disclosures reflect the impact from credit card securitizations only.See discussion of adoption of SFAS 166/167 in Note 1 to the Consolidated Financial Statements.(4) The 90+ days and 30–89 days past due and related ratios for North America Regional Consumer Banking exclude U.S. mortgage loans that are guaranteed by U.S. government sponsored agencies since the potentialloss predominantly resides within the U.S. agencies. The amounts excluded for loans 90+ days past due and (end-of-period loans) are $235 million ($0.8 billion) at December 31, 2010. The amount excluded for loans30–89 days past due (end-of-period loans have the same adjustment as above) is $30 million.(5) The 90+ days and 30–89 days past due and related ratios for North America LCL (excluding cards) exclude U.S. mortgage loans that are guaranteed by U.S. government sponsored agencies since the potential losspredominantly resides within the U.S. agencies. The amounts excluded for loans 90+ days past due and (end-of-period loans) for each period are $5.2 billion ($8.4 billion), $5.4 billion ($9.0 billion), and $3.0 billion($6.2 billion) at December 31, 2010, December 31, 2009, and December 31, 2008, respectively. The amounts excluded for loans 30–89 days past due (end-of-period loans have the same adjustment as above) foreach period are $1.6 billion, $1.0 billion, and $0.6 billion, as of December 31, 2010, December 31, 2009, and December 31, 2008, respectively.(6) The December 31, 2010 loans 90+ days past due and 30–89 days past due and related ratios for North America (excluding Cards) exclude $1.7 billion of loans that are carried at fair value.(7) Total loans include interest and fees on credit cards.103