Applications of state space models in finance

Applications of state space models in finance

Applications of state space models in finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6.3 Analysis <strong>of</strong> empirical results 117<br />

mean error<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

(a) Average mean errors<br />

MAE<br />

MSE<br />

0.0<br />

MSM MS OLS SV MR tG RW GRW MMR<br />

rank<br />

8<br />

6<br />

4<br />

2<br />

(b) Average ranks<br />

MAE<br />

MSE<br />

0<br />

MSM MS tG SV OLS RW MR GRW MMR<br />

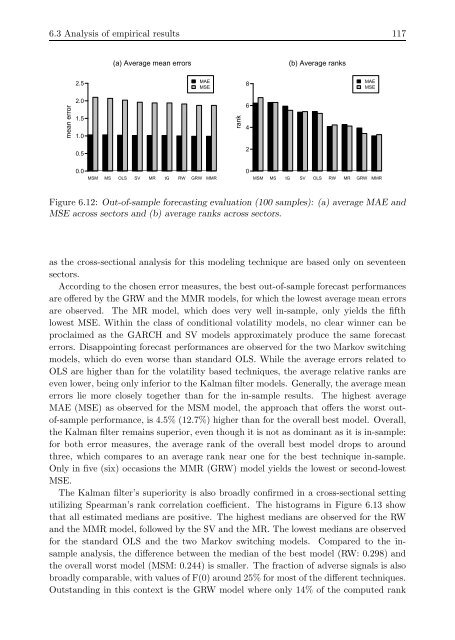

Figure 6.12: Out-<strong>of</strong>-sample forecast<strong>in</strong>g evaluation (100 samples): (a) average MAE and<br />

MSE across sectors and (b) average ranks across sectors.<br />

as the cross-sectional analysis for this model<strong>in</strong>g technique are based only on seventeen<br />

sectors.<br />

Accord<strong>in</strong>g to the chosen error measures, the best out-<strong>of</strong>-sample forecast performances<br />

are <strong>of</strong>fered by the GRW and the MMR <strong>models</strong>, for which the lowest average mean errors<br />

are observed. The MR model, which does very well <strong>in</strong>-sample, only yields the fifth<br />

lowest MSE. With<strong>in</strong> the class <strong>of</strong> conditional volatility <strong>models</strong>, no clear w<strong>in</strong>ner can be<br />

proclaimed as the GARCH and SV <strong>models</strong> approximately produce the same forecast<br />

errors. Disappo<strong>in</strong>t<strong>in</strong>g forecast performances are observed for the two Markov switch<strong>in</strong>g<br />

<strong>models</strong>, which do even worse than standard OLS. While the average errors related to<br />

OLS are higher than for the volatility based techniques, the average relative ranks are<br />

even lower, be<strong>in</strong>g only <strong>in</strong>ferior to the Kalman filter <strong>models</strong>. Generally, the average mean<br />

errors lie more closely together than for the <strong>in</strong>-sample results. The highest average<br />

MAE (MSE) as observed for the MSM model, the approach that <strong>of</strong>fers the worst out<strong>of</strong>-sample<br />

performance, is 4.5% (12.7%) higher than for the overall best model. Overall,<br />

the Kalman filter rema<strong>in</strong>s superior, even though it is not as dom<strong>in</strong>ant as it is <strong>in</strong>-sample:<br />

for both error measures, the average rank <strong>of</strong> the overall best model drops to around<br />

three, which compares to an average rank near one for the best technique <strong>in</strong>-sample.<br />

Only <strong>in</strong> five (six) occasions the MMR (GRW) model yields the lowest or second-lowest<br />

MSE.<br />

The Kalman filter’s superiority is also broadly confirmed <strong>in</strong> a cross-sectional sett<strong>in</strong>g<br />

utiliz<strong>in</strong>g Spearman’s rank correlation coefficient. The histograms <strong>in</strong> Figure 6.13 show<br />

that all estimated medians are positive. The highest medians are observed for the RW<br />

and the MMR model, followed by the SV and the MR. The lowest medians are observed<br />

for the standard OLS and the two Markov switch<strong>in</strong>g <strong>models</strong>. Compared to the <strong>in</strong>sample<br />

analysis, the difference between the median <strong>of</strong> the best model (RW: 0.298) and<br />

the overall worst model (MSM: 0.244) is smaller. The fraction <strong>of</strong> adverse signals is also<br />

broadly comparable, with values <strong>of</strong> F(0) around 25% for most <strong>of</strong> the different techniques.<br />

Outstand<strong>in</strong>g <strong>in</strong> this context is the GRW model where only 14% <strong>of</strong> the computed rank