Applications of state space models in finance

Applications of state space models in finance

Applications of state space models in finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

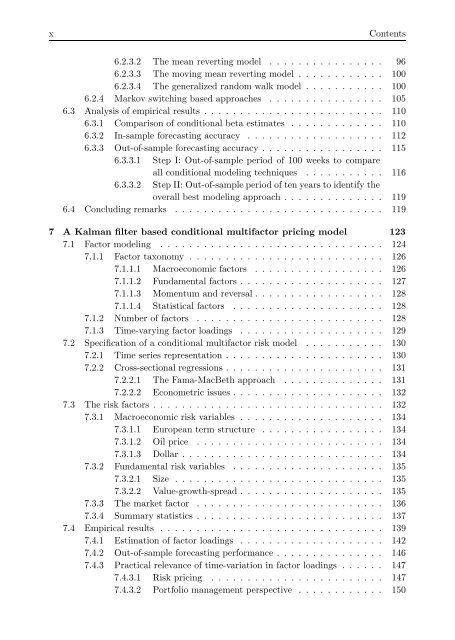

x Contents<br />

6.2.3.2 The mean revert<strong>in</strong>g model . . . . . . . . . . . . . . . . 96<br />

6.2.3.3 The mov<strong>in</strong>g mean revert<strong>in</strong>g model . . . . . . . . . . . . 100<br />

6.2.3.4 The generalized random walk model . . . . . . . . . . . 100<br />

6.2.4 Markov switch<strong>in</strong>g based approaches . . . . . . . . . . . . . . . . 105<br />

6.3 Analysis <strong>of</strong> empirical results . . . . . . . . . . . . . . . . . . . . . . . . . 110<br />

6.3.1 Comparison <strong>of</strong> conditional beta estimates . . . . . . . . . . . . . 110<br />

6.3.2 In-sample forecast<strong>in</strong>g accuracy . . . . . . . . . . . . . . . . . . . 112<br />

6.3.3 Out-<strong>of</strong>-sample forecast<strong>in</strong>g accuracy . . . . . . . . . . . . . . . . . 115<br />

6.3.3.1 Step I: Out-<strong>of</strong>-sample period <strong>of</strong> 100 weeks to compare<br />

all conditional model<strong>in</strong>g techniques . . . . . . . . . . . 116<br />

6.3.3.2 Step II: Out-<strong>of</strong>-sample period <strong>of</strong> ten years to identify the<br />

overall best model<strong>in</strong>g approach . . . . . . . . . . . . . . 119<br />

6.4 Conclud<strong>in</strong>g remarks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119<br />

7 A Kalman filter based conditional multifactor pric<strong>in</strong>g model 123<br />

7.1 Factor model<strong>in</strong>g . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124<br />

7.1.1 Factor taxonomy . . . . . . . . . . . . . . . . . . . . . . . . . . . 126<br />

7.1.1.1 Macroeconomic factors . . . . . . . . . . . . . . . . . . 126<br />

7.1.1.2 Fundamental factors . . . . . . . . . . . . . . . . . . . . 127<br />

7.1.1.3 Momentum and reversal . . . . . . . . . . . . . . . . . . 128<br />

7.1.1.4 Statistical factors . . . . . . . . . . . . . . . . . . . . . 128<br />

7.1.2 Number <strong>of</strong> factors . . . . . . . . . . . . . . . . . . . . . . . . . . 128<br />

7.1.3 Time-vary<strong>in</strong>g factor load<strong>in</strong>gs . . . . . . . . . . . . . . . . . . . . 129<br />

7.2 Specification <strong>of</strong> a conditional multifactor risk model . . . . . . . . . . . 130<br />

7.2.1 Time series representation . . . . . . . . . . . . . . . . . . . . . . 130<br />

7.2.2 Cross-sectional regressions . . . . . . . . . . . . . . . . . . . . . . 131<br />

7.2.2.1 The Fama-MacBeth approach . . . . . . . . . . . . . . 131<br />

7.2.2.2 Econometric issues . . . . . . . . . . . . . . . . . . . . . 132<br />

7.3 The risk factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132<br />

7.3.1 Macroeconomic risk variables . . . . . . . . . . . . . . . . . . . . 134<br />

7.3.1.1 European term structure . . . . . . . . . . . . . . . . . 134<br />

7.3.1.2 Oil price . . . . . . . . . . . . . . . . . . . . . . . . . . 134<br />

7.3.1.3 Dollar . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134<br />

7.3.2 Fundamental risk variables . . . . . . . . . . . . . . . . . . . . . 135<br />

7.3.2.1 Size . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 135<br />

7.3.2.2 Value-growth-spread . . . . . . . . . . . . . . . . . . . . 135<br />

7.3.3 The market factor . . . . . . . . . . . . . . . . . . . . . . . . . . 136<br />

7.3.4 Summary statistics . . . . . . . . . . . . . . . . . . . . . . . . . . 137<br />

7.4 Empirical results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 139<br />

7.4.1 Estimation <strong>of</strong> factor load<strong>in</strong>gs . . . . . . . . . . . . . . . . . . . . 142<br />

7.4.2 Out-<strong>of</strong>-sample forecast<strong>in</strong>g performance . . . . . . . . . . . . . . . 146<br />

7.4.3 Practical relevance <strong>of</strong> time-variation <strong>in</strong> factor load<strong>in</strong>gs . . . . . . 147<br />

7.4.3.1 Risk pric<strong>in</strong>g . . . . . . . . . . . . . . . . . . . . . . . . 147<br />

7.4.3.2 Portfolio management perspective . . . . . . . . . . . . 150