Adopted 2017 Annual Operating & Capital Improvement Budget

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TAXPAYER SERVICES<br />

Statement of Purpose<br />

The Taxpayer Services Program ensures the receipt of tax revenues in a manner that contributes to successful<br />

Village outcomes.<br />

Description<br />

The Taxpayer Services Program is responsible for the collection of Sales, Use, Lodging, and Occupational Privilege<br />

taxes. Ensuring the receipt of Village revenues is accomplished through information, education, and auditing<br />

activities.<br />

Accomplishments<br />

In 2016, Taxpayer Services began the implementation of online tax filing. This was in conjunction with additional<br />

software upgrades, allowing for online tax account registration, account updates and tax payment inquiries. These<br />

upgrades may potentially ease any burdens associated with the licensing and remittance of taxes. In addition,<br />

providing online access to our business community may potentially reduce costs incurred by the City. Staff continued<br />

to focus on the development and education of staff. Staff participated in the Western States Tax Administrator’s<br />

meeting, Colorado Tax Audit Coalition meetings as well as the Municipal Enforcement and Collections Group.<br />

Goals/Objectives<br />

In <strong>2017</strong>, staff will complete the implementation of software that will facilitate online tax remittances. This will also<br />

allow taxpayers to register, update and make online inquiries of their tax accounts. In addition, staff will continue to<br />

develop mutually beneficial relationships with members of our business community. Quarterly tax classes will be<br />

offered on a variety of topics. This will be in addition to one-on-one training as requested by our taxpayers. Staff will<br />

work diligently to meet our <strong>2017</strong> audit and enforcement budget.<br />

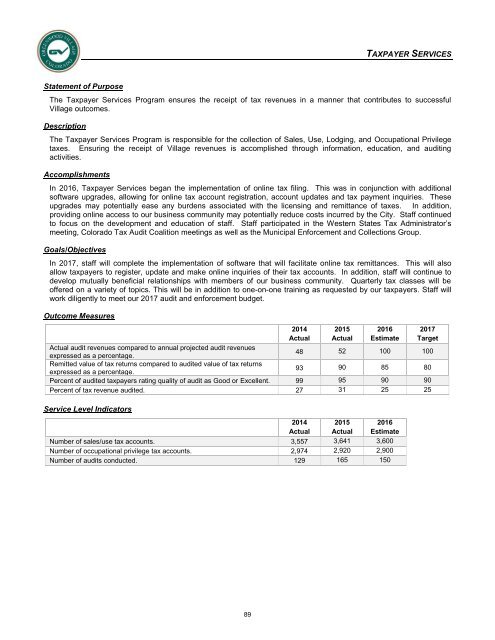

Outcome Measures<br />

2014<br />

Actual<br />

2015<br />

Actual<br />

2016<br />

Estimate<br />

Actual audit revenues compared to annual projected audit revenues<br />

expressed as a percentage.<br />

48 52 100 100<br />

Remitted value of tax returns compared to audited value of tax returns<br />

expressed as a percentage.<br />

93 90 85 80<br />

Percent of audited taxpayers rating quality of audit as Good or Excellent. 99 95 90 90<br />

Percent of tax revenue audited. 27 31 25 25<br />

Service Level Indicators<br />

2014<br />

Actual<br />

2015<br />

Actual<br />

2016<br />

Estimate<br />

Number of sales/use tax accounts. 3,557 3,641 3,600<br />

Number of occupational privilege tax accounts. 2,974 2,920 2,900<br />

Number of audits conducted. 129 165 150<br />

<strong>2017</strong><br />

Target<br />

89