The Economy of Catalonia

the_economy_of_catalonia._questions_and_answers_on_the_economic_impact_of_independence

the_economy_of_catalonia._questions_and_answers_on_the_economic_impact_of_independence

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

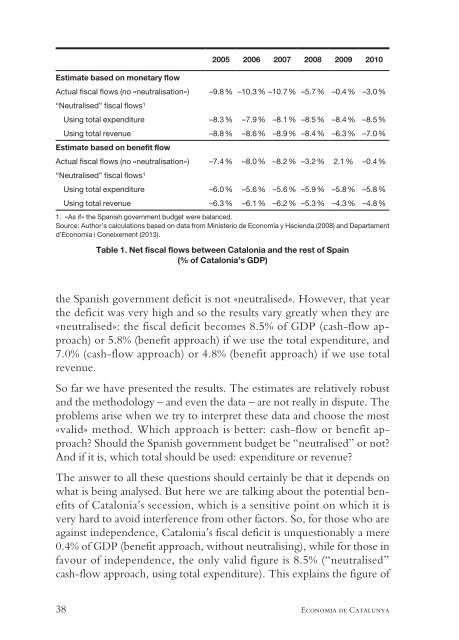

2005 2006 2007 2008 2009 2010<br />

Estimate based on monetary flow<br />

Actual fiscal flows (no «neutralisation») –9.8% –10.3% –10.7 % –5.7 % –0.4 % –3.0 %<br />

“Neutralised” fiscal flows 1<br />

Using total expenditure –8.3% –7.9% –8.1 % –8.5 % –8.4 % –8.5 %<br />

Using total revenue –8.8% –8.6% –8.9 % –8.4 % –6.3 % –7.0 %<br />

Estimate based on benefit flow<br />

Actual fiscal flows (no «neutralisation») –7.4% –8.0% –8.2 % –3.2 % 2.1 % –0.4 %<br />

“Neutralised” fiscal flows 1<br />

Using total expenditure –6.0% –5.6% –5.6 % –5.9 % –5.8 % –5.8 %<br />

Using total revenue –6.3% –6.1% –6.2 % –5.3 % –4.3 % –4.8 %<br />

1. «As if» the Spanish government budget were balanced.<br />

Source: Author’s calculations based on data from Ministerio de Economía y Hacienda (2008) and Departament<br />

d’Economia i Coneixement (2013).<br />

Table 1. Net fiscal flows between <strong>Catalonia</strong> and the rest <strong>of</strong> Spain<br />

(% <strong>of</strong> <strong>Catalonia</strong>’s GDP)<br />

the Spanish government deficit is not «neutralised». However, that year<br />

the deficit was very high and so the results vary greatly when they are<br />

«neutralised»: the fiscal deficit becomes 8.5% <strong>of</strong> GDP (cash-flow approach)<br />

or 5.8% (benefit approach) if we use the total expenditure, and<br />

7.0% (cash-flow approach) or 4.8% (benefit approach) if we use total<br />

revenue.<br />

So far we have presented the results. <strong>The</strong> estimates are relatively robust<br />

and the methodology – and even the data – are not really in dispute. <strong>The</strong><br />

problems arise when we try to interpret these data and choose the most<br />

«valid» method. Which approach is better: cash-flow or benefit approach?<br />

Should the Spanish government budget be “neutralised” or not?<br />

And if it is, which total should be used: expenditure or revenue?<br />

<strong>The</strong> answer to all these questions should certainly be that it depends on<br />

what is being analysed. But here we are talking about the potential benefits<br />

<strong>of</strong> <strong>Catalonia</strong>’s secession, which is a sensitive point on which it is<br />

very hard to avoid interference from other factors. So, for those who are<br />

against independence, <strong>Catalonia</strong>’s fiscal deficit is unquestionably a mere<br />

0.4% <strong>of</strong> GDP (benefit approach, without neutralising), while for those in<br />

favour <strong>of</strong> independence, the only valid figure is 8.5% (“neutralised”<br />

cash-flow approach, using total expenditure). This explains the figure <strong>of</strong><br />

38 Economia de Catalunya