This document has been provided by the International Center for Not ...

This document has been provided by the International Center for Not ...

This document has been provided by the International Center for Not ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

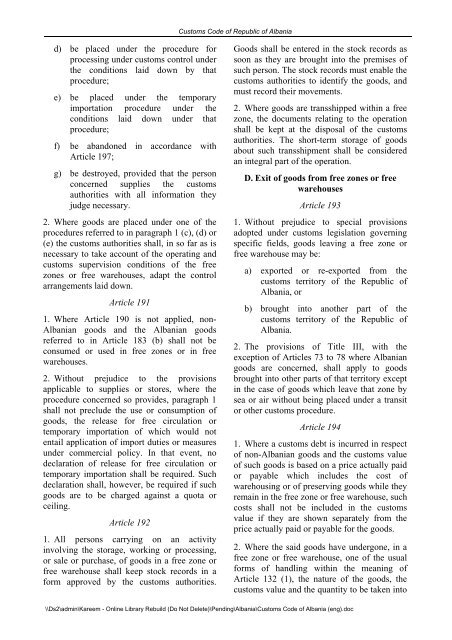

Customs Code of Republic of Albaniad) be placed under <strong>the</strong> procedure <strong>for</strong>processing under customs control under<strong>the</strong> conditions laid down <strong>by</strong> thatprocedure;e) be placed under <strong>the</strong> temporaryimportation procedure under <strong>the</strong>conditions laid down under thatprocedure;f) be abandoned in accordance withArticle 197;g) be destroyed, <strong>provided</strong> that <strong>the</strong> personconcerned supplies <strong>the</strong> customsauthorities with all in<strong>for</strong>mation <strong>the</strong>yjudge necessary.2. Where goods are placed under one of <strong>the</strong>procedures referred to in paragraph 1 (c), (d) or(e) <strong>the</strong> customs authorities shall, in so far as isnecessary to take account of <strong>the</strong> operating andcustoms supervision conditions of <strong>the</strong> freezones or free warehouses, adapt <strong>the</strong> controlarrangements laid down.Article 1911. Where Article 190 is not applied, non-Albanian goods and <strong>the</strong> Albanian goodsreferred to in Article 183 (b) shall not beconsumed or used in free zones or in freewarehouses.2. Without prejudice to <strong>the</strong> provisionsapplicable to supplies or stores, where <strong>the</strong>procedure concerned so provides, paragraph 1shall not preclude <strong>the</strong> use or consumption ofgoods, <strong>the</strong> release <strong>for</strong> free circulation ortemporary importation of which would notentail application of import duties or measuresunder commercial policy. In that event, nodeclaration of release <strong>for</strong> free circulation ortemporary importation shall be required. Suchdeclaration shall, however, be required if suchgoods are to be charged against a quota orceiling.Article 1921. All persons carrying on an activityinvolving <strong>the</strong> storage, working or processing,or sale or purc<strong>has</strong>e, of goods in a free zone orfree warehouse shall keep stock records in a<strong>for</strong>m approved <strong>by</strong> <strong>the</strong> customs authorities.Goods shall be entered in <strong>the</strong> stock records assoon as <strong>the</strong>y are brought into <strong>the</strong> premises ofsuch person. The stock records must enable <strong>the</strong>customs authorities to identify <strong>the</strong> goods, andmust record <strong>the</strong>ir movements.2. Where goods are transshipped within a freezone, <strong>the</strong> <strong>document</strong>s relating to <strong>the</strong> operationshall be kept at <strong>the</strong> disposal of <strong>the</strong> customsauthorities. The short-term storage of goodsabout such transshipment shall be consideredan integral part of <strong>the</strong> operation.D. Exit of goods from free zones or freewarehousesArticle 1931. Without prejudice to special provisionsadopted under customs legislation governingspecific fields, goods leaving a free zone orfree warehouse may be:a) exported or re-exported from <strong>the</strong>customs territory of <strong>the</strong> Republic ofAlbania, orb) brought into ano<strong>the</strong>r part of <strong>the</strong>customs territory of <strong>the</strong> Republic ofAlbania.2. The provisions of Title III, with <strong>the</strong>exception of Articles 73 to 78 where Albaniangoods are concerned, shall apply to goodsbrought into o<strong>the</strong>r parts of that territory exceptin <strong>the</strong> case of goods which leave that zone <strong>by</strong>sea or air without being placed under a transitor o<strong>the</strong>r customs procedure.Article 1941. Where a customs debt is incurred in respectof non-Albanian goods and <strong>the</strong> customs valueof such goods is based on a price actually paidor payable which includes <strong>the</strong> cost ofwarehousing or of preserving goods while <strong>the</strong>yremain in <strong>the</strong> free zone or free warehouse, suchcosts shall not be included in <strong>the</strong> customsvalue if <strong>the</strong>y are shown separately from <strong>the</strong>price actually paid or payable <strong>for</strong> <strong>the</strong> goods.2. Where <strong>the</strong> said goods have undergone, in afree zone or free warehouse, one of <strong>the</strong> usual<strong>for</strong>ms of handling within <strong>the</strong> meaning ofArticle 132 (1), <strong>the</strong> nature of <strong>the</strong> goods, <strong>the</strong>customs value and <strong>the</strong> quantity to be taken into\\Ds2\admin\Kareem - Online Library Rebuild (Do <strong>Not</strong> Delete)\Pending\Albania\Customs Code of Albania (eng).doc